Tom Lee’s BitMine Makes Massive 7,660 ETH Acquisition Through Galaxy Digital

Fundstrat's crypto mining arm just executed a whale-sized Ethereum move that's turning heads across digital asset markets.

The Strategic Accumulation

BitMine's latest power play—scooping up 7,660 ETH via Galaxy Digital's institutional desk—signals growing confidence in Ethereum's infrastructure value proposition. This isn't just another portfolio rebalance; it's a statement position being built while traditional finance still debates whether crypto belongs in retirement accounts.

Institutional Grade Execution

Galaxy Digital's desk facilitated the sizable transfer, demonstrating how crypto-native firms continue to capture institutional flow that traditional banks once dominated. The move showcases how sophisticated players navigate digital asset markets—bypassing retail platforms for direct OTC execution that doesn't move markets.

Because nothing says 'serious investment' like buying millions in crypto while Wall Street analysts still can't agree whether blockchain is a passing fad or the future of finance.

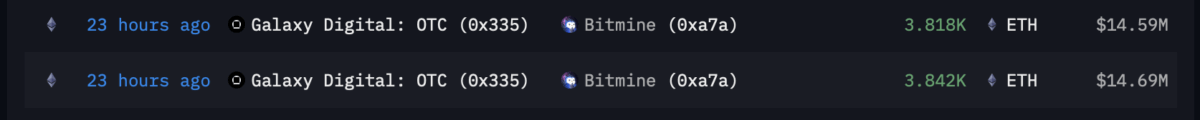

Bitmine’s transaction with Galaxy | Source: Arkham

Bitmine’s transaction with Galaxy | Source: Arkham

Thriving for 5% of total ETH supply

This purchase aligns with the firm’s “Alchemy of 5%” goal, a strategy led by its Chairman, Thomas Lee, to accumulate up to 5% of Ethereum’s entire circulating supply of roughly 120 million tokens.

Currently, BitMine holds about 2.8% of the total ETH in circulation, which is valued at around $12.24 billion, making it the largest corporate holder of Ethereum in the world.

The company started accumulating ETH earlier in 2025. In October alone, BitMine purchased over 200,000 worth of ETH valued at $800 million. Recently, it raised $365 million in capital from selling 5.22 million shares at a premium price. BitMine’s approach avoids market volatility by purchasing OTC rather than on open exchanges.

Traders skeptical about ETH’s $5000 prediction

While institutions like BitMine are buying heavily, smaller traders are more careful. According to data from the prediction market on Kalshi, the chances that Ethereum will reach $5,000 by the end of 2025 has dropped to 31% compared to the previous month’s 40%.

This drop is because of the concern that the Federal Reserve might cut interest rates this month, which is still uncertain. Meanwhile, after the FOMC meeting last October, Fed Chair Jomore Powell said that the state of the economy has not changed a lot to result in another rate cut.

Currently, Ethereum is trading at $3,879. This a modest 0.27% drop over the last 24 hours, and it ended the month of October with a 13% drop.

Despite this skepticism, crypto analyst Ted Pillows believes that the cryptocurrency could surge again if a few more buyers like Bitmine comes in.

“Bitmine bought $29,280,000 in $ETH today. They are consistently buying $200M-$300M in Ethereum each week. We need a few more buyers like that, and ETH reversal could happen.” he said in his post.

Also Read: Ethereum Foundation Launches New Site for Institutions and TradFi