Big Ethereum (ETH) Whales: What Moves Are They Making in 2025?

Ethereum's heavyweight investors aren't sitting idle—so where's the smart money flowing?

Tracking the ETH whales

While retail traders chase memecoins, Ethereum's big players are quietly repositioning. On-chain data reveals strategic accumulations in layer-2 solutions and staking derivatives—sectors poised to dominate the next bull cycle.

The institutional playbook

VCs and hedge funds are doubling down on DeFi blue chips, hedging with ETH puts, and—in classic finance fashion—creating synthetic exposure to assets they publicly call 'overvalued'.

Bottom line: When whales move, markets ripple. Just don't expect them to telegraph their next trade.

Whales Filled Their Bags

The price of ethereum (ETH) has been on a significant uptrend in the past month, rising by almost 50% to just south of $4,200. The resurgence was aligned with a massive accumulation from whales (investors who hold between 10,000 and 100,000 coins), who bought more than 1.8 million tokens during that timeframe.

The USD equivalent of the stash is over $7 billion, while this cohort of market participants now controls 28.5 million assets, or roughly 23.6% of ETH’s circulating supply.

Purchases of this type leave fewer coins available on the open market and could propel a further price rally (should demand remain steady or head north). The whales’ activity is also closely monitored by smaller players who might decide to mimic their MOVE and distribute fresh capital into the ecosystem.

Shortly after revealing the size of the accumulation, the popular X user Ali Martinez made a highly bullish price prediction. He argued that $6,400 becomes “a magnet” if ETH breaks above $4,000.

Other optimistic analysts include CryptoELITES and crypto GEMs. The former set the next target at $4,500, whereas the latter envisioned a price increase beyond $5,000 this summer.

Observing These Factors

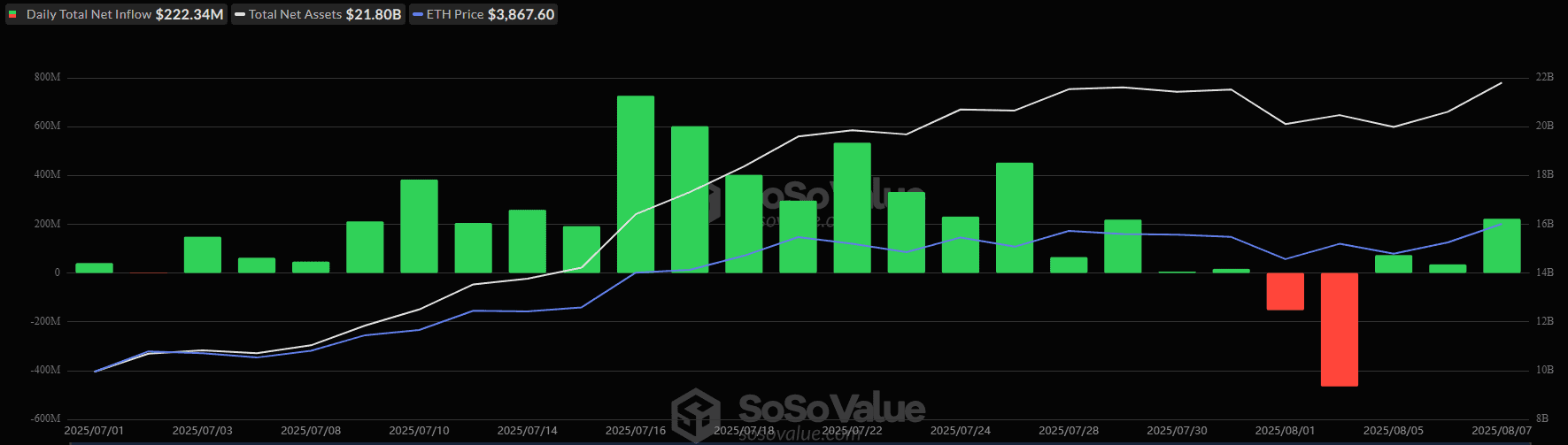

At the start of the month, spot Ethereum ETFs experienced significant outflows; however, over the past three days, capital has begun flowing back into the funds. This suggests that investor interest remains solid.

