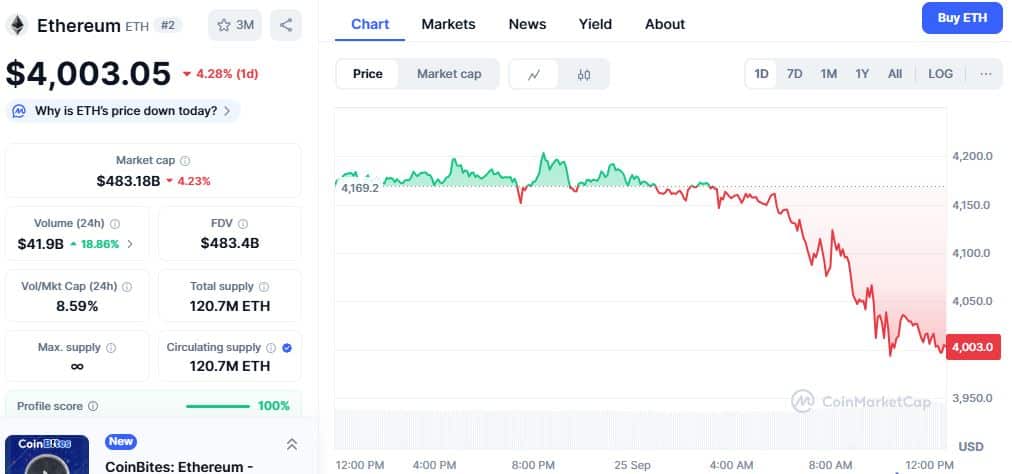

Ethereum Plunge Wipes Out Millions: 4.2% Drop Triggers Mass Liquidations

Another day, another crypto bloodbath—except this time it's the smart contract king taking the hit.

The Domino Effect

Leveraged positions crumbled faster than a house of cards as ETH's price action turned vicious. Margin calls echoed across exchanges while traders watched their positions evaporate in real-time.

Market Mechanics Exposed

The liquidation cascade reveals what happens when over-leveraged markets meet volatility. Automated systems don't care about your conviction—they just liquidate.

Silver Linings Playbook

Volatility cleanses weak hands from the market. Every major correction creates buying opportunities for those with dry powder. The fundamentals haven't changed—if anything, the network grows stronger during downturns.

Meanwhile, traditional finance continues charging 2% management fees for mediocre returns. At least crypto's losses are transparent and instantaneous.

Source: CoinMarketCap

Source: CoinMarketCap

The market cap of ETH currently stands at $483.18 billion, and the 24-hour trading volume is valued at $41.9 billion, pumping 18%.

Massive liquidations shake traders

A major reason for the drop was forced sell-offs, or liquidations. In the past 24 hours, $178.55 million in ethereum positions were wiped out. Of this, $160.04 million came from traders betting on a rise in price, while $18.51 million came from those betting on a fall.

Across all cryptocurrencies, total liquidations hit $407.22 million, with $333.14 million in long positions and $73.94 million in shorts. Over 128,926 traders were impacted during this period. The largest single loss in the market came on Hyperliquid, where an ETH-USD position worth $29.12 million was liquidated.

Bitcoin also faced heavy liquidations, totaling $57.07 million. Of this, $42.08 million came from traders betting the price would go up, while $15 million came from those expecting a fall. The wave of selling pushed Ethereum from nearly $4,500 down to about $4,075, before it recovered slightly to around $4,200.

Withdrawals weigh on ETH

Investors pulled around $196.6 million from Ethereum funds following the U.S. Securities and Exchange Commission’s rule update. While these changes provide long-term clarity, many short-term traders took money out, reducing immediate buying interest and adding to the market’s downward pressure.

Ethereum’s price has been closely tracking Bitcoin over the past month. The two coins have moved in near sync, and Bitcoin currently trades around $111,880, down about 3% since Monday.

Overall market

The total value of all cryptocurrencies dropped to about $3.82 trillion, a fall of 1.57%. At the same time, Ethereum’s trading activity increased, with a volume of $41.94 billion, showing more trading as prices fell. Investors are also keeping an eye on bigger events, like a possible U.S. government shutdown, which now has a 77% chance according to Polymarket.

Ethereum is approaching an important level at $3,900. If it stays above this, the price could steady, but if it falls below, more selling might follow. Traders are keeping a close eye on the market as price movements and external events continue to influence cryptocurrencies.

Also Read: Hack Turns $GAIN Into Pain, Griffin AI Token Crashes 84%