MOVE Token Tanks 16% After Coinbase’s Delisting Bombshell

Another day, another crypto casualty. MOVE price nosedives as Coinbase—the blue-chip exchange that once promised ’the future of finance’—prepares to pull the plug on trading.

Why the sell-off? Traders are dumping first and asking questions later. Delistings often trigger death spirals—liquidity dries up, bots stop arbitraging, and suddenly your ’long-term hold’ looks like a bagholder’s trophy.

Silver lining? This is crypto. The same token could moon 200% next week when some anonymous Twitter account posts a vague thread about ’strategic partnerships.’ Just don’t tell the SEC.

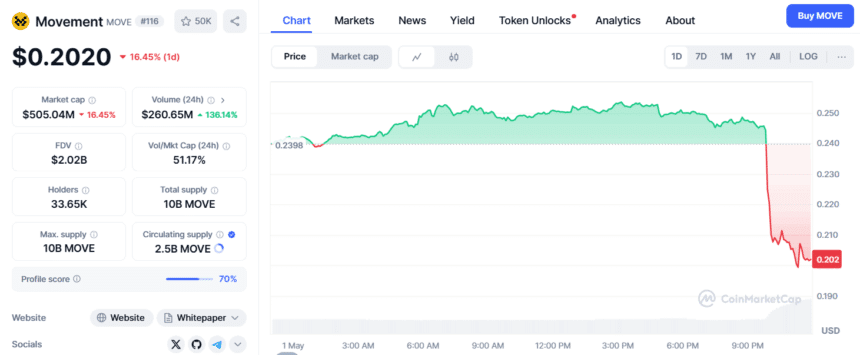

MOVE Price Drops 16% – Source: CoinMarketCap

MOVE Price Drops 16% – Source: CoinMarketCap

While Coinbase has not given the exact reason behind MOVE’s removal, an X post from MetaverseSG exposes the catastrophic events surrounding the crypto asset and the team behind it.

This discovery reveals that Movement Labs raised over $38 million with the backing of Donald Trump’s World Liberty Financial and the project was launched with the promise of a significant airdrop. But the value of the token plummeted 85% after a questionable middleman dumped 66 million tokens on its debut day, December 9, 2024.

$MOVE raised $38M.

Had Trump backing. Promised a big airdrop.

Now it’s down 85% and getting delisted from Coinbase on May 15.

What happened?

• 66M tokens handed to a sketchy middleman

• $38M worth dumped day one — price nuked

• The wallet tied to that dump was banned by… pic.twitter.com/ZW2pph7kcZ

Moreover, Movement Labs also failed to deliver on a promised $38 million buyback and delayed the airdrop, leaving users upset who supported the project during its initial phase.

Furthermore, the involvement of Donald Trump’s World Liberty Fi – which holds 7.5 million MOVE tokens – raised concerns about the transparency and ethics of Movement Labs as the project’s rumored $100 million funding round disappears from the play.

Also read: Ethena Labs announced its partnership with TON Blockchain