Bitcoin ETF Exodus Intensifies as Market Trembles – Is This the Dip Before the Rally?

Wall Street's crypto love affair hits a rough patch as Bitcoin ETFs bleed for the fifth straight week. The 'smart money' suddenly remembers volatility exists.

Price pressure mounts as $1.2B flees crypto funds

Grayscale's GBTC continues leading the outflow charge – ironic for a product that spent years begging for ETF status. Meanwhile, Bitcoin dances dangerously close to key support levels, with traders watching the $60K threshold like hawks.

Funny how fast sentiment shifts when the Fed whispers 'maybe no rate cuts after all.' The crypto market's memory? About as long as a Bitcoin block time.

Silver lining? Every ETF outflow is someone else's opportunity to buy the damn dip. The blockchain doesn't care who holds the keys – it just keeps on hashing.

Fewer buyers, bigger withdrawals

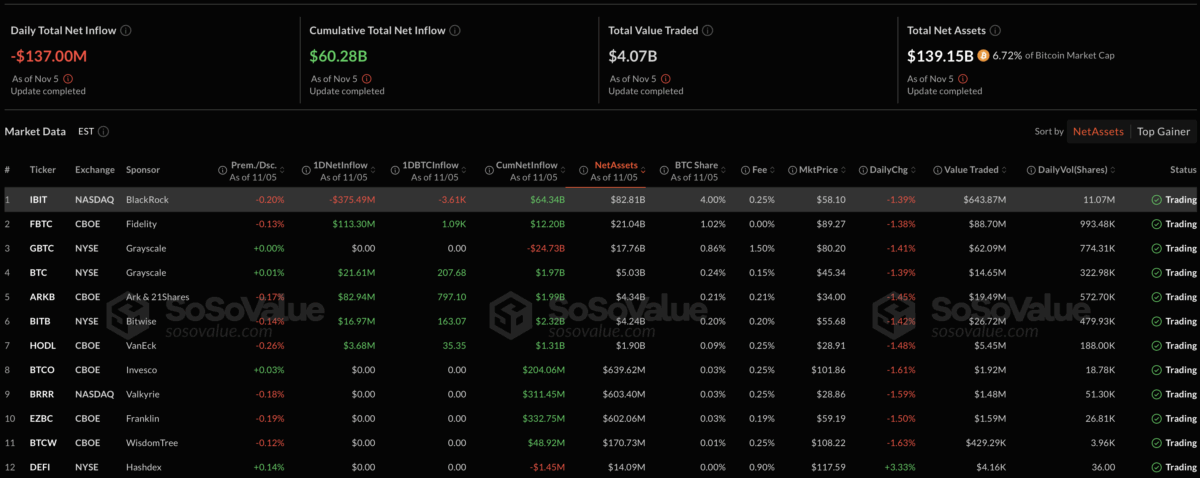

As a result, trading activity has slowed across the market, with only half of the 12 bitcoin ETF issuers recording any activity that day. Among the few that saw inflow, Fidelity’s FBTC led with $113 million, while Ark & 21Shares’ ARKB added $83 million.

Grayscale, Bitwise, and VanEck also reported smaller gains. However, these inflows were not enough to balance out the large withdrawal from BlackRock’s iShares Bitcoin Trust (IBIT), which lost about $375 million. This one fund alone made up most of the day’s total outflows.

Bitcoin lost 5% in one week

Over the past week, BTC has dropped 5%. At one point, the cryptocurrency even slid down $98,000 before recovering back above $100k. Still, this rebound has not given market participants enough confidence to change the momentum.

At this moment, traders are cautious as they wait for confirmation before entering the market. About $323 million has been liquidated from the market in the last 24 hours. $61.26 million from that total came from traders who had bet on Bitcoin, according to Coinglass.

Many traders are watching the $106,000 level closely, which has now turned from a support zone into a strong barrier. Some believe Bitcoin could fall below $100,000 again if buyers do not return soon.

According to data from Deribit exchange, some are positioning for a potential drop to $80,000, with open interest in Bitcoin options exceeding $40 billion. Deribit noted a “notable surge in put options positioned near the $80,000 mark,” suggesting that more investors are hedging against deeper losses. The exchange, which handles over 80% of global crypto options, reported that the $80,000 and $90,000 put options have open interest worth over $1 billion and $1.9 billion, respectively.

Macro events add pressure to the market

Market observers, including Singapore-based QCP Capital, say the sell-off was due to macroeconomic pressures and recent comments by Federal Reserve Chair Jerome Powell, which have weakened interest in Bitcoin ETFs.

“Macro pressure filtered directly into crypto via four consecutive sessions of roughly $1.3 billion in net outflows from U.S. spot Bitcoin ETFs,” QCP Capital said in a market update.

According to Ecoinometrics, the risk of a feedback loop is growing, where ETF outflows push prices lower, leading to even more outflows. Bitcoin has now fallen more than 18% since reaching its all-time high, leaving the market searching for stability amid mounting uncertainty.

Also Read: Miami Mayor Suarez Says BTC Salary Is Up 300%, Unfazed by Dips