Bitcoin STHs Hit First Loss Since January—Is This the Dip Before the Rip?

Short-term Bitcoin holders just felt their first sting of red since January—but savvy traders know blood in the streets smells like opportunity.

Market psychology flip-flops

When STHs panic-sell, whales accumulate. The last time this happened, BTC rallied 40% in three months. Coincidence? Wall Street would call it 'irrational exuberance.' Crypto calls it Tuesday.

Liquidity chess match

Miners are hodling, derivatives open interest just reset, and the Fed's printer stays cold. This isn't 2022's bear market—it's a volatility sandwich with a side of leverage flush.

Bonus jab: Traders who 'realized losses' today probably bought the top while yelling 'hyperbitcoinization' on Twitter Spaces.

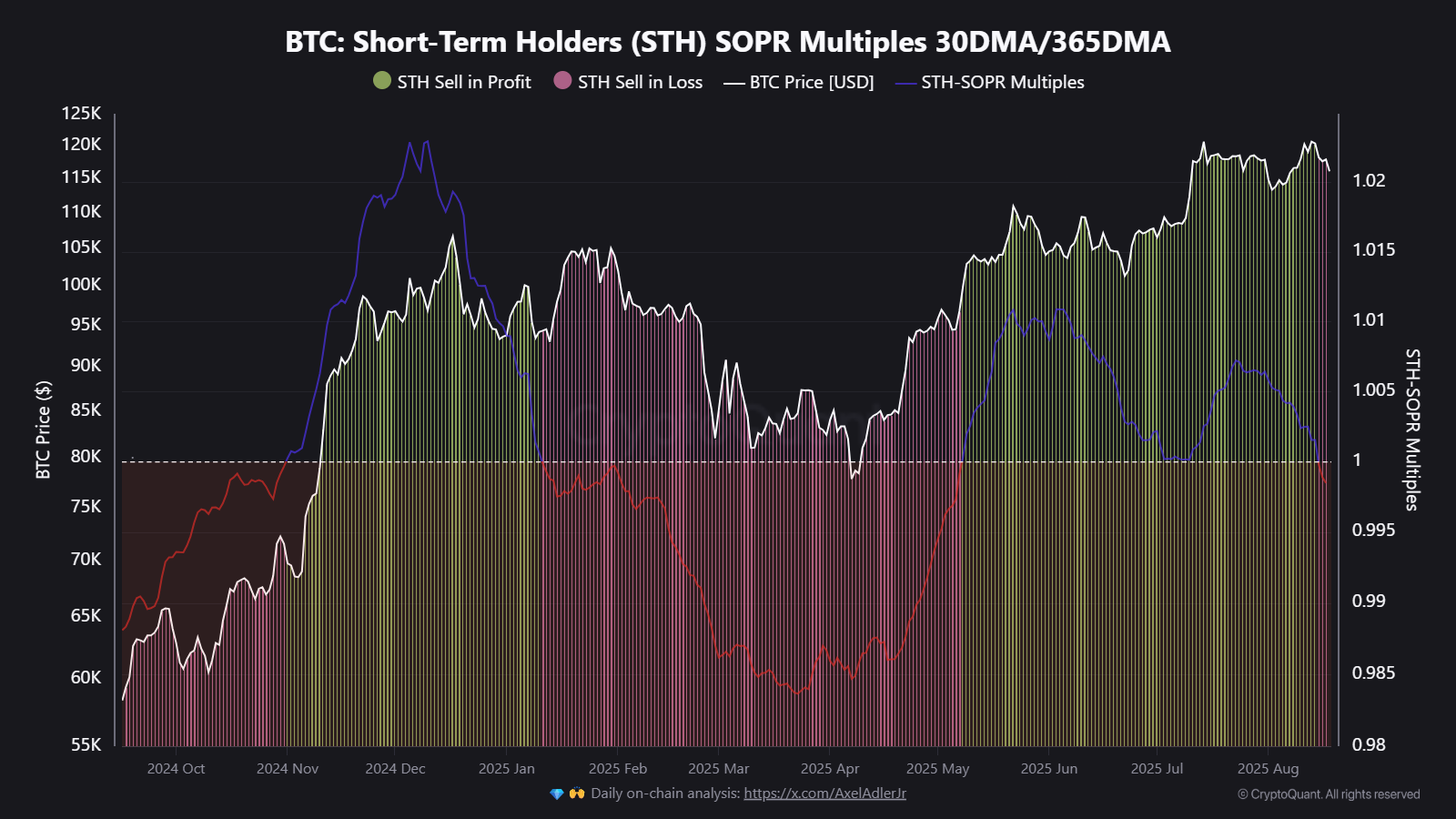

Short-Term Losses

Bitcoin’s short-term holders (coins held for about 5 months or less, or less than 155 days) have been selling at a loss for the first time since January of this year, when the asset started its most painful correction of this cycle. At that time, there was still uncertainty about how the TRUMP administration would affect markets, fears of interest rate hikes, and an AI tech sell-off caused by the introduction of DeepSeek.

