🚨 Ethereum Whales Dump $69M as Taker Volume Tanks – Time to Panic?

Whales are making waves—and not the good kind. Ethereum's big players just shifted a staggering $69 million as taker volume nosedived. Is this a strategic exit or just another Tuesday in crypto?

The Whale Watch: When these giants move, markets tremble. The sudden sell-off raises eyebrows—especially with liquidity drying up faster than a DeFi yield farm in a bear market.

Volume Vanishes: Taker activity plummeting alongside whale exits? That's not a coincidence—it's a flashing neon sign for traders. Either the smart money knows something we don't, or someone's overreacting to Elon's latest tweet.

Bottom Line: In crypto, $69 million is just a rounding error—until it isn't. Whether this is a blip or the start of something bigger, one thing's certain: the only free lunch in finance is the whale watching.

Large Sell-Side Volume Raises Attention

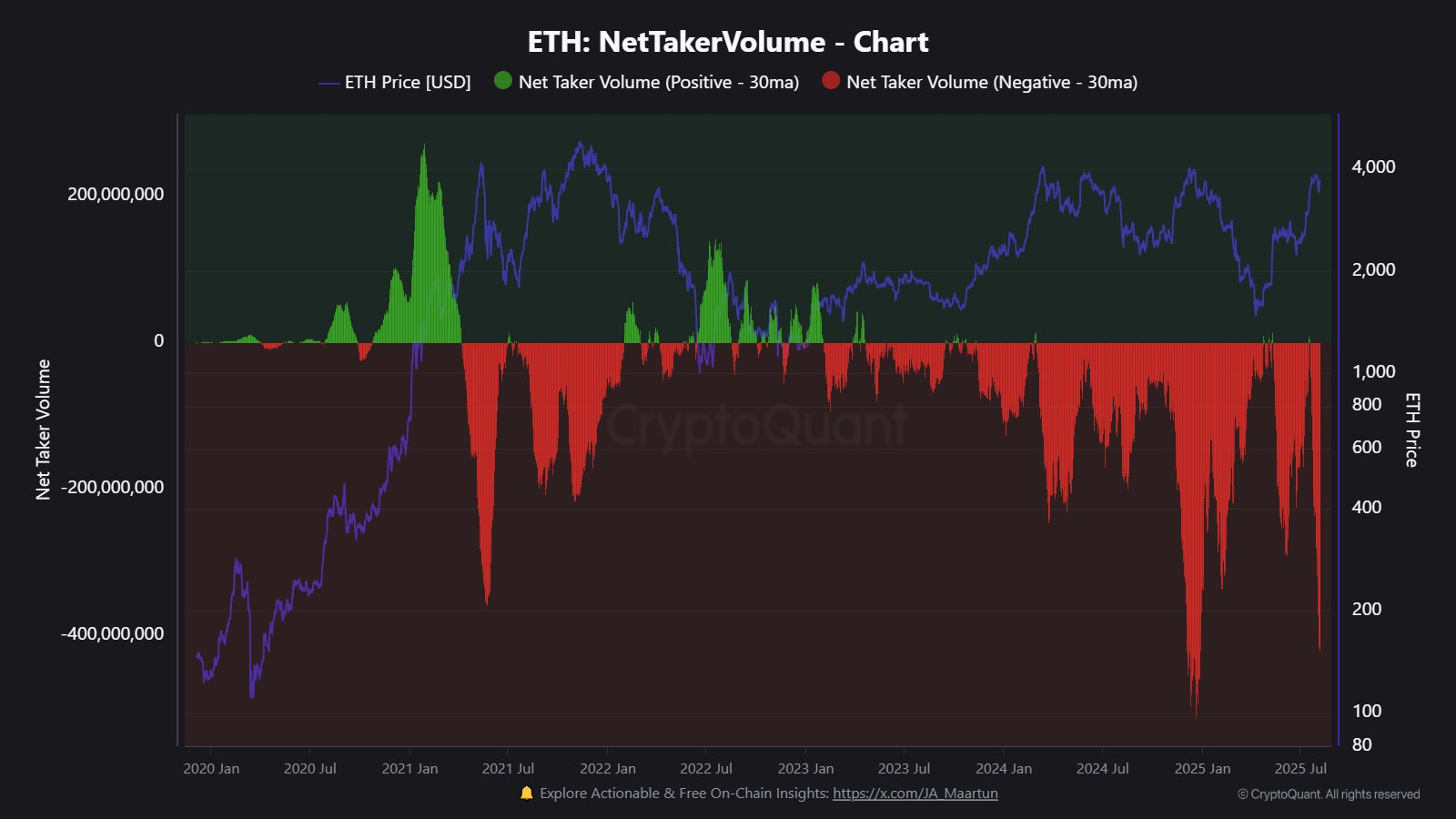

Ethereum (ETH) recorded a sharp drop in taker activity, with daily Net Taker Volume falling to -$418.8 million, according to data from CryptoQuant. This means that around 115,400 more ETH were sold using market orders than bought on the same day.

Meanwhile, this kind of order flow suggests urgency from sellers who prioritized speed over price. Such deep negative values have not occurred often and are usually seen NEAR market peaks. The imbalance signals that buyers were not able to match the volume coming from the sell side.

Whale Wallets Move Funds to Exchanges

Two large ETH holders have moved a combined total of nearly $69 million to centralized exchanges within the past 24 hours. The wallet 0xc156 deposited 13,459 ETH to Binance, while 0x46DB sent 5,504 ETH to OKX.

Whales are selling $ETH.

0xc156 deposited all 13,459 $ETH($49M) to #Binance 20 minutes ago.

0x46DB deposited 5,504 $ETH($19.8M) to #OKX in the past 16 hours.https://t.co/zRG9Tn5pQ9https://t.co/FQe95DLj9R pic.twitter.com/vmp4VKgS2r

— Lookonchain (@lookonchain) August 6, 2025

Transfers of this size often appear before increased sales. While not all deposits lead to sales, they usually indicate preparation to exit positions, especially during uncertain market conditions.

Price Remains Under Resistance After Trendline Break

Ethereum is now trading close to $3,630, down roughly 1% in the last day and 4% over the week. After rising steadily in July, the price broke below a trendline that had supported the move up, as outlined by analyst crypto Patel. A recent retest of this trendline failed, suggesting that sellers remain in control for now.

Notably, the current setup shows the $3,800 level as key resistance. If the asset remains under this area, focus shifts to possible support around $3,147 and $2,913. These zones may offer buyers an entry point, especially if broader conditions stabilize.

ETF Activity Sends Mixed Signals

Ethereum ETFs saw new inflows of $73.3 million on Tuesday, following what had been a stretch of heavy withdrawals. Just days earlier, products tied to ETH recorded a single-day outflow of $465 million, the largest so far.

Consequently, this change in FLOW indicates a shift in sentiment. While retail buyers may have been cutting exposure, some recent buying could mean that some traders are setting up for a rebound. Overall flow extinction timing differences lead to uncertain short-term direction.