Bitcoin Plunges Below Critical Cost Basis - $107K Liquidity Trap Intensifies Market Pressure

Bitcoin's brutal descent below key quantile levels signals deepening structural vulnerabilities.

The Liquidity Abyss Widens

Market makers face unprecedented pressure as Bitcoin's price action defies historical support levels. The $107,000 liquidity zone now acts as gravitational pull—sucking in leveraged positions and trapping premature bulls.

Cost Basis Breakdown

Traditional valuation models fracture as Bitcoin slices through quantile-based support. Institutional entry points vaporize while retail sentiment mirrors 2018's ghost-town momentum.

Wall Street's Crypto Conundrum

Meanwhile, traditional finance giants keep recycling 'digital gold' narratives—because nothing says stability like 30% intraday swings. The irony's thicker than a blockchain ledger.

This isn't a dip—it's a structural test of crypto's maturity. And frankly, the market's answering with a shaky hand.

Leverage stacks, liquidity builds as Bitcoin risks deeper correction

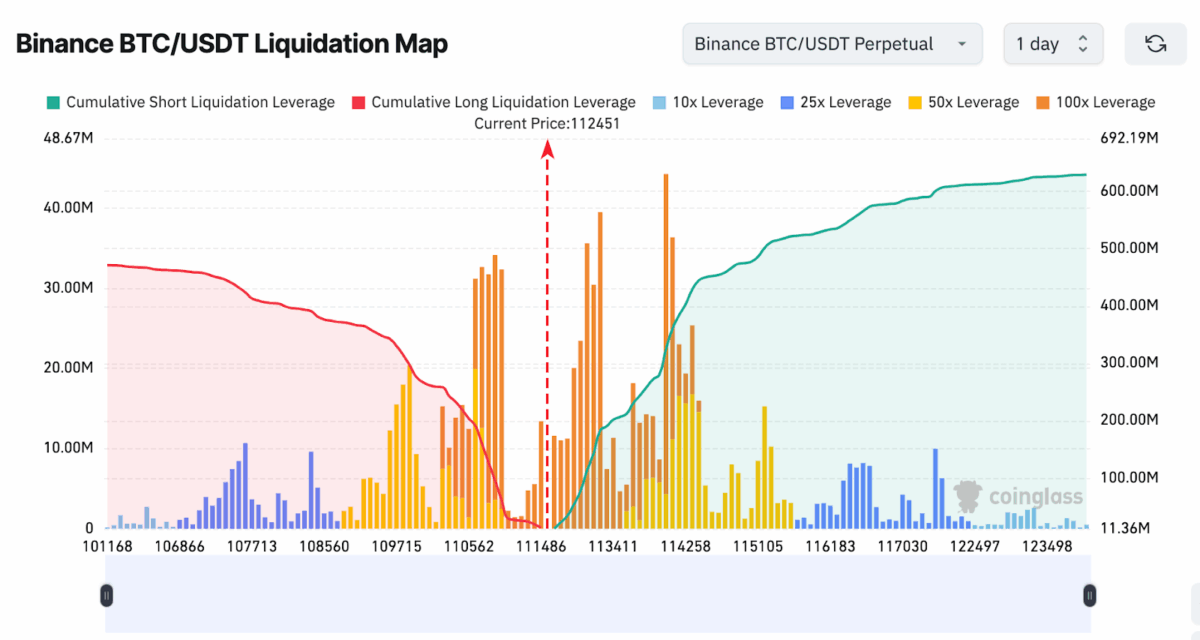

The danger isn’t just technical. Coinglass data shows a dense concentration of high-leverage long positions between $110K and $114K—particularly at 50x and 100x leverage. Compounding the risk, liquidity clusters have formed just below the current price, especially NEAR $107K, creating a gravitational pull that could draw prices lower. A breakdown into this zone may trigger mass liquidations, amplifying volatility in an already fragile market structure.

Meanwhile, the global crypto market reflects similar strain. Overall market cap dropped 0.52% to $3.89 trillion, while volume sank over 10% to $163.97 billion, reflecting lower conviction across both retail and institutional flows.

Bitcoin reached an all-time high of $124,457 on August 14 but has since declined over 10%, now sitting on the edge of structurally significant zones. Without a swift recovery above the Cost Basis Quantile, the path of least resistance could lead to the $105K–$90K range—a level with historical confluence, but also a setup for deeper liquidations.

Also read: B-HODL, UK’s first bitcoin Treasury company, buys 100 BTC

The crypto Times does not endorse or recommend any specific cryptocurrencies, tokens, projects, financial products, or investment strategies. We do not accept legal liability for any financial losses incurred as a result of reliance on information published by us. Readers should always do their own research (“DYOR”), consult with licensed professionals, and evaluate risks independently.