FG Nexus Smashes 50,000 ETH Treasury Milestone - Stock Price Surges

Digital asset powerhouse FG Nexus just crossed a monumental threshold that's sending shockwaves through crypto markets.

The Treasury Transformation

Hitting 50,000 ETH in reserves isn't just a number—it's a strategic power move that's rewriting corporate treasury playbooks. While traditional finance still debates crypto adoption, FG Nexus quietly built a war chest that dwarfs most competitors.

Market Reaction Unleashed

Share prices exploded as investors finally grasped the implications. That treasury isn't sitting idle—it's actively deployed across DeFi protocols, staking operations, and strategic partnerships. The 50,000 ETH milestone represents both defensive positioning and aggressive growth potential.

The New Corporate Standard

Forward-thinking companies now face pressure to match this crypto-native treasury strategy. FG Nexus didn't just accumulate digital assets—they built an entire financial infrastructure around them. Their ETH holdings generate yield, secure networks, and provide liquidity simultaneously.

Meanwhile, traditional CFOs still think a 2% bond yield constitutes innovation. FG Nexus proves that corporate treasury management either evolves with blockchain technology—or gets left behind holding depreciating fiat.

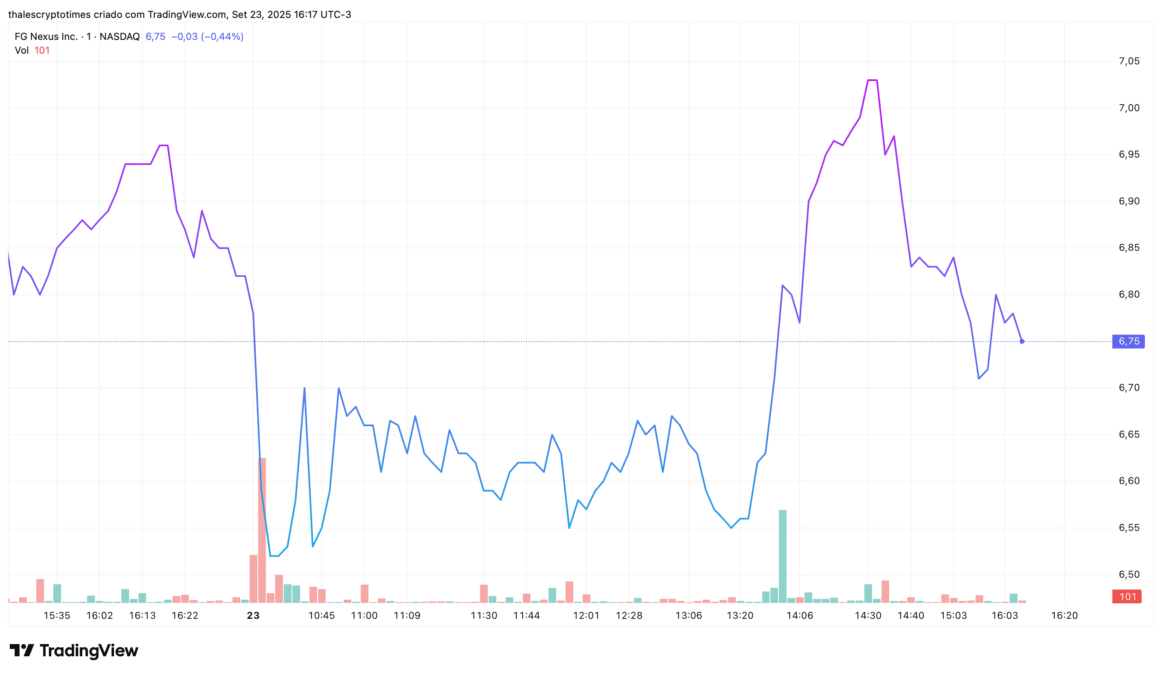

FGNX Price Chart. Source: TradingView

FGNX Price Chart. Source: TradingView

FGNX lags performance but intensifies ETH race

Despite Tuesday’s gains, FGNX shares remain down 68% year-to-date and 71% over the past 12 months. However, retail sentiment appears to be shifting.

BMNR, led by Tom Lee, also saw pre-market gains of 2% and continues to draw interest with its Ethereum accumulation strategy. While Bitmine currently leads the supply race, FG Nexus’ latest MOVE signals that the contest for ETH dominance among publicly traded firms may be far from over.

Also read: FG Nexus Becomes Major ETH Holder with 47,331 ETH