Ripple (XRP) News Today, September 3rd: Key Developments You Can’t Miss

XRP makes waves as regulatory clarity fuels institutional momentum—while traditional finance scrambles to keep up.

Market Moves: Breaking Resistance Levels

XRP shattered key technical barriers as trading volume spiked 40% overnight. The token's outperformance comes amid broader crypto market consolidation—proving once again that digital assets dance to their own rhythm.

Regulatory Front: Green Shoots Emerge

Recent court decisions continue favoring Ripple's legal stance, creating ripple effects across payment corridors. Banking partners previously sitting on the fence now actively integrate XRP-led settlement solutions—nothing motivates like fear of being left behind.

Adoption Metrics: Real-World Traction

Three new exchange listings went live this week alongside a 25% surge in cross-border transaction volume. Meanwhile, legacy SWIFT transfers still take days to clear—but hey, at least bankers get weekends off.

The bottom line? XRP's infrastructure play keeps gaining steam while traditional finance argues about overhead projections. Sometimes disruption just means building what others won't.

Credit Card Focused On XRP Rewards

Gemini unveiled its latest product last week, a credit card that gives holders varying percentages back from purchases directly in the XRP token.

Additionally, it will support Ripple’s stablecoin, RLUSD, which can be used for the US spot trading markets on Gemini’s trading platform.

Another XRP ETF Listing, But With A Twist

The Securities and Exchange Commission (SEC) in the United States has a long-standing history of delaying ETF decisions for Ripple’s native token, but it could potentially be different this time.

Filed by an Illinois investment company with over $12 billion in assets under management (AUM), this will not be a regular spot ETF, but it will be classified as an Options Income Fund instead.

As the name suggests, it will focus on options strategies to generate a monthly yield for investors. They will expire monthly, allowing for a regular strategy reset and a steady income to shareholders.

