Ethereum’s $4,950 Liquidity Grab Sparks Major Plunge: Is a Catastrophic Dump Next?

Ethereum just got rocked—hard. A sudden liquidity grab at $4,950 sent the asset into a tailspin, leaving traders scrambling and portfolios bleeding.

What Triggered the Drop?

Markets don’t crash without a catalyst. This wasn’t just profit-taking; it was a structured wipeout. Whales moved, liquidity vanished, and retail got caught holding the bag—classic crypto.

Is This the Start of Something Worse?

History rhymes, especially in crypto. Sharp rejections at key levels often precede deeper corrections. If support cracks, things could get ugly fast.

Where Does Ethereum Go From Here?

Either this is a healthy flush before the next leg up… or the beginning of a much nastier downturn. One thing’s certain: in crypto, the only free lunch is the one you take from someone else’s plate.

Ethereum Price Action

Ethereum surged to a new all-time high of $4,950 on August 24 before losing momentum. The token has since pulled back to around $4,550, down 4.5% over the past 24 hours, though still up 8% on the week. Since early August, ETH has climbed 26% and remains more than 220% above its yearly low.

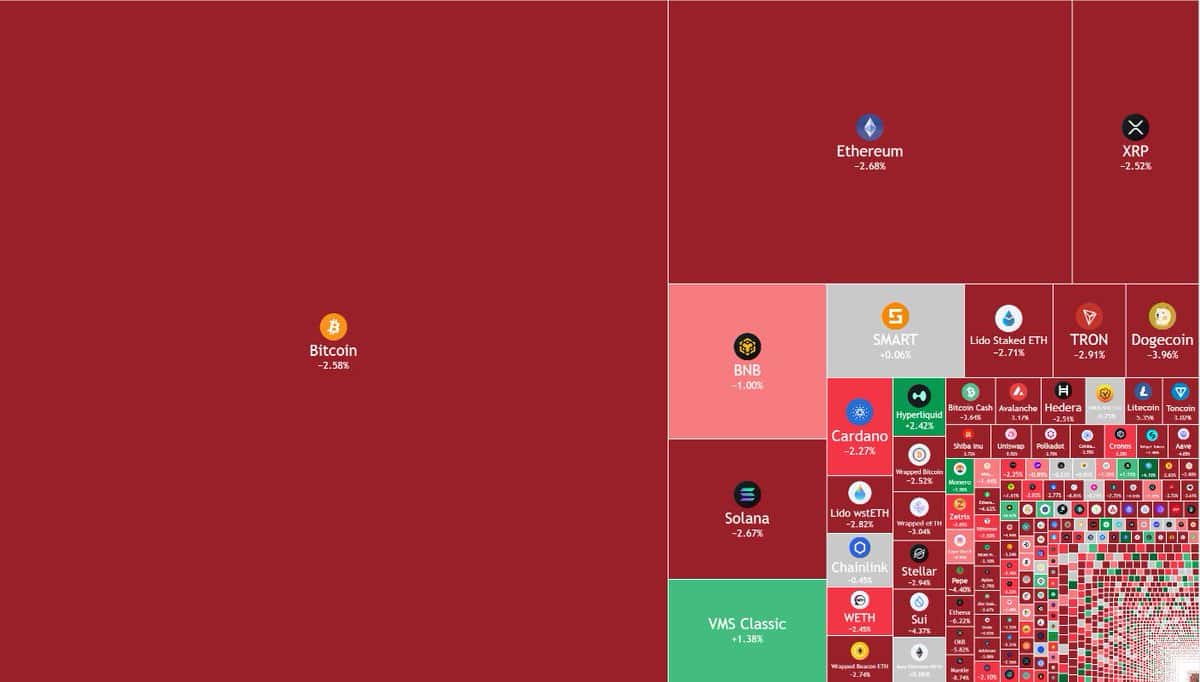

Meanwhile, the reversal came during a wave of liquidations across the market. More than $720 million in positions were wiped out in the last day, with nearly $500 million tied to Bitcoin and ethereum longs. The rejection near $4,950 triggered much of the flush.

Liquidity Grab and Support Levels

Analyst Lennaert Snyder said Ethereum “took liquidity above $4,880 and flushed Leveraged longs.” He added that ETH is “currently testing ~$4,500 support, but it doesn’t look strong.”

Snyder pointed to $4,693 as the key range low for bulls to reclaim quickly. A recovery above that level could open another MOVE toward $4,880. If $4,500 fails, the chart suggests ETH could slide to $4,300, which marked the start of its last impulse higher.

