Metaplanet Stock Primed for 40% Surge—Thanks to Bitcoin’s Power-Law Model

Wall Street’s latest buzz? A Bitcoin price-prediction model just flashed bullish for an obscure Japanese stock. Here’s how crypto math is shaking up traditional markets.

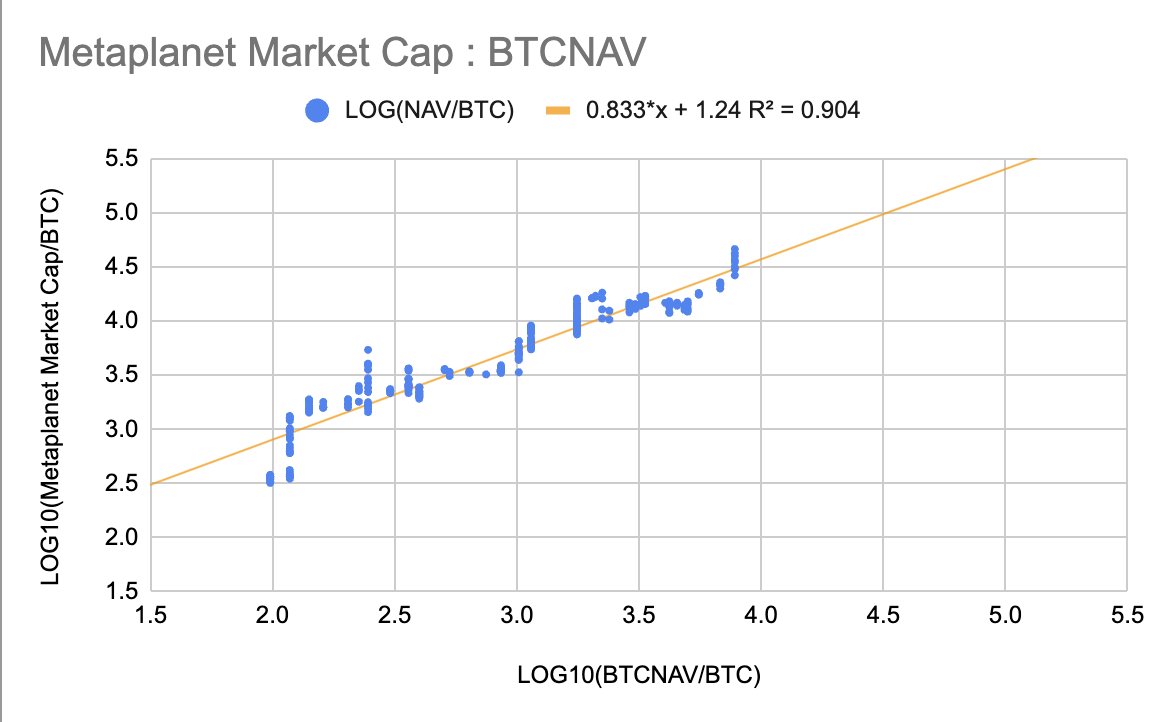

The power-law correlation—once dismissed as ’voodoo charting’ by suits—now suggests Metaplanet could ride Bitcoin’s coattails to serious gains. No fundamentals required, apparently.

Funny how a ’bubble asset’ keeps writing checks that legacy finance can’t cash. Maybe those ’digital gold’ maximalists were onto something after all.

Metaplanet nav (Source: TakaAnikuni)

Metaplanet nav (Source: TakaAnikuni)

Why it matters:

- Re-rating potential. Even with multiple compression, doubling BTC every two months, as Metaplanet has since January, projects ≈15 k BTC by early August, which the model pegs at a still-healthy mNAV ~3.5, lifting implied equity value ~40 %.

- Fuel in the tank. Metaplanet continues to issue bonds and warrants to finance buys, signalling management is committed to the accumulation flywheel.

- Retail froth check. After a 1,560 % Y/Y rally, the share closed today at ¥1,222, yet the model suggests room before froth sets in.

Anikuni’s framework offers a quantifiable undervaluation thesis and a handy lookup table that could resonate with both equity and crypto-native audiences as Metaplanet races toward five-digit BTC holdings.