The crypto market’s retracement culminated in early April with massive price declines, but began its recovery in the following months. Not only were the losses erased, but some assets, including BTC, managed to break their previous ATHs and chart new ones. This allows STHs to sell at a profit as Bitcoin went into a six-digit price territory.

The past several days, though, have seen another minor correction that took BTC south by ten grand. This resulted in another slight deviation as STHs have started to sell at a loss for the first time since January.

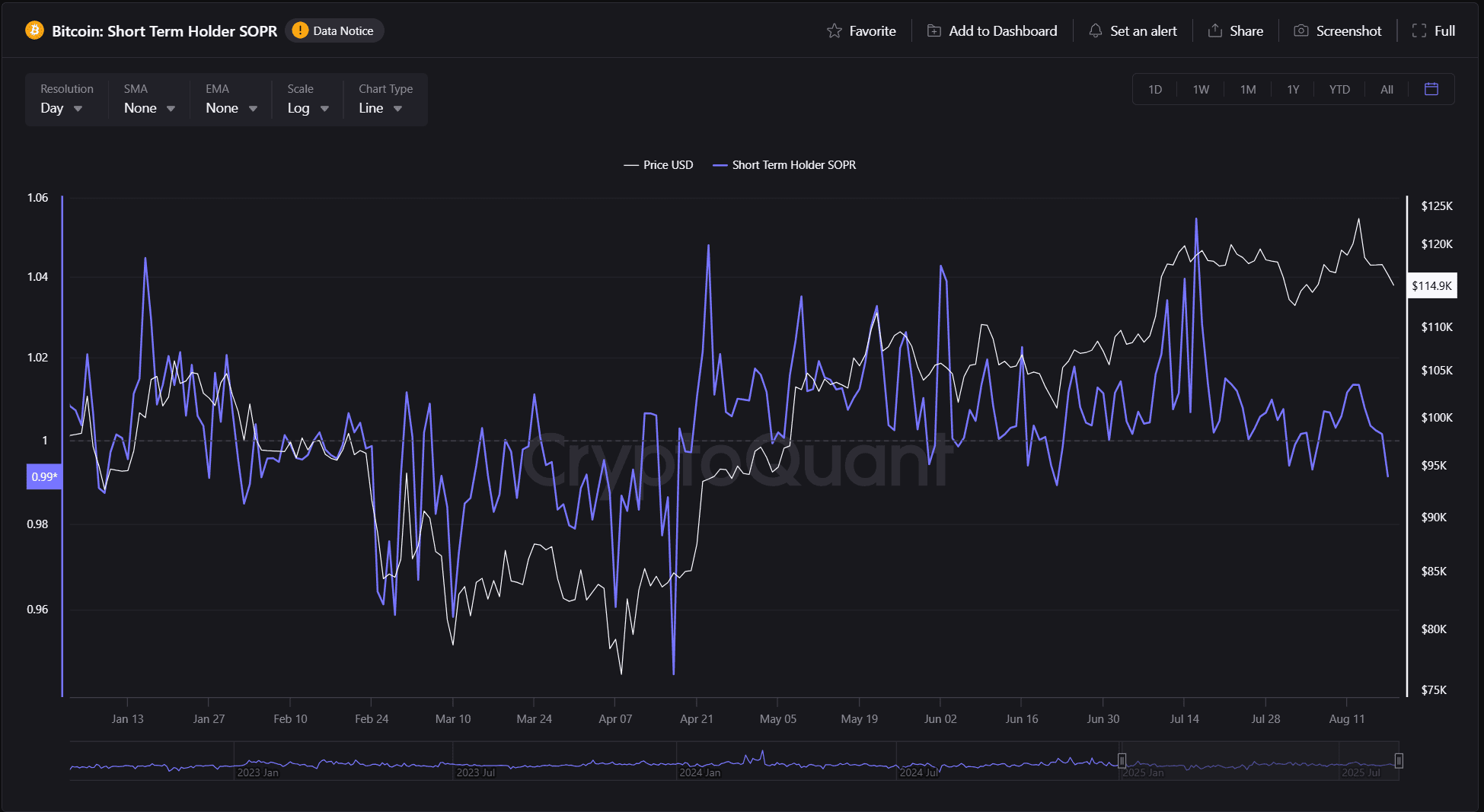

The STH-SOPR multiples (Spent Output Profit Ratio) have dropped below 1 for the first time in over six months, indicating that short-term investors are again realizing losses.

