Stellar Outshines XRP and Solana in Real-World Asset Race—But Ethereum Still Wears the Crown

Move over, XRP Ledger and Solana—Stellar’s making waves where it counts. The blockchain just leapfrogged both competitors in real-world asset (RWA) adoption, proving you don’t need maximalist hype to build utility. (Take notes, ’institutional-grade’ chains.)

Yet here’s the kicker: Ethereum still dominates the sector by a country mile. Like a Wall Street banker at a crypto conference, it’s playing a different game entirely—one where network effects and first-mover advantage trump raw throughput specs.

Funny how the ’legacy smart contract platform’ keeps winning even when the narrative shifts, isn’t it?

Total Value by Blockchain in RWA Sector—Source: app.rwa.xyz

Total Value by Blockchain in RWA Sector—Source: app.rwa.xyz

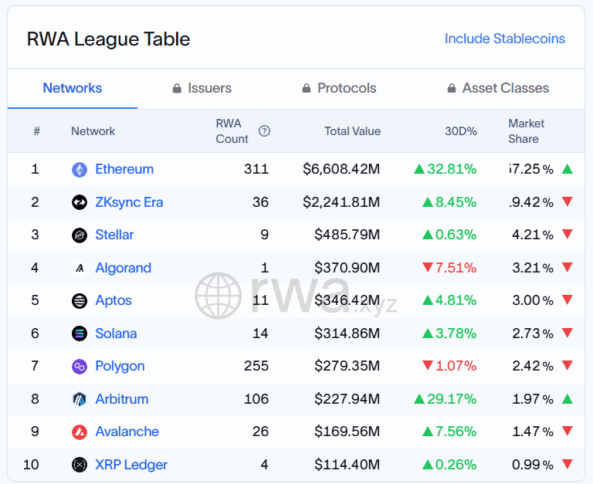

The rise of Stellar in the RWA rankings highlights its growing traction in the tokenization sector. Despite a drop of 4.21% in its market shares, the XRP-rival blockchain has outpaced Solana, which now sits in sixth place with $314.86 million, and XRP Ledger, which ranks ninth with $114.40 million—as per RWA.zyx data.

Stellar’s efficient infrastructure for tokenized assets has given it a competitive edge in its recent growth, making it a preferred network for RWA pioneers. Following closely behind Ethereum is zksync Era, an Ethereum Layer-2 solution, with $2.23 billion, reinforcing Ethereum’s ecosystem dominance.

Algorand also made headlines by securing fourth place with $370.90 million in RWA value, largely driven by the tokenized Exodus stock (EXOD). However, some analysts suggest that Algorand’s figures may be underreported, with projects like Lofty.ai and Meldgold potentially unaccounted for, which could elevate its ranking further.

To the surprise of many, Aptos rounds out the top five with $345.85 million, as it’s quite a new player in the blockchain space.

Ethereum’s lead is bolstered by its robust infrastructure and the support of major financial players like BlackRock, which has tokenized $150 billion in assets on the network. Despite this, the price of ETH has struggled to reflect the growth.

Meanwhile, Stellar’s performance signals a potential rebound as the blockchain continues to attract interest in the asset tokenization space.

The RWA tokenization market is proving to be a transformative force in blockchain finance, bridging traditional assets with decentralized ecosystems. As Stellar gains momentum and Ethereum holds its ground, the competition among blockchains like Solana, XRP Ledger, and Algorand intensifies, setting the stage for further innovation in the tokenization landscape.

Also read: Stellar Stablecoin Supply Hits New High; Will XLM price Follow?