BlackRock’s iShares ETF Just Became the World’s Largest Bitcoin Holder—Here’s Why It Matters

Wall Street's quiet takeover of Bitcoin just hit a seismic milestone.

BlackRock's iShares Bitcoin ETF (IBIT) now holds more BTC than any known entity—including Satoshi's rumored stash. The fund's relentless accumulation strategy has reshaped the entire crypto landscape in under two years.

Institutional Onslaught

Daily inflows aren't just steady—they're structural. Pension funds, RIAs, and corporate treasuries now treat Bitcoin like any other asset allocation. The old guard never saw this coming.

Market Impact

Supply shock? Try supply annihilation. With BlackRock hoarding coins faster than miners produce them, available liquidity keeps shrinking. Price discovery becomes a function of ETF flows rather than spot trading.

Traditional finance finally found a way to embrace crypto—by turning it into exactly what they understand: another product to package and sell. Sometimes progress looks suspiciously like repackaged conformity.

History Being Made

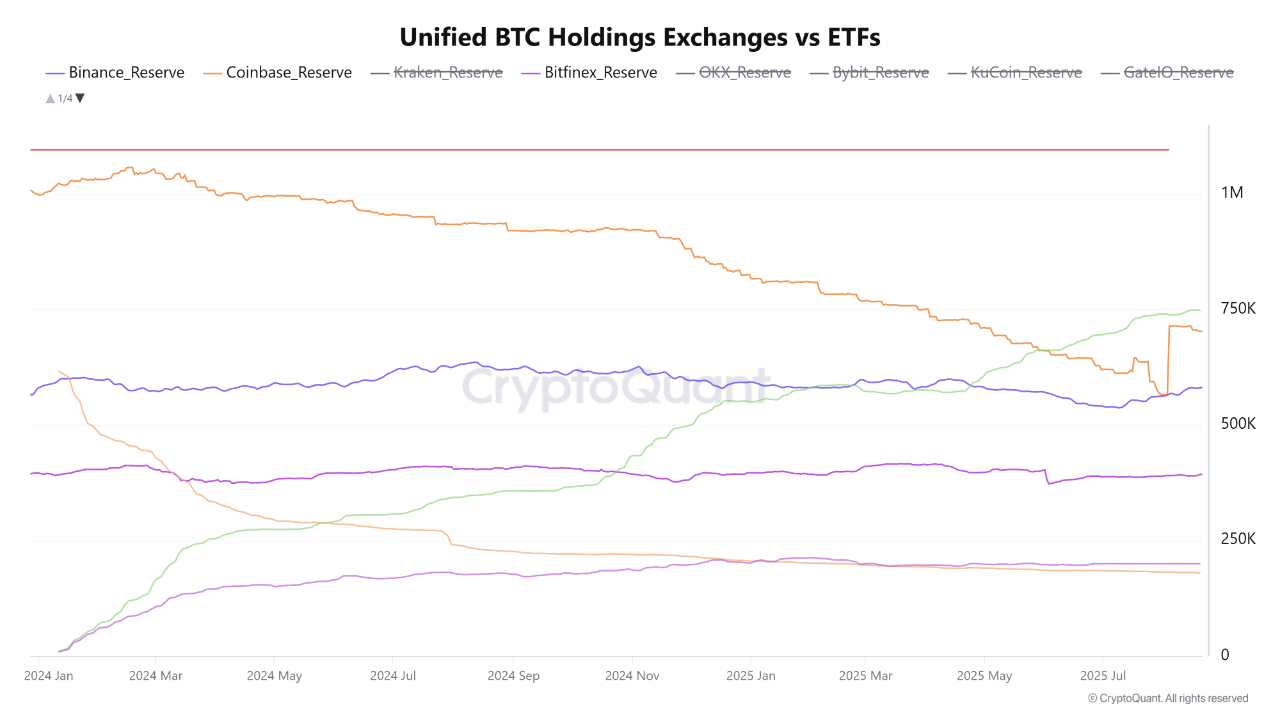

The on-chain analysis platform shared its latest report, highlighting a monumental feat achieved by BlackRock’s iShares Bitcoin Trust (IBIT) ETF. Launched in January of last year, the exchange-traded fund has amassed over 781,000 bitcoins, a staggering amount equivalent to more than $88 billion, considering the asset’s current price of around $113,000.

According to CryptoQuant’s data, the ETF has been leading the accumulation charge since May 2025, when it surpassed the stash held on Coinbase. As August came around, the lead was solidified, making the fund the largest holder of Bitcoin, with only the pseudonymous Satoshi Nakamoto’s wallet holding more.

The latest readings show a significant lead over Coinbase, and even Binance remains behind, with the exchanges owning over 703,000 and 558,000 units, respectively.

The investment company’s fund has even surpassed the gargantuan bitcoin treasury company Strategy, as according to the latest data from BitcoinTreasuries, it currently has 629,376 bitcoins, valued at around $71 billion, considering the prices at the time of writing.

What makes BlackRock’s achievement even more impressive is that the behemoth managed to overthrow the Saylor-led company’s 5-year accumulation lead in just a year and a half, showcasing the rapidly accelerating institutional adoption of the leading crypto asset.

What Does This All Mean?

The unrelenting inflows into the ETF indicate a significant shift in the market. The main driver of demand is no longer limited to retail exchanges and seasoned investors, but is now shifting to regulated financial products tailored to organizations.

The constant buying pressure from the IBIT fund is creating an ever-increasing supply shock, as the capital from the ETF is, for the most part, removed from circulation, compared to exchanges that use their reserves for trading. This provides strong support for the price, as the available supply drops.

This signals a behavioral change for investors as well, as the santiment towards more traditional and compliant funds increases. As holdings in prominent exchanges decline, their usual role as a storehouse of assets makes room for institutional demand.

While this marks a new chapter for the OG crypto, which has undergone a remarkable journey since it came to light in 2009, this corporational centralization goes against its ethos. It is unclear what effect this may have going forward, so continuous monitoring will be crucial in maintaining the balance.