Trump Media Deal Ignites Explosive Demand and Price Boom for CRO

Trump's latest media partnership sends CRO skyrocketing—traders pile in as institutional money meets meme energy.

Market Frenzy

The announcement triggered immediate double-digit percentage gains, pushing CRO toward yearly highs. Exchange volumes exploded 300% within hours as retail traders chased the momentum.

Liquidity Onslaught

Bid walls thickened across major platforms while open interest in derivatives markets hit record levels. The surge briefly overwhelmed several exchange engines during peak trading.

Regulatory Side-Eye

Watchdogs reportedly began monitoring the unusual activity—though let's be honest, they're always three steps behind when political narratives collide with crypto markets.

This isn't just another pump—it's a perfect storm of celebrity endorsement, pent-up demand, and that classic crypto willingness to bet big on headlines over fundamentals.

CRO Price Hits Multi-Year Peak

Cronos (CRO) has broken out with one of its largest moves in years. The token is up more than 138% in a week and 55% in the past 24 hours, trading at $0.36 after it peaked at $0.38 earlier today. The rally takes CRO to its highest level in over three years.

Market data shows a capitalization of $11.52 billion and daily turnover of $3.71 billion, with trading volume up 166% in one day. The rally follows news of the recently announced partnership between TRUMP Media and Crypto.com.

Consequently, the deal includes token purchases, credit lines with Yorkville Acquisition Corp., and broader coverage tied to the Trump brand. The news brought CRO into the spotlight, attracting both retail and institutional traders.

CRO had been under pressure for much of the year, trading in a downtrend until late July. A slow recovery started in early August, but the latest announcement accelerated the move. Within days, the token reversed its year-long losses and pushed sharply higher.

Network Activity Surges

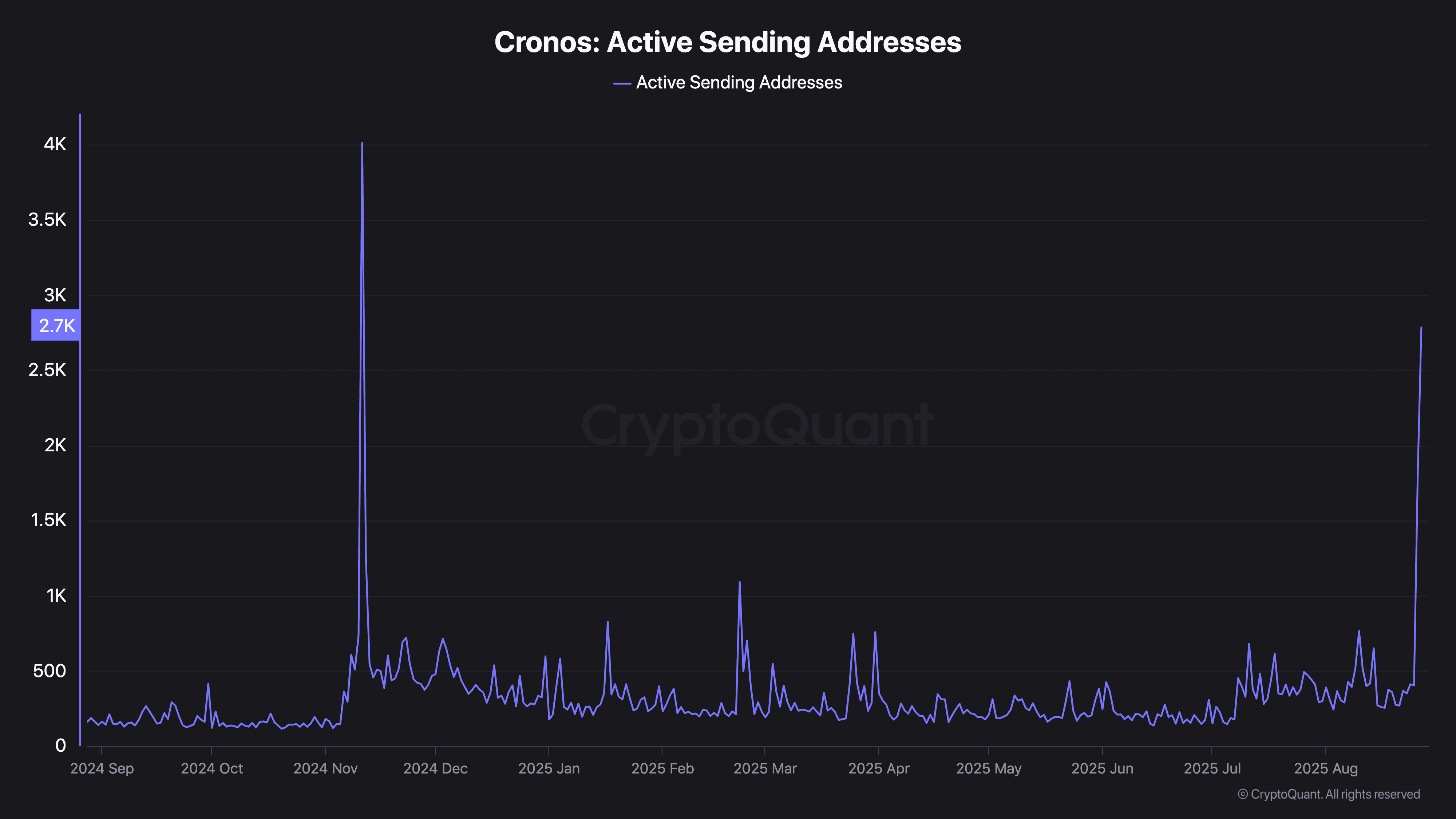

On-chain activity ROSE alongside the rally. Data from CryptoQuant shows active sending addresses climbing above 2,700 on August 27, the highest level in almost a year. Daily averages had been closer to 500 before the spike.

Meanwhile, the transfer count also increased. More than 15,000 transactions were recorded in a single day, compared with a usual range of 500 to 2,000. The rise points to heavy movement of CRO across exchanges and wallets, consistent with speculative trading and profit-taking.

Record Futures Market Positioning

CRO futures activity has also hit new highs. Open interest jumped 64% in one day, reaching $187.43 million, the largest figure ever recorded for CRO derivatives.

During past cycles, open interest peaked near $120 million. Current levels show a sharp rise in Leveraged trading, adding to the volatility around CRO. With both spot and futures markets active, the token has entered its most intense trading phase since 2021.