WIF Primed for Explosive Breakout as Bullish Wedge Signals 17% Rally

Dogwifhat (WIF) isn't just barking—it's biting into a technical setup that could send shockwaves through meme coin markets. The 17% single-day pump? Just an appetizer.

The Wedge Playbook

Traders are circling as WIF's consolidation tightens into a textbook bullish wedge. Breakout protocols are live—watch for a volume spike to confirm the next leg up.

Meme Coin Math

While 'fundamentals' remain an inside joke (it's literally a dog with a hat), the charts don't lie. This pattern historically precedes 40-60% runs when BTC isn't being a buzzkill.

The Cynic's Corner

Another day, another dog coin rally. At least this one's got better technicals than your average 'vampire attack' token—though that's not saying much in this circus.

Price Breakout From Broadening Wedge

Dogwifhat (WIF) was trading at $1.04 at press time after gaining 17% in the past 24 hours and 20% over the week. Trading volume in the last day reached $401.3 million.

CryptoBull_360 noted that WIF is “primed for a good breakout” from a broadening wedge pattern on the 4-hour timeframe.

On the 1-hour chart, price broke above resistance at $1.02–$1.04 after rising from $0.9. The projected target from this breakout is $1.3, a 23% gain from current levels.

#WIF also primed for good breakout from the broadening wedge pattern formation in 4hr TF, Keep an eye on$WIF #WIFUSDT #BOME #DOGE #SHIB #meme pic.twitter.com/0j9virE0ny

— CryptoBull_360 (@CryptoBull_360) August 13, 2025

Resistance and Support Levels

CW observed that WIF is “breaking through the first sell wall.” The 4-hour chart shows price entering a red resistance zone between $1.04 and $1.08. Above this, further resistance is seen up to $1.25.

Support remains around $0.90–$0.93, where price previously bounced. Holding above the breakout zone may keep the bullish momentum intact.

