Ivy League Bets Big: Brown University Drops $4.9M Into BlackRock’s Bitcoin ETF

Wall Street’s crypto embrace hits academia—Brown University just funneled nearly $5M into BlackRock’s spot Bitcoin ETF. The Ivy League endowment joins a growing list of institutional players hedging with digital gold.

Who needs textbooks when you’ve got a volatility rollercoaster? The move signals deepening mainstream adoption, though skeptics whisper about endowment committees chasing shiny returns after missing crypto’s first act.

One thing’s clear: when stodgy university treasurers start ape-ing into BTC, the ’digital tulips’ narrative gets harder to sustain. Even if this turns out to be peak ’smart money’ timing—classic.

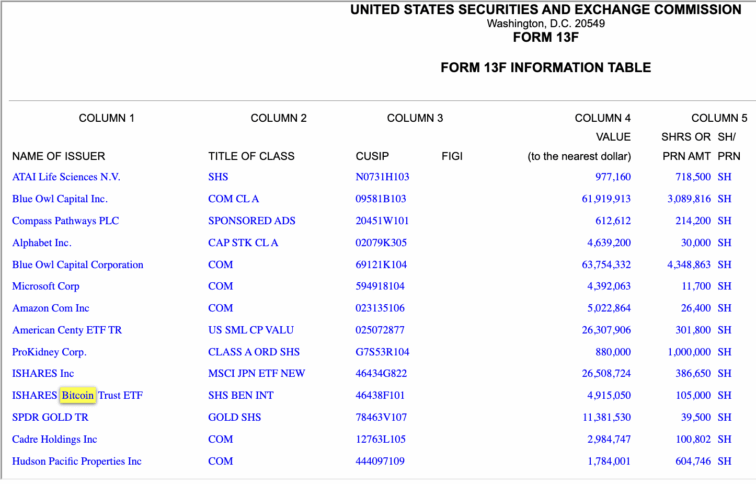

Brown University Invests in Bitcoin ETF, Source: SEC

Brown University Invests in Bitcoin ETF, Source: SEC

With this move, Brown University joined many established institutions that now access digital assets through approved investment funds. Investors from hedge funds and pension funds, along with university endowments, have chosen Spot Bitcoin ETFs such as IBIT as their preferred Bitcoin investment solution, offering a dependable and well-known Bitcoin access method.

The SEC-endorsed IBIT institutional investment solution has risen to appeal as a preferred option during January 2024. In less than twelve months, this Bitcoin price tracker emerged to become one of the leading ever-performing ETFs. The trust maintained 576,000 BTC within its holdings, which resulted in total assets worth $47.78 billion as of March 31, 2024.

Moreover, Brown University has an impressive $7 billion investment portfolio, which saw an impressive 11.3% return in 2024. It is typically diversified across a range of asset classes, this allocation to a Bitcoin ETF signals a potential shift in investment strategy.

The university adapts to a business pattern where institutional investment managers are transitioning Bitcoin investments through traditional financial instruments. Through IBIT spot ETFs, institutions obtain Bitcoin’s growth prospects, although they avoid dealing with the direct management of Bitcoin tokens themselves.

Also Read: Bitcoin ETFs Amass $1B Inflow in 4 Days As BTC Builds Momentum