Crypto Carnage: $1.12B Liquidated as Bloodbath Hits Digital Markets

Red waves crash across crypto charts as leveraged positions get obliterated in Friday's brutal selloff.

The Great Unwinding

Margin calls trigger cascade liquidations totaling exactly $1.12 billion—enough to make even seasoned traders sweat. Exchanges bleed red as stop-loss orders execute like dominoes falling in slow motion.

Whale Watching Turns Bloody

Over-leveraged bulls get slaughtered when support levels shatter. The liquidation massacre spans major tokens—Bitcoin, Ethereum, and altcoins all take heavy casualties. Trading screens resemble crime scenes.

Market Mechanics Exposed

High leverage works both ways—amplifying gains until it doesn't. Today's bloodletting reveals how quickly paper profits vaporize when volatility strikes. Another reminder that crypto markets eat the greedy for breakfast.

Just another Friday where digital gold suddenly feels more like digital lead—proving once again that in crypto, the only thing faster than moonshots are margin calls.

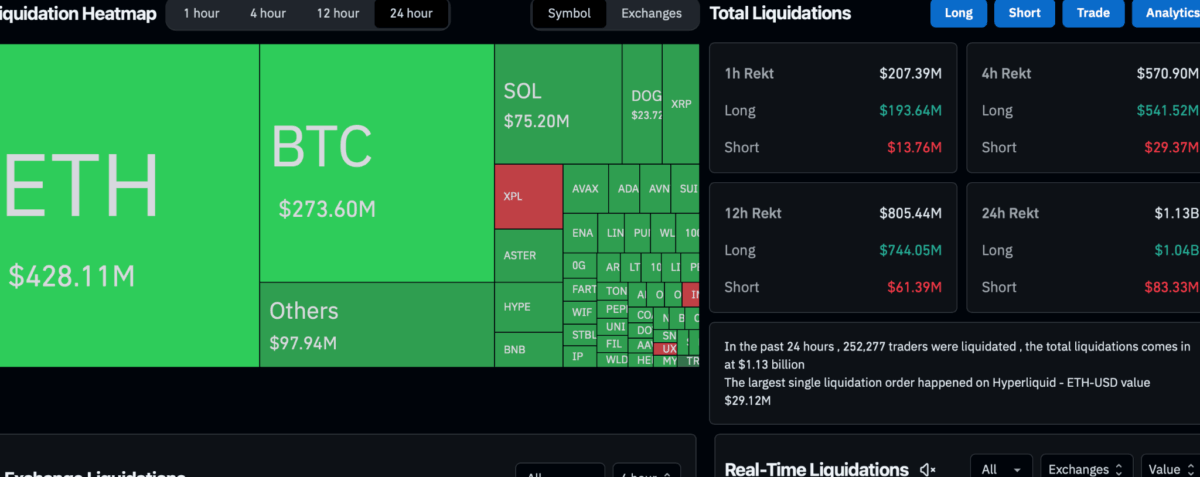

Total Liquidation Heatmap | Coinglass

Total Liquidation Heatmap | Coinglass

Ethereum (ETH) recorded the heaviest losses with over $428.11 million liquidated in a single day. Bitcoin(BTC) followed behind with $273.60 million in liquidations, while solana recorded $75.20 million.

Other altcoins like Avalanche (AVAX), XRP, and Dogecoin(DOGE) also added to the sell-off. The single largest liquidation order, valued at $29.12 million, was recorded on Hyperliquid in the ETH-USD market.

Coinglass heatmap showed that Ethereum’s dominance in this wipeout was overwhelming as traders who had bet on the price going up face the majority of losses. An unlucky trader alone lost $45m during the dump. According to a previous report, the trader also took a bet on ethereum surge but lost his position as the price dropped below $4000 and left the trader with less than half a million dollars in the account.

The cryptocurrency has lost 5.92% of its gains today following the massive sell-off. At the time of writing, ETH is trading for $3,924, which is down from its daily high of $4,273.

Bitcoin also dropped to $3.42 from its intraday high of $113,660. Currently, it’s trading for $108.823. In fact, the overall market valuation is down by 3.95% to $3.73 trillion, according to CoinMarketCap.

Also Read: Hack Turns $GAIN Into Pain, Griffin AI Token Crashes 84%