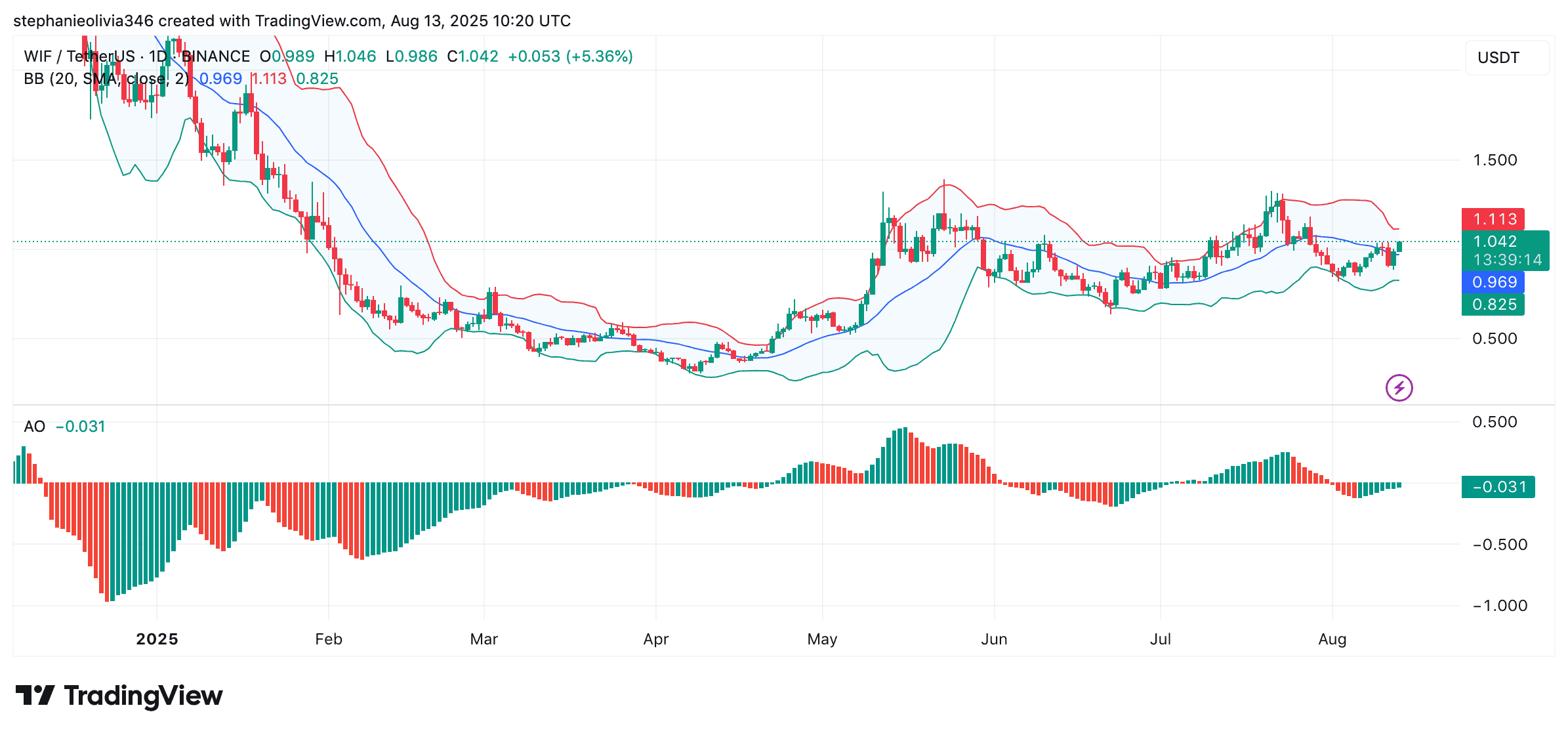

Bollinger Bands on the daily chart show price above the middle band at $0.969, suggesting short-term strength, while the upper band NEAR $1.112 is the next resistance. The Awesome Oscillator is slightly negative at -0.031, pointing to possible short-term consolidation.

Network Activity and Market Data

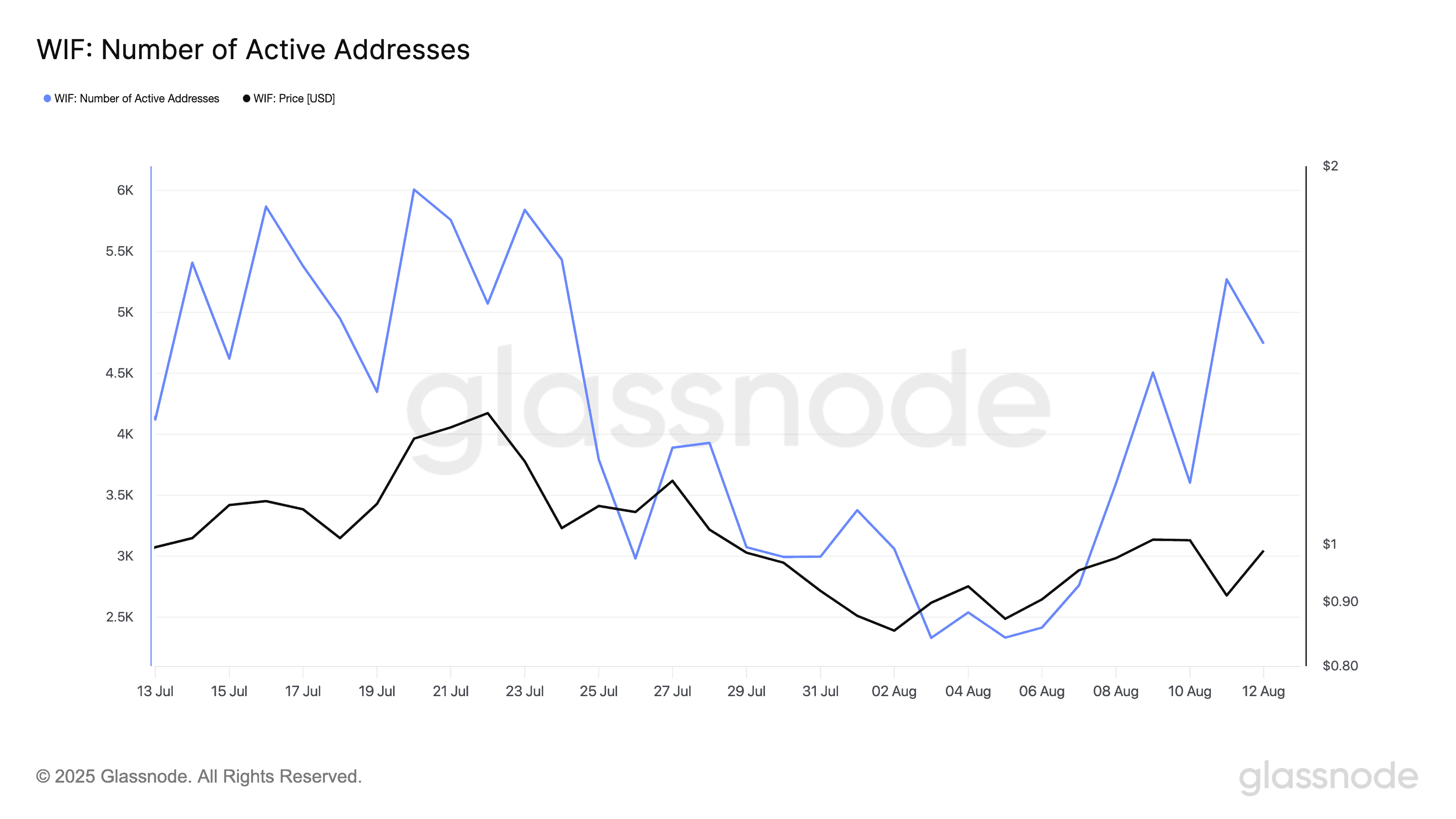

Glassnode data shows 4,745 active addresses on August 12. Active addresses peaked above 6,000 in late July before dropping below 2,500 in early August. Since then, they have rebounded, aligning with price recovery from $0.85–$0.90 to the $1 range.

CoinGlass reports a 28% rise in trading volume to $1.8 billion. Open interest increased 13% to $421 million. The growth in both metrics suggests rising market participation as WIF approaches key resistance.