$ETH took liquidity above $4,880 and flushed leveraged longs.

Currently testing ~$4,500 support, but is doesn’t look strong.

Best case scenario for the bulls is to reclaim $4,693 rangelow asap.

If we lose here, Ethereum will probably retest the $4,300 start impulse. pic.twitter.com/Mkl4BtFizy

— Lennaert Snyder (@LennaertSnyder) August 25, 2025

The $4,880 zone now acts as immediate resistance, while $4,500 remains under pressure.

Whale Buying and Institutional Flows

Large players have been active in recent sessions. Wise crypto noted that whales added more than $1.6 billion worth of ETH this week, even as volatility increased. They described $4,590–$4,760 as a demand area that aligns with the 0.5 Fibonacci retracement at $4,780.

Wise Crypto highlighted $4,950 (0.618 Fib) as the resistance to clear. A break above that line could set a path toward $5,500, with checkpoints at $5,190 and $5,500.

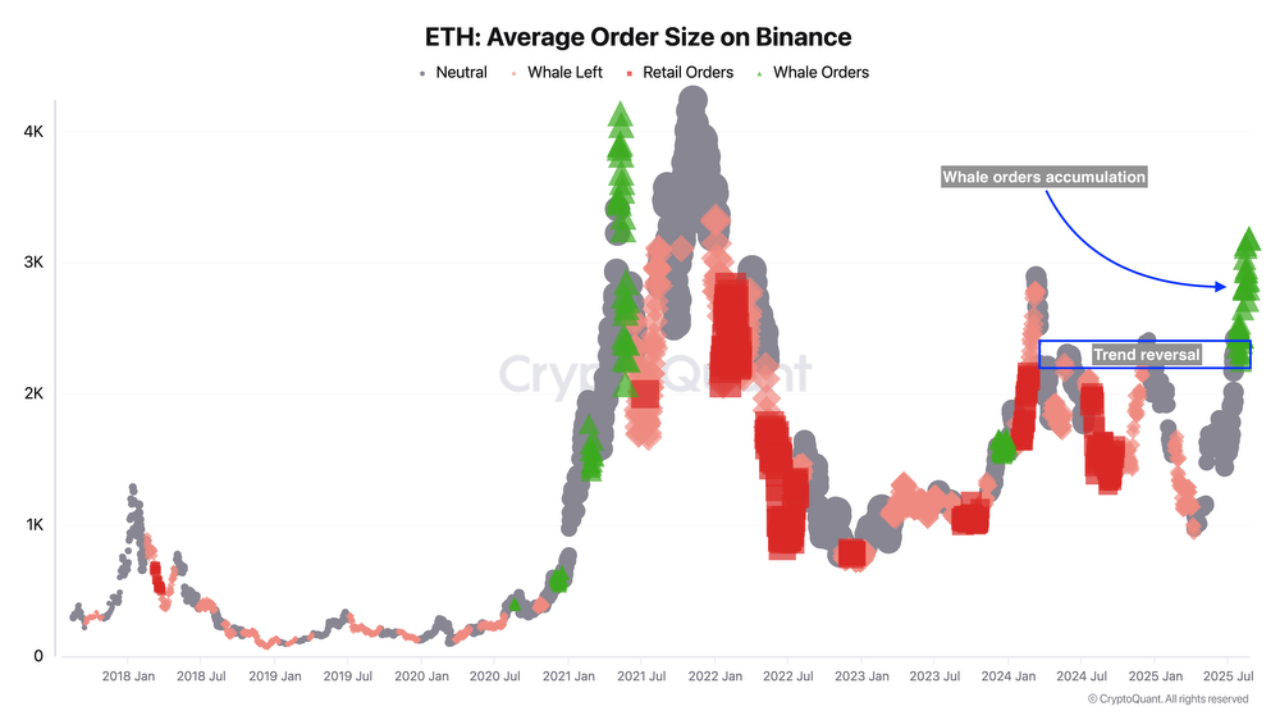

At the same time, CryptoQuant analyst Darkfost pointed to continued whale accumulation on Binance.

“Since July, we have seen a significant increase in demand coming from Binance whales,” they wrote.

According to the analyst, their activity shows a preference for building positions after explicit trend confirmation, which could provide extra support if ETH attempts another push toward $5,000.

Ethereum’s rally in August has been strong, but historical trends indicate that September often brings corrections after a profitable August. Data from CoinGlass suggests the same could apply this year.

For now, ETH sits between critical levels: $4,690 on the upside and $4,500–$4,300 on the downside. A reclaim could reignite momentum toward $5,000, while failure may reinforce seasonal weakness.