Suppose we use historic periods as an example. In that case, this change usually leads to either a weakening momentum in the market, when traders exit once too many losses accrue, or a recovery phase, clearing out the so-called ‘weaker hands’ in preparation for a new rally.

As BTC goes through its recent correction, this event will be pivotal for the future outlook of the cycle. If the bulls manage to absorb the wave of sell-offs quickly, it could lead to a rapid rebound; if not, there is a risk of further bearish price action.

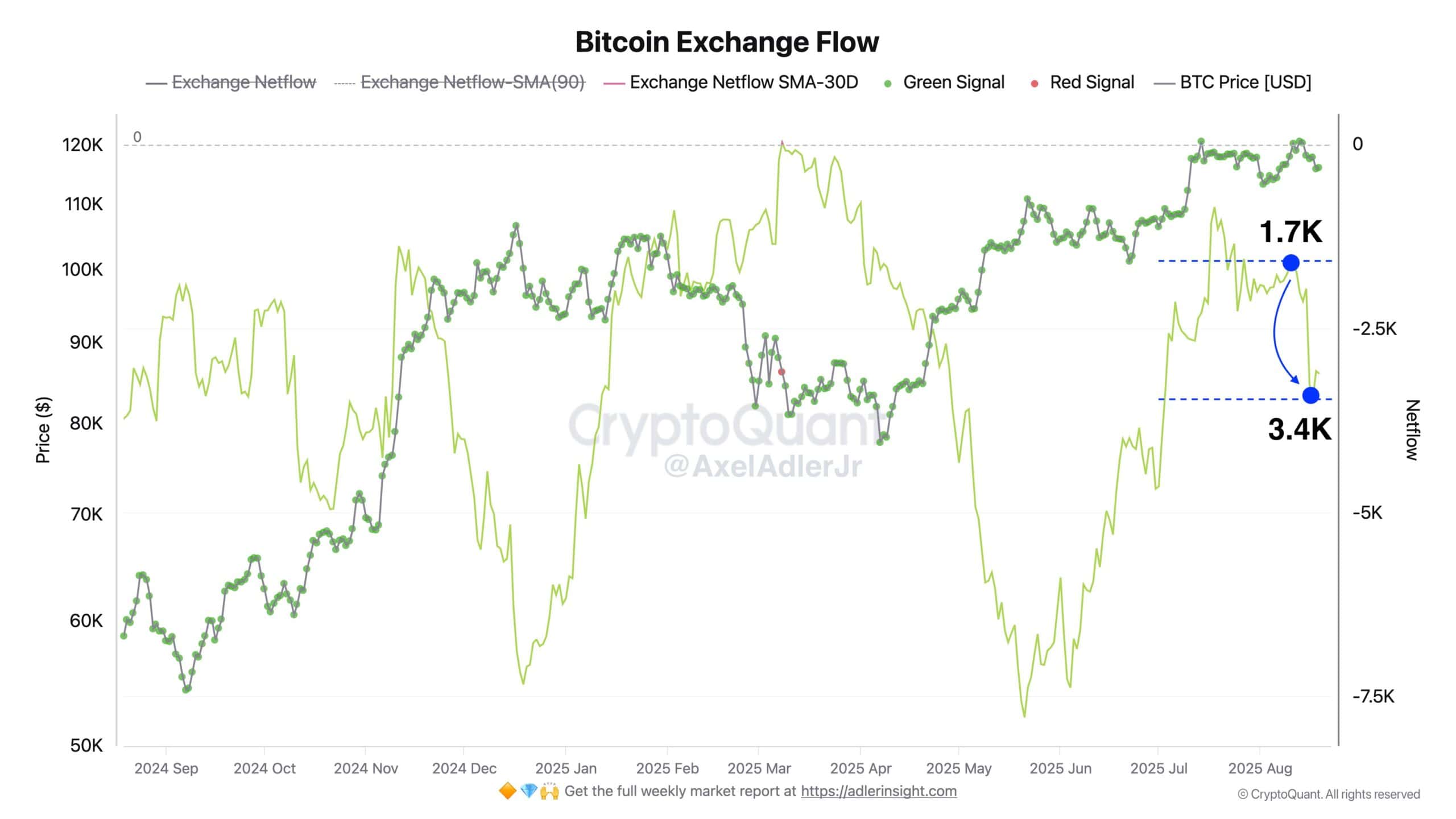

It’s Not All Bad

An analyst from CryptoQuant offers a glimpse of a potential turnaround, with Bitcoin’s exchange netflow (the difference between the amount of BTC leaving and entering exchanges) becoming more negative, from -1.7K to -3.4K BTC/day.

This means that the asset is being bought faster than it is sold on CEXs, hinting at traders buying the dip, preparing for a potential leg up.