HYPE Plunges After Rejection - Can This Critical Support Level Save It?

HYPE token faces brutal sell-off following failed breakout attempt—traders scramble as key support level comes under fire.

The Rejection That Shook Markets

HYPE's rejection at resistance triggered a cascade of liquidations, wiping out leveraged positions across major exchanges. The token now tests a make-or-break support zone that previously served as springboard for rallies.

Technical Breakdown

Price action suggests institutional players are dumping bags while retail gets rekt—classic crypto casino behavior. Trading volume spikes 300% as panic sets in, with order books showing massive sell walls stacking up.

Market Psychology at Play

Fear dominates sentiment as 'buy the dip' crowd hesitates—everyone's waiting for someone else to be the exit liquidity. Meanwhile, perpetual funding rates flip negative, indicating speculators are betting on further downside.

Support Level Showdown

This support held strong during May's market turmoil, but current stress tests reveal weakening conviction. A breakdown here could trigger algorithmic selling and push HYPE toward yearly lows.

Because nothing says 'sound investment' like watching your portfolio value get halved before breakfast—just another Tuesday in crypto.

Price Reversal After Resistance Test

Hyperliquid (HYPE) slipped after failing to hold above $48–$50. The token turned lower, repeating a rejection seen earlier at the same level. Analyst Ali Martinez said the next area to watch is $39.

HYPE was trading NEAR $42 at press time. It is down 4% in 24 hours and 3% over the week. The asset has fallen through support around $44–$45.

Charts show $39 as the next clear line, with heavier support at $36–$37. A move back above $46 WOULD help the bulls, while a break over $50 would reset the trend.

After a rejection at the top of the channel, Hyperliquid $HYPE targets $39! https://t.co/gen0qbWYYT pic.twitter.com/pYmqHFLtZp

— Ali (@ali_charts) August 18, 2025

Different Views in Market

Other voices remain more optimistic. Hydraze called HYPE “the most comfy ALT hold in crypto this year,” saying long-term holders should sit tight.

At the same time, Hyperliquid News reported that the project’s Assistance Fund has repurchased more than $29 million in HYPE, taking total buybacks above $540 million. Last week, CryptoPotato reported the latest MOVE higher was “led by spot buying,” with the fund absorbing supply. Buybacks of more than $5 million a day are expected to continue.

On-Chain Activity Holds Firm

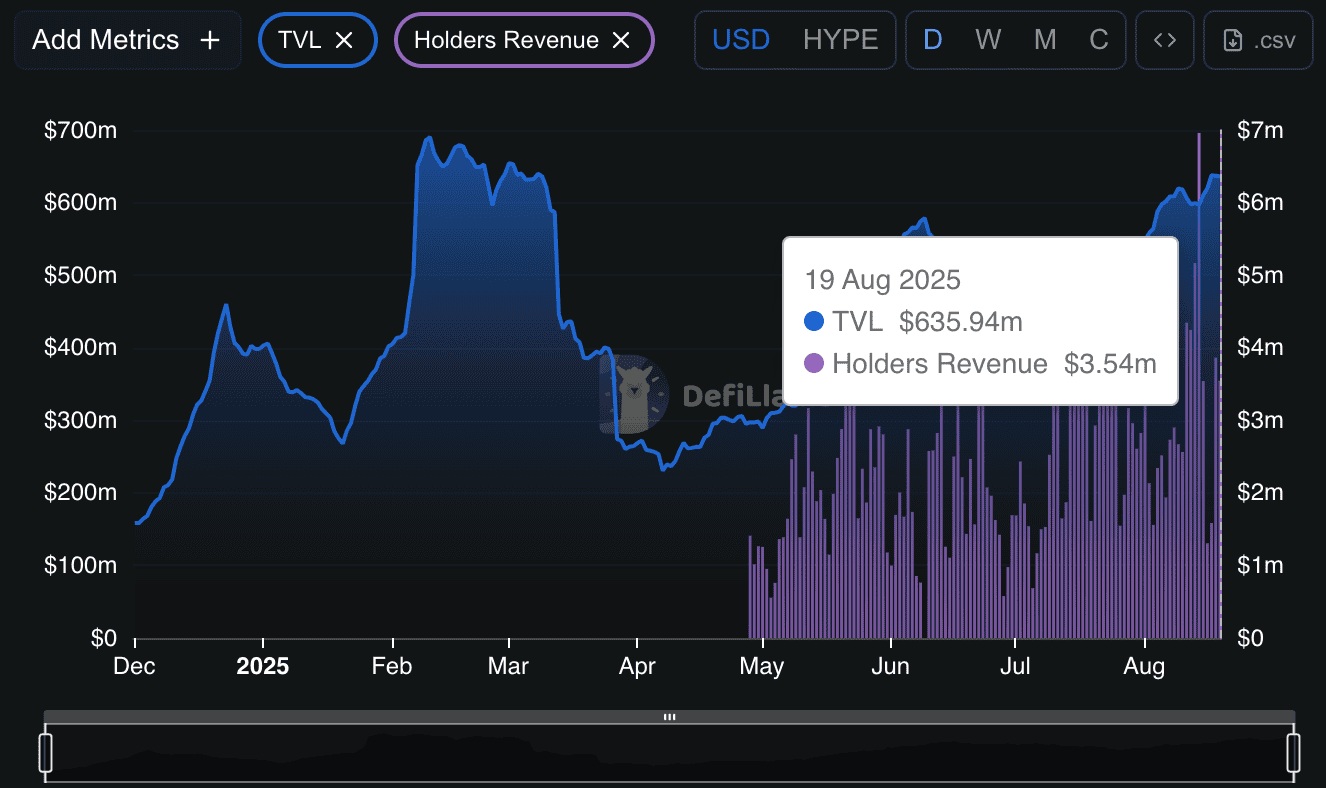

Apart from the price, network data indicate rising usage. Hyperliquid recorded $635.94 million in total value locked on August 19, alongside $3.54 million in holders’ revenue. TVL has more than doubled since April, when it dropped under $300 million.

Holders’ revenue has also stayed firm. Since June, daily numbers often topped $2 million, with peaks near $7 million. That growth shows steady demand for the platform’s services despite token volatility.

Charts now point lower, with $39 the level in focus. But continued buybacks and strong revenue may limit downside pressure. Traders are watching to see if HYPE stabilizes or extends its decline.