SpaceX Executes Massive $268 Million Bitcoin Transfer During Market Volatility

Elon Musk's aerospace giant makes bold crypto move as digital assets face turbulence

The Whale Movement That's Turning Heads

SpaceX just shifted a staggering $268 million in Bitcoin while the cryptocurrency markets continue their rollercoaster ride. This isn't just another transaction—it's a statement from one of the most watched companies in the tech space.

Timing Is Everything

The transfer comes during one of the most volatile periods in recent crypto history. While retail investors panic-sell, institutional players like SpaceX are making calculated moves that could signal either strategic repositioning or confidence in Bitcoin's long-term value proposition.

Market Impact and Speculation

When Musk-affiliated companies move, markets listen. This $268 million transaction immediately sparked speculation across trading desks and crypto communities. Is this a rebalancing act? A liquidity play? Or simply business as usual for a company that's been accumulating Bitcoin since 2021?

The Bigger Picture

SpaceX's move highlights how major corporations are increasingly comfortable treating Bitcoin as a legitimate treasury asset—even during market downturns. While traditional finance veterans scoff about 'digital gold,' real companies are moving real money in amounts that would make most hedge funds blush.

Another day, another multi-million dollar crypto transaction that somehow still surprises the Wall Street crowd clinging to their paper assets and outdated spreadsheets.

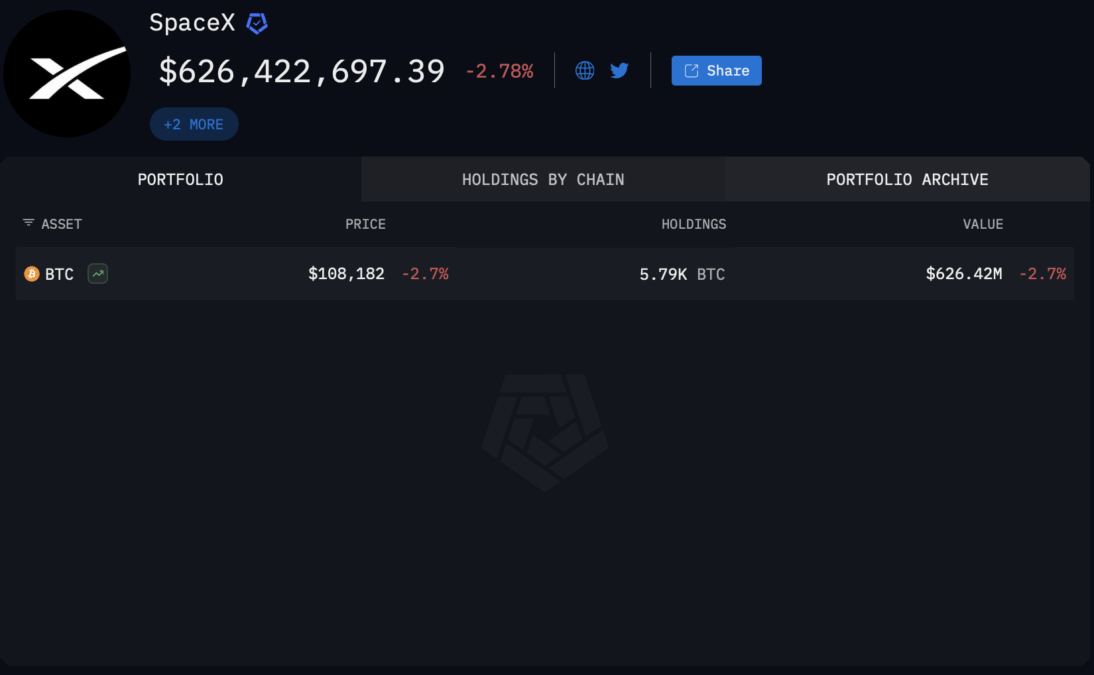

SpaceX Portfolio Balance | Source: Arkham Intelligence

SpaceX Portfolio Balance | Source: Arkham Intelligence

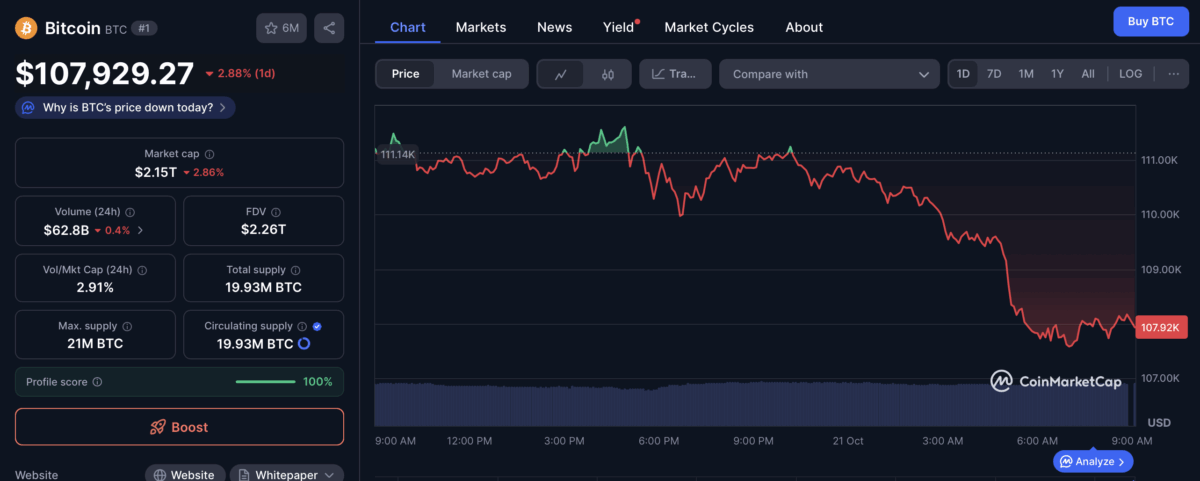

Bitcoin Price Drops Below $108k

Meanwhile, the transaction comes as Bitcoin’s price falls below $108,000 due to ongoing trade dispute between the U.S.–China, which has put a lot of pressure on the global market. The uncertainty behind this event has triggered a wave of risk-off sentiment among investors.

Currently, Bitcoin is trading for $107,929. This is down 0.4% from its daily high of $111k with a modest 1.84% drop in trading activity which recorded over $62 billion in trading volume.

Over the last 24 hours, the Spot Bitcoin exchange-traded funds (ETFs) recorded about $40 million in outflows. Among them, BlackRock’s iShares Bitcoin Trust saw the largest redemption, totaling nearly $100 million.

Also Read: OranjeBTC Adds 10 BTC and Lifts Treasury to 3,701