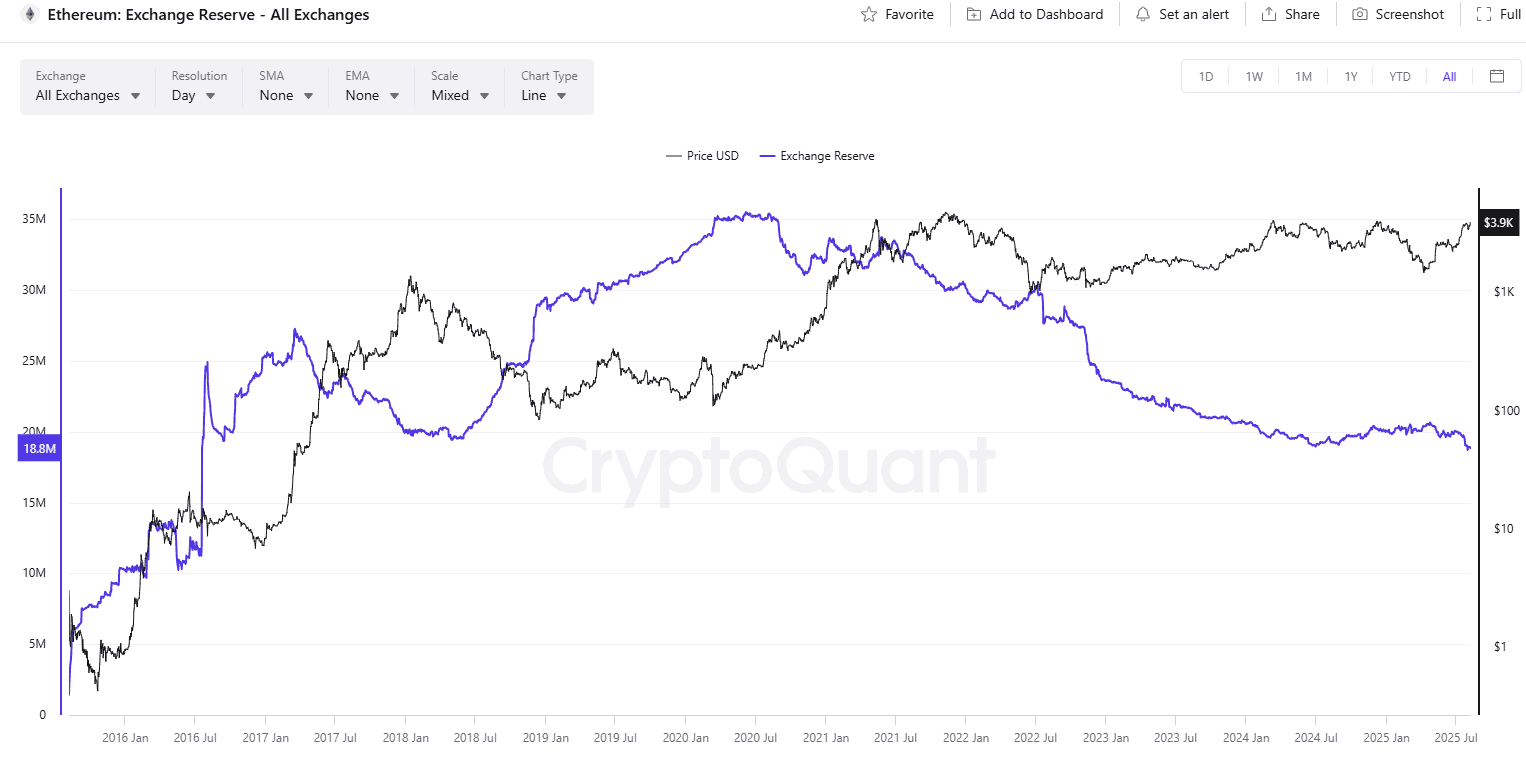

Next on the list is the amount of ETH stored on crypto exchanges, which recently dropped to a nine-year low. This development suggests that many investors have shifted from centralized platforms toward self-custody methods, which reduces the immediate selling pressure.

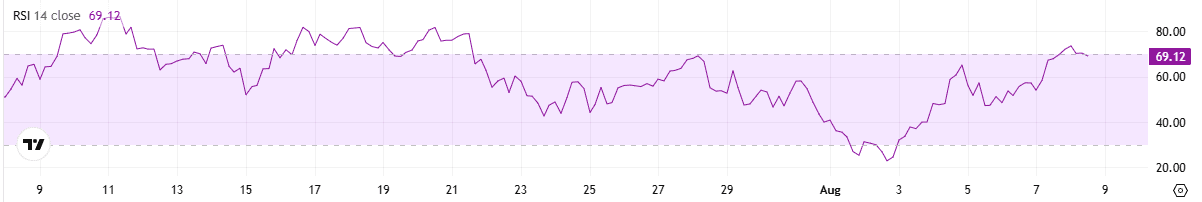

On the other hand, ETH’s Relative Strength Index (RSI) has climbed to bearish territory of 70. The technical analysis tool measures the speed and magnitude of recent price changes, and traders use it to spot potential reversal points. Readings above 70 indicate that the valuation has soared too rapidly in a short period and could be a precursor to a pullback. Anything below 30 is considered a buying opportunity.