Bitcoin Plunges to $104K, Liquidates $1.36B - Market Reels as Bulls Get Crushed

Digital gold shows its sharp edges as Bitcoin tumbles to $104,000, triggering a massive liquidation bloodbath across crypto markets.

The Great Unwind

Over $1.36 billion in leveraged positions evaporated in hours—proof that even in crypto's brave new world, gravity still works. Longs got demolished while shorts feasted on the volatility buffet.

Market Mechanics Exposed

This isn't just a dip—it's a system purge. The cascade of liquidations reveals how tightly wound the leverage game has become. When Bitcoin sneezes, the entire crypto complex catches pneumonia.

Traditional finance veterans are probably smirking into their coffee—another 'irrational exuberance' moment for the digital asset class. But here's the thing: these violent resets have always been crypto's secret sauce for creating stronger foundations.

The real question isn't whether Bitcoin will recover—it's how many 'smart money' investors will miss the bottom while waiting for perfect clarity.

Market under pressure

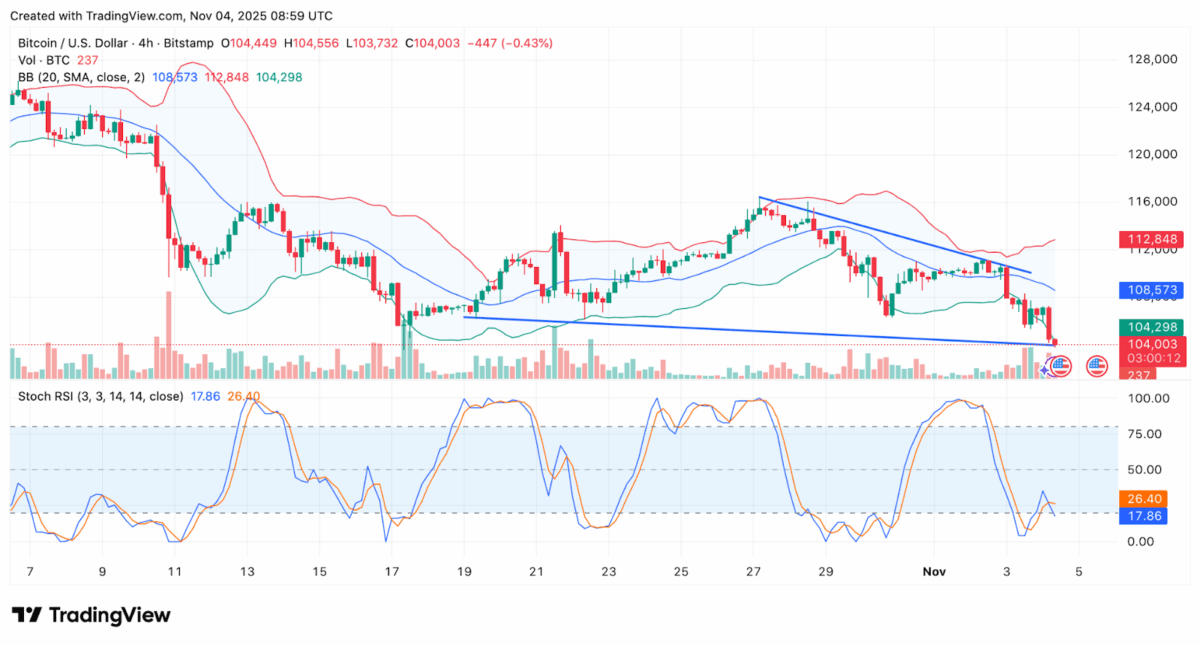

Bitcoin continues to lack strength, according to technical charts. According to data from TradingView on a 4-hour chart, BTC trades at $104,000, down 0.43%. The cryptocurrency has repeatedly tried to pierce through $108,500, which has now turned into solid resistance.

The expanding Bollinger Bands indicate increasing price volatility, with sellers holding their ground around the bottom at $104,000. Bollinger Bands helps traders in identifying market volatility by showing when prices MOVE too far from their average and may be due for reversal.

