The Bitcoin Treasury Movement Rolls On — Here’s What’s New in 2025

Corporate treasuries keep stacking sats while Wall Street watches from the sidelines.

The Balance Sheet Revolution

Public companies worldwide continue converting cash reserves into Bitcoin—hedging against inflationary monetary policies that keep printing presses running hot. No boardroom wants to explain why they held decaying fiat while competitors built digital gold positions.

Institutional Adoption Accelerates

BlackRock's ETF dominance created a gateway for Fortune 500 entries. Treasury managers now face shareholder pressure to allocate 1-3% to Bitcoin—or risk looking technologically obsolete. The 'optionality play' narrative shifted to 'strategic imperative' almost overnight.

Regulatory Hurdles (And Loopholes)

While the SEC dances around spot ETF approvals, corporations use Canadian listings and over-the-counter derivatives to gain exposure. Because nothing says 'financial innovation' like navigating three different regulatory regimes to buy an asset your CFO doesn't fully understand.

The New Corporate Arms Race

MicroStrategy's 200,000+ BTC hoard remains the benchmark, but energy companies and tech firms are closing the gap. Mining operations now hedge energy costs with Bitcoin treasuries—creating circular economies that would make traditional finance heads spin.

Watch the dominoes fall while traditional portfolio managers still debate 'store of value' merits. Their loss—literally.

Slowly Climbing Up

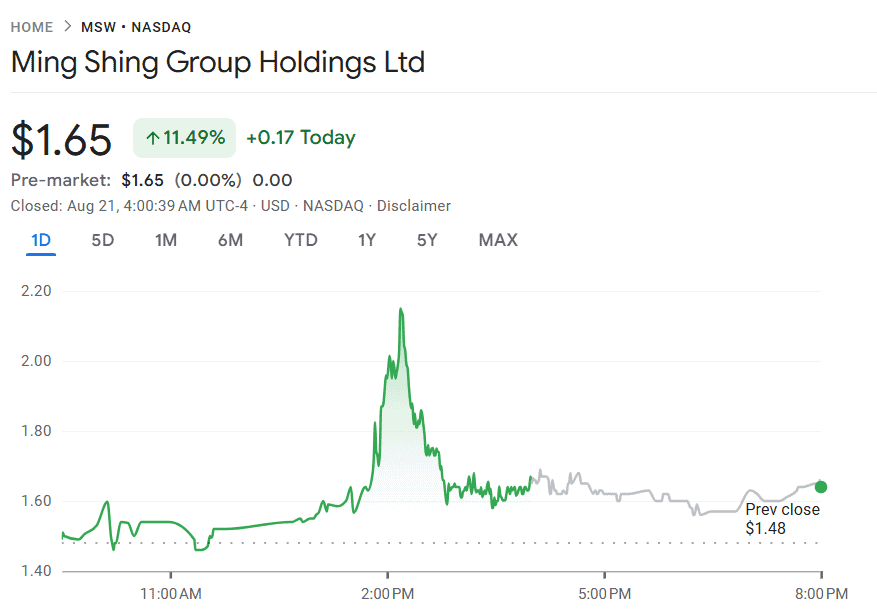

One of the more recent procurements comes from Ming Shing Group, a publicly traded Hong Kong-based company listed on the NASDAQ (MSW), specializing in wet trades, such as plastering, tiling, and bricklaying, among others.

The purchase agreement is for 4,250 bitcoins, worth approximately $482 million, with an average price of $113,638 per unit. It is currently ranked 45th on the BitcoinTreasuries leaderboard, with 833 BTC, having started accumulating in early January, trailing the Nordic healthcare company H100 Group’s stash of 911 BTC.

Its stock has reacted positively to the announcement, rising over 11% daily earlier tshi week, according to the most recent data from Google Finance.

A Known Face

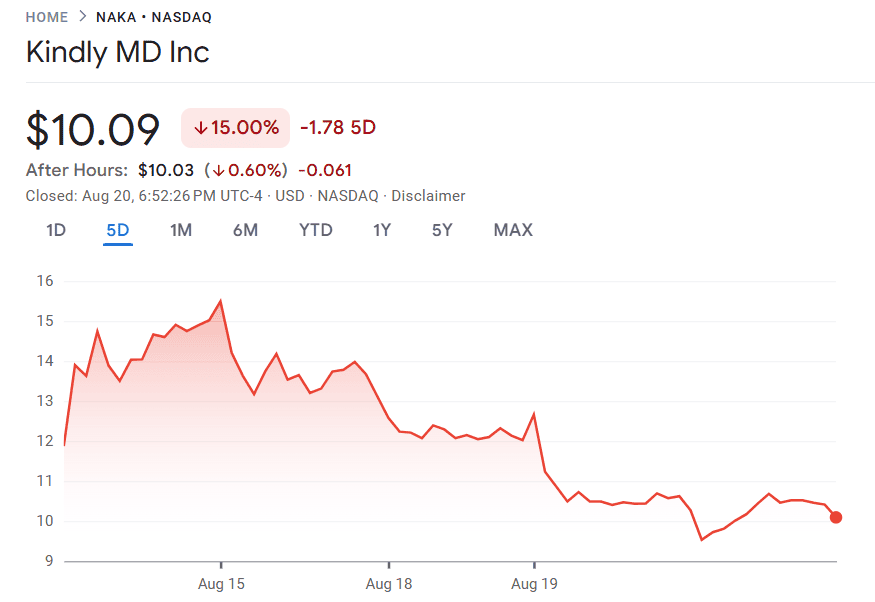

Earlier in the week, KindlyMD increased its holdings by a notable 5,744 BTC, with an estimated cost of $679 million, at an average cost per Bitcoin of $118,204. It’s an American healthcare and healthcare data company, also trading on the NASDAQ (NAKA), having merged with its Bitcoin-native holding company, Nakamoto Holdings Inc., at the start of May.

The firm joined the race later in the same month, with the mission of accumulating a million of the leading crypto asset. They’re much further ahead in the rankings, holding 5,765 BTC and currently sitting in 16th place, with a notable lead over Semler Scientific, which owns 5,021 BTC at print time.

“This acquisition reinforces our conviction in bitcoin as the ultimate reserve asset for corporations and institutions alike.

Our long-term mission of accumulating one million Bitcoin reflects our belief that Bitcoin will anchor the next era of global finance, and we are committed to building the most trusted and transparent vehicle to achieve that future,” noted the CEO and Chairman, David Bailey.

The company’s stock, however, did not react so well to the news and has been declining since the start of the week, as indicated by data from Google Finance at the time of writing.