Bitcoin Network Shatters Activity Records: Bullish Signal for BTC Price Surge?

Bitcoin's blockchain just hit unprecedented activity levels—and the market's taking notice.

Network On Fire

Transaction volumes are screaming past previous benchmarks, creating a fundamental bedrock that could propel prices upward. When the network buzzes this loudly, history shows price explosions often follow.

Miners Raking It In

Record activity means record fees flowing to miners—the infrastructure backbone securing the entire system. This isn't just technical noise; it's economic fuel for the ecosystem Wall Street still struggles to comprehend.

Price Implications

Network activity typically leads price action by weeks. Current metrics suggest institutional FOMO might be brewing—while traditional finance still debates whether crypto is 'real'.

The tape doesn't lie: Bitcoin's network strength continues outperforming legacy systems that require three business days to move money across town.

Rising On-Chain Transactions Signal Growing Demand

QryptoQuant’s latest report shows there has been a noticeable increase in activity on the Bitcoin network. Analysts believe that the flagship cryptocurrency’s price trajectory might be impacted by the recent spike in network activity.

CryptoOnchain’s study looked at Bitcoin’s transaction count, which shows how many confirmed transfers happen on the network at a given time. In 2025, the 14-day average of these transactions reached 540,000, the highest level so far this year. The analyst said this jump points to stronger demand and more use of the network, with protocols like bitcoin Ordinals and Runes likely adding to the activity.

The report also pointed out a “ullish convergence” between Bitcoin’s transaction count and its price since July. This pattern suggests that the current uptrend is not just based on speculation. Unlike earlier periods when price and activity moved in different directions, the current rally is being supported by stronger real usage on the network. However, keeping this level of activity will be important for Bitcoin to maintain its momentum.

Market Outlook

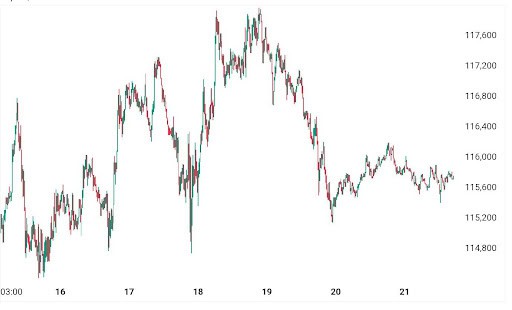

Bitcoin is currently trading around $112,500, down roughly 4% on the day, and appears to be breaking down from its consolidation range amid mild bearish pressure. The leading cryptocurrency’s price swung sharply over the past week, falling below $113,000 before briefly rallying to $117,800. This was after the Federal Reserve slashed interest rates by 25 bps, only for it to settle back to its earlier level before today’s drop.

Since September 9, US spot Bitcoin ETFs have attracted over $2.8 billion in net inflows, pushing activity into positive territory. Institutional demand remains a stabilizing factor, with ETF allocations and exchange withdrawals reinforcing long-term conviction.

While technical indicators suggest alignment for a potential breakout, network activity has not kept pace with price momentum, and miner incentives remain under scrutiny. On the other hand, sentiment indicators, including a neutral Fear & Greed Index and mixed MACD signals, urge caution. Investors should monitor macroeconomic shifts and ETF flows closely to navigate the next phase of Bitcoin’ss trajectory.