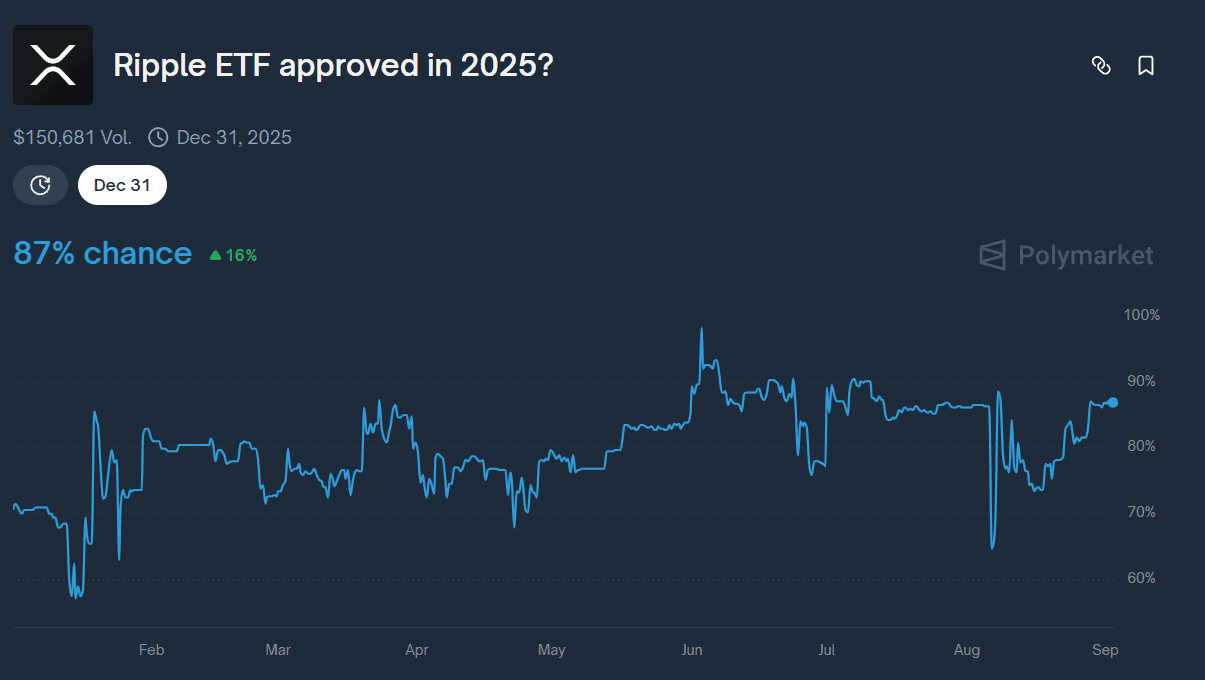

Meanwhile, odds of a spot XRP ETF approval by year’s end stand at 87% at the time of writing, according to Polymarket.

XRP Ledger Posting Highs

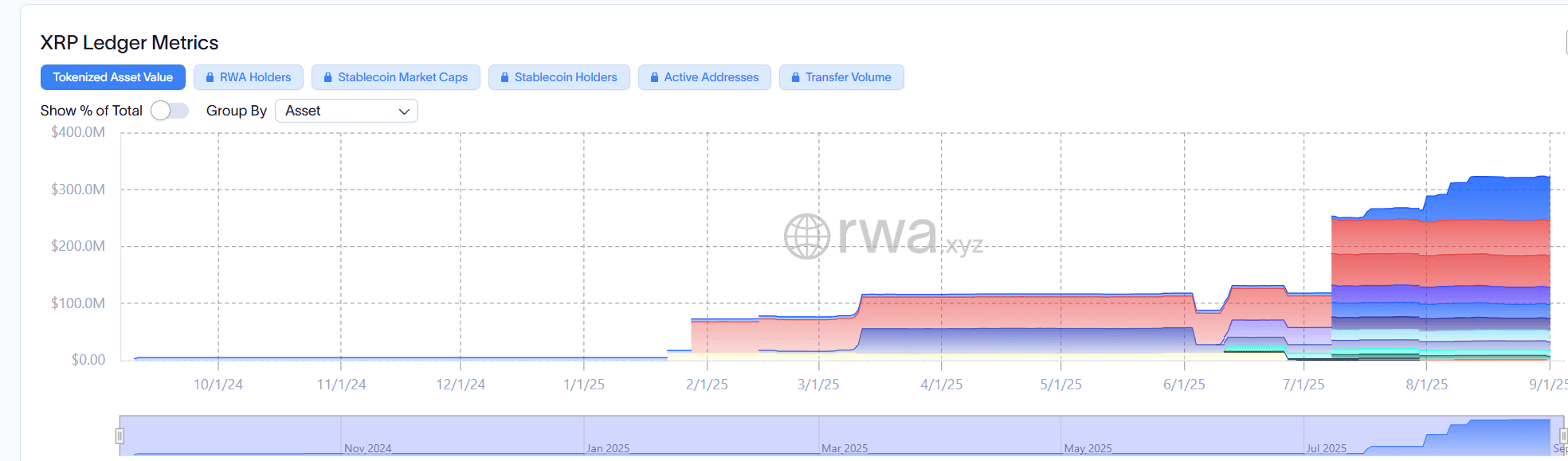

The project’s underlying blockchain has seen some impressive numbers recently, achieving a real-world asset (RWA) market cap of over $130 million at the end of the second quarter of 2025.

That same metric, just two months later, taking data from last week, has made an impressive jump of 144% to over $320 million, according to RWA.xyz.

Price Outlook

XRP closed off last Tuesday spot on the $3 mark, and, at the time of writing, is trading at around $2.7, a 10% drop, likely caused by profit-taking, macro-related events, or political jitters.

Current sentiment on social media for the token seems to be bullish, with analysts predicting rallies and potentially new all-time highs. Another popular chartist on X laid out the necessary steps for XRP to break out of its current downfall and head for a new all-time high.

There are, of course, people preparing for a bear market, and they have presented potential price targets if the buyers fail to take control.