With the Stochastic RSI Indicator which measures the strength of Relative strength index (RSI) at 17.86, means Bitcoin is in oversold territory. Usually Stochastic RSI is overbought at a range of above 80 or oversold being below 20. This might result in a brief rebound in case buyers reenter the market. Failure by buyers to regain control of the market quickly, Bitcoin may be under more pressure due to the continued downward trend in the chart.

Massive liquidations shake the market

According to Coinglass data, over 336,000 traders were liquidated in the last 24 hours and lost a cumulative total of about $1.36 billion. Most of the losses — around $1.22 billion — came from long positions, meaning those betting on a price increase took the biggest hit. Bitcoin saw the largest wipeout at $23.9 million, followed by ethereum (ETH) with $12.06 million. Other top coins like XRP and Solana (SOL) also suffered notable, though smaller, losses.

The single largest liquidation occurred on HTX, where a Bitcoin-USDT trade worth about $47.87 million was wiped out. Another $400 million in positions disappeared in just four hours, showcasing how quickly the market sell-off gained momentum. These swift liquidations led to even more dramatic price plunges, making this downturn even more severe across exchanges.

Analysts explain market behavior

CryptoQuant analyst Crazzyblockk highlighted how the Realized Cap metric explains current market behavior. “In mid-July, when bitcoin reached around $120,000, the market entered a distribution phase,” the analyst noted. Long-term holders (LTHs) began selling, pushing LTH Realized Dominance from 55% to 46%.

Moreover, short-term holders accumulated these coins, but when prices dipped, they sold again, intensifying bearish sentiment. “Has been the pattern in recent months: long-term investors selling to take partial profits, while new market entrants accumulate and hold for longer periods,” CryptoQuant confirmed on X.

Understanding Market Behavior Through Bitcoin Realized Dominance

“Has been the pattern in recent months: long-term investors selling to take partial profits, while new market entrants accumulate and hold for longer periods.” – By @Crazzyblockk

Link ⤵️https://t.co/oVEfKClF7o pic.twitter.com/4hPKNECVEW

Emmett Gallic also pointed to whale activity fueling the shift. “A Bitcoin Whale that hasn’t moved funds in 6 years deposited 2300 $BTC to Paxos 13 hours ago,” he said, noting the whale holds over 31,000 BTC worth about $3 billion.

Despite this, Crazzyblockk believes the correction is nearing its end. Many new holders still show conviction, suggesting underlying bullish momentum remains intact.

Macro and market dynamics

The recent event comes after the “Red October” incident, which occurred in a complex macroeconomic environment. U.S. Federal Reserve Chair Jerome Powell announced the end of quantitative tightening but later tempered rate-cut expectations, unsettling investors.

Consequently, risk assets, including Bitcoin, saw declining returns. Data from Velo shows Bitcoin’s U.S.-session returns fell from 0.94% on October 29 to -4.56% over the past week.

Besides, geopolitical tensions have cooled slightly after the Trump-Xi truce paused tariff hikes, reducing global market anxiety. However, analysts believe structural selling still weighs on Bitcoin’s price.

Crypto analyst Julio Moreno explained, “Instead of looking at Bitcoin long-term holder distribution/spending, I like to look at the other side of the trade. Is there enough demand to absorb the supply at higher prices? Since a few weeks ago the answer is no.”

Instead of looking at Bitcoin long-term holder distribution/spending, I like to look at the other side of the trade.

Is there enough demand to absorb the supply at higher prices? Since a few weeks ago the answer is no, and that is why we see prices declining.

On a longer term… pic.twitter.com/3cNBY9Vk7e

Similarly, analyst Quinten emphasized, “Long-term holders dumped 400,000 Bitcoin in the last 30 days. That’s nearly 2% of supply.” He added, “If Bitcoin can stay above $100,000 while whales unload hundreds of thousands of coins, you don’t want to know what it’ll do when the real demand turns on.”

Why this matters

Bitcoin’s drop below $104,000 shows how quickly excitement in the market can turn into worry. Many traders lost money, and big investors moving their coins only added to the fear. Still, some signs suggest prices could bounce back soon if buyers return. This means confidence hasn’t disappeared, but the road ahead looks bumpy. With global uncertainty still high, traders should expect more ups and downs before stability returns.

Also Read: Why is crypto Market Down Today