Bitcoin Eats the Dollar’s Lunch as Fed Policies Backfire

Another day, another dollar decline—and Bitcoin’s licking its chops. The crypto king rockets past $70k as the greenback stumbles through its worst slump since 2022. Traders are piling in like it’s a Black Friday sale on hedge assets.

Why the rally won’t quit:

- DXY index craters to 10-month lows after Fed Chair Powell’s ’higher for longer’ flub

- Institutional inflows hit $1.2B this week—even Goldman’s quants are drawing bull flags now

- Miners hoarding coins again (always a tell)

Meanwhile in legacy finance: Treasury secretaries keep printing ’transitory’ press releases while their currency burns. Tick tock, Jerome.

BTCUSD Price Chart | Source: CoinMarketCap

BTCUSD Price Chart | Source: CoinMarketCap

Bitcoin’s price is spiking just as the Federal Reserve’s latest warning about the U.S. dollar could set the stage for a “megaforce” shock.

The Federal Reserve, which controls the dollar, has been trying to keep it strong. But now, pressure from President Trump and changes in global trade rules are making the dollar weaker.

Deutsche Bank analysts wrote that the “preconditions are now in place” for a major downtrend in the dollar. They warned that there is a high risk of market disruptions because of all the uncertainty. Goldman Sachs also said that the dollar’s weakness is “here to stay,” according to a Forbes report.

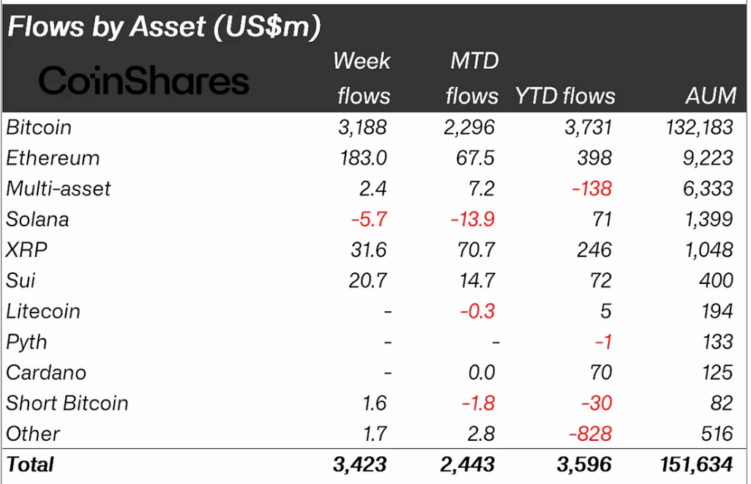

In response, investors are increasingly turning to Bitcoin. Last week alone, people put $3.4 billion into crypto investment products, including Bitcoin ETFs. This was the third-biggest week ever for crypto investments, according to CoinShares.

James Butterfill, the head of research at CoinShares, said that because of fears about tariffs and the weaker dollar, more investors are seeing Bitcoin as a SAFE place to put their money.

“We believe concerns over the tariff impact on corporate earnings and the dramatic weakening of the U.S. dollar are the reasons investors have turned towards digital assets,” He said

In addition, large institutions are also getting more serious about Bitcoin. BlackRock, the world’s biggest asset manager, is known for managing more than $10 trillion globally and has been leading the charge by creating Bitcoin ETFs

Jay Jacobs, head of thematics and active ETFs at BlackRock, said that the world is entering a time of “geopolitical fragmentation,” and Bitcoin will become more important because people want assets that aren’t tied to any one country.

He said Bitcoin is now behaving more like an independent asset, not moving up and down with tech stocks like before.

Even BlackRock’s CEO Larry Fink has changed his stance on Bitcoin. He recently admitted that he had been wrong in the past and now sees Bitcoin as “digital gold.”

As the dollar struggles and global tensions rise, Bitcoin is getting more attention from investors everywhere. Many experts believe a new all-time high for Bitcoin is “imminent” and could happen very soon.

Also Read: Cardano Founder Charles Hoskinson Says ADA Could Reach $10