XRP Surges Back Into Top 100 Global Assets as Bitcoin Challenges Silver’s Throne

Ripple's XRP just smashed its way back into the elite top 100 global assets by market cap—right as Bitcoin takes aim at dethroning silver from its precious metals pedestal.

The Crypto Resurgence

XRP's re-entry signals more than just a price pump—it marks a defiant return to relevance amid regulatory clarity and institutional adoption. While traditional finance still scratches its head about blockchain utility, digital assets keep rewriting the rulebook on what constitutes value storage.

Bitcoin vs. Silver: The Heavyweight Bout

Bitcoin isn't just knocking on silver's door—it's kicking it down. With market cap momentum building, the original cryptocurrency threatens to flip the millennia-old precious metal in global rankings. Silver had a good run, but code doesn't tarnish and algorithms don't need mining permits.

Finance's awkward relationship with crypto continues—bankers still call it a 'fad' while quietly adding it to their balance sheets. Maybe they're waiting for a gold-plated hardware wallet to feel properly sophisticated.

Ripple Is Back

CryptoPotato reported back on August 23 that XRP had found a place within the aforementioned ranking, as, at the time, it had become the 99th biggest asset on CompaniesMarketCap. The following few weeks were quite turbulent for the entire cryptocurrency market, and XRP was not spared.

The cross-border token dipped in price from $3.02, which was enough to keep its market cap around $180 billion, to a multi-month low of $2.70. Consequently, the asset fell out of that coveted group.

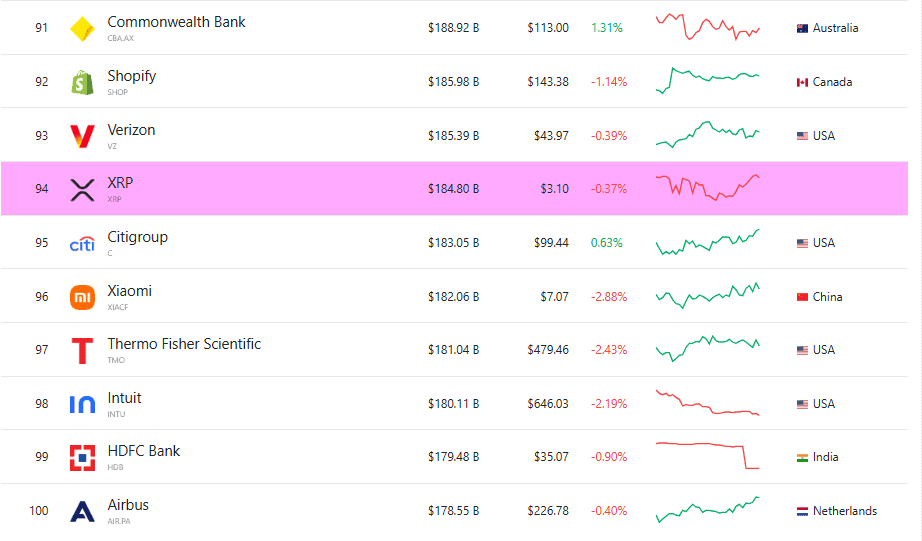

However, the crypto market has been on a strong rebound in the past week. XRP is no exception, as it has jumped by 10% and now trades at $3.10 after it was rejected yesterday at $3.20. Still, its market cap is up to $185 billion, which makes it the 94th largest global asset by that metric.

It has surpassed the likes of Citigroup, Xiaomi, and Airbus on the way up, while some of the next big names in its scope are Verizon, Shopify, Commonwealth Bank, and Uber.

BTC Battles Silver

As the market leader and largest in the industry, BTC was the first to enter the top 100 assets. Its growth over the past several years has pushed it into the largest 10. Although at one point it had climbed above silver and Amazon and was aiming at fifth, it has lost some ground, while the aforementioned duo has been on an uptrend (especially the precious metal).

Now, bitcoin’s market cap stands at just over $2.3 trillion, which makes it the 8th largest global asset. Silver is above it with a market cap of $2.4 trillion. Gold continues to be the undisputed leader with a market cap of nearly $25 trillion after it marked a new all-time high against the greenback earlier this week.

Ethereum’s recent meteoric rise has driven it to the 22nd spot in this ranking, slightly above Mastercard and Netflix, and behind Visa and Tencent.