XRP, BNB, and BTC Have Soared—Is Ethereum (ETH) Next to Explode in 2025?

The crypto heavyweights are flexing—XRP, BNB, and BTC have already punched through resistance. Now, traders are eyeing Ethereum like a coiled spring.

Why ETH’s Turn Might Be Coming

Market cycles don’t wait for sentiment. With Bitcoin dominance wobbling and altcoins itching for a run, ETH’s tech upgrades and institutional adoption could spark the fuse.

The Looming Catalyst

DeFi’s backbone isn’t just sitting pretty. Gas fee optimizations and staking yields are turning heads—even among the ‘traditional finance’ crowd (who still think blockchain is a type of Excel filter).

Risks? Sure. The SEC’s coffee machine probably brews enforcement actions by now. But if ETH flips the script, the FOMO could make 2021 look tame.

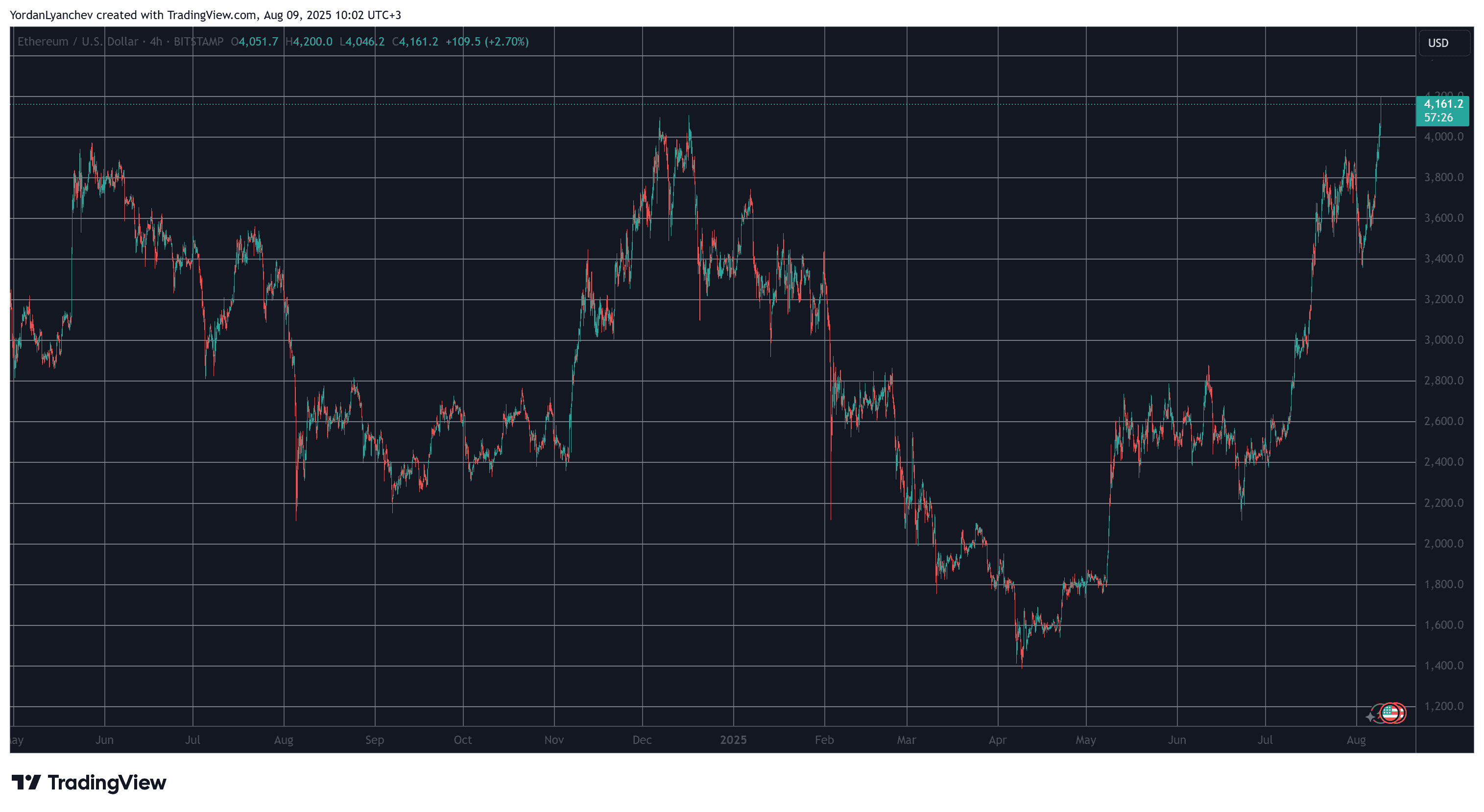

ETHUSD. Source: TradingView

ETHUSD. Source: TradingView

Is it Time?

The 4-hour graph above paints a very interesting picture. Ethereum, alongside the rest of the market, rocketed at the end of 2024 after the US elections. However, while BTC managed to surge past $100,000 to chart a fresh peak, ETH’s rally was capped at around $4,000. It tried to break that crucial resistance a few times, but it faced immediate rejection.

The last one, which took place in early 2025, was particularly painful as it led to a violent correction that culminated in early April with a price dump to under $1,400. At the time, the sentiment around the largest altcoin was extremely bearish, with multiple holders disposing of their ETH holdings.

However, the landscape quickly turned, and it wasn’t long until ether managed to rebound past $2,000. It stayed there for a few weeks before the bulls stepped on the gas pedal and drove the asset north hard. By the end of July, it had neared the familiar $4,000 resistance, but couldn’t penetrate it.

This finally happened last night when ETH shot up past it and shipped to a new three-and-a-half-year high of $4,200. This meant that the world’s second biggest cryptocurrency had added 200% in just four months.

Now, though, all eyes are turning to the November 2021 all-time high of almost $4,900 (CoinGecko data), which is roughly 15% away. If it manages to break it, ETH will join the likes of BNB and XRP as some of the altcoins that have gone into uncharted territory during this cycle.

What’s Driving ETH’s Pump?

The answer to this is multi-fold. Investors using the ETFs to gain ETH exposure went berserk by accumulating massive shares within a relatively short time period. In fact, July outperformed all 11 previous months combined in which the ETH ETFs existed.

Then, there were companies that went all in by spending billions to acquire more ether. Whales have also gone on a buying spree, and all of this has helped the underlying asset to gain traction and outperform many of its competitors in the past few months. Nevertheless, the big target is still ahead of it, and only time will tell if this is indeed ETH’s moment to take the spotlight and run with it.