Bitcoin Breaks $99K Barrier—$100K in Sight as Fed Pauses Rate Hikes

BTC’s bull run just got rocket fuel. The Fed’s decision to hold rates sends institutional FOMO into overdrive—because nothing says ’sound monetary policy’ like watching digital gold moon while traditional finance plays catch-up.

Key drivers: Liquidity pumps, spot ETF inflows, and that sweet, sweet macro desperation. Even Wall Street’s old guard can’t ignore the gamma squeeze brewing at six figures.

Watch the $100K psych level. When it cracks, the scramble for exits will make GameStop look like a dress rehearsal. (Bonus jab: Meanwhile, Jamie Dimon’s gold-plated Rolodex just auto-dialed a Bitcoin miner.)

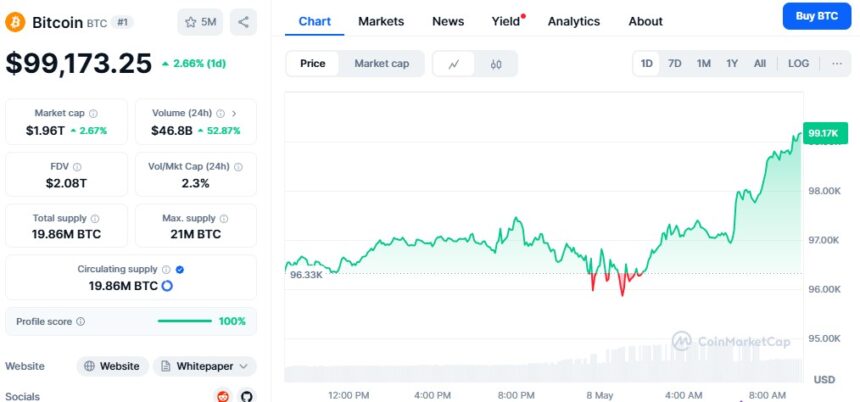

Bitcoin (BTC) Price Crash – Source: CoinMarketCap

Bitcoin (BTC) Price Crash – Source: CoinMarketCap

But, according to Powell, the economy is still healthy and resilient, mainly due to volatilities associated with Trump’s protectionism. Following Powell’s speech, the BTC price fell below $96,000 and then immediately rebounded, demonstrating stability despite the fluctuations in the economy.

The technical analysis of BTC/USD also depicts that it has a strong bullish trend in the coming days. Bitcoin has now crossed above $97,200 and is now trading above crucial levels such as the 100-hour Simple Moving Average. The MACD is in the bullish territory, and the RSI is still above 50, which is a sign of an upward pressure.

As Bitcoin approaches $100,000, analysts are paying attention to the support and resistance levels. The first support level is at $98,250 with the second support at $99,500 and the rounded figure of $100000. On the flip side, there is support at $97,700 and $96,400.

The price action indicates that a breakout could push the price of Bitcoin towards its previous high of around $109,000. But some analysts have noted that if the Fed does not lower its rates, the BTC/USD pair may retreat to $70,000.

There are more ETF inflows, and technical indicators are also strong, suggesting that there is potential for a large movement in Bitcoin. The next big trend should be determined by daily closes and trade volumes.

Also Read: Fed Keeps Rates Steady, Impact on Bitcoin and Crypto Market