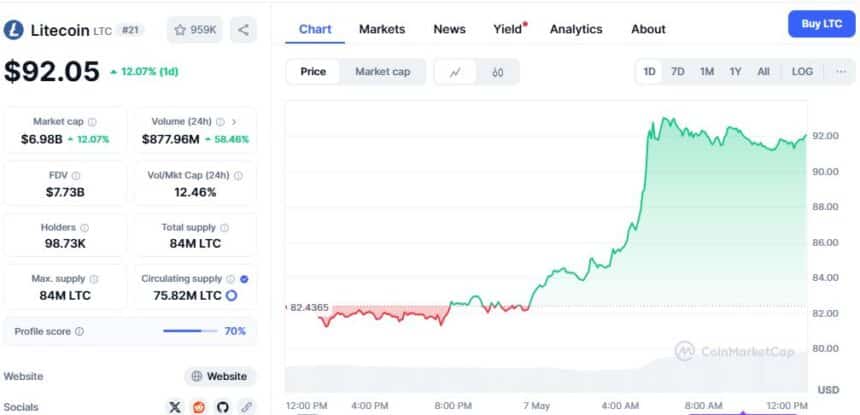

Litecoin Jumps 12% as SEC Kicks ETF Can Down the Road

Regulators hit snooze—traders hit buy. Litecoin’s price surge shows crypto markets still move faster than bureaucracy.

SEC delays = trader payday? The ’silver to Bitcoin’s gold’ rides another wave of speculative frenzy as Wall Street’s paperwork pile grows.

Meanwhile in traditional finance: hedge funds still charging 2-and-20 to underperform a meme coin.

Source: CoinMarketCap

Source: CoinMarketCap

Litecoin’s trading volume didn’t just rise—it exploded, jumping over 59% to $877 million as the SEC’s ETF delay sparked fresh buying.

The proposal, submitted by Canary Funds, aims to launch the first U.S.-based spot ETF tied directly to Litecoin’s market price. But instead of approving or rejecting it, the SEC is now opening the floor for public comments—mainly on whether such an ETF can effectively protect investors from fraud and market manipulation.

LTC now sits at the #21 spot on the crypto charts with a market cap nearing $7 billion.

The sudden pump? It’s a clear sign investors are still hungry for crypto ETFs—even if regulators are still dragging their feet. With the SEC opening the floor to public comments, the final call might not come until 2025.

Also Read: XRP price Could Surge to $100: Reddit User Make Bold Claims