1,000,000 ETH in 30 Days: Is the Crypto Market Primed for Another Mega Rally?

Ethereum's next big moment might be just around the corner—and the numbers don't lie.

When whales move, markets tremble. A potential 1,000,000 ETH accumulation event could send shockwaves through DeFi, NFTs, and the broader crypto ecosystem. Here's why traders are watching the chain like hawks.

The institutional FOMO factor

With ETH hovering near key levels, the smart money's playing a high-stakes game of chicken. Will they trigger a supply crunch or wait for retail to panic-sell first? (Spoiler: Wall Street always eats first.)

Liquidity crunch incoming?

30 days. 1,000,000 ETH. That's enough to drain multiple CEX reserves—and we all remember what happened last time exchanges ran dry. Market makers might need to rewrite their algo playbooks.

The cynical take: Of course this happens right after the SEC quietly approves another ETH futures ETF. Nothing moves markets like regulatory theater and good old-fashioned greed.

Further Gains on the Horizon?

Ethereum (ETH) has been on the crest of the wave over the last month, with its price surging by 60%. Just a few hours ago, it climbed to roughly $3,940, the highest mark since December last year, whereas it currently trades at around $3,800 (per CoinGecko’s data).

The popular X user, Ali Martinez, revealed that during that timeframe, over one million ETH tokens had been withdrawn from crypto exchanges. The stash equals almost $3.9 billion (calculated at current rates)

More than 1 million ethereum $ETH have been withdrawn from crypto exchanges in the past month! pic.twitter.com/rP18ToPz7V

— Ali (@ali_charts) July 28, 2025

According to CryptoQuant’s data, the total number of ETH stored on exchanges has dropped to roughly 19 million on July 27, which is the lowest level registered in almost a decade. This is typically interpreted as a bullish factor, as it suggests that investors have switched to self-custody methods, which reduces the immediate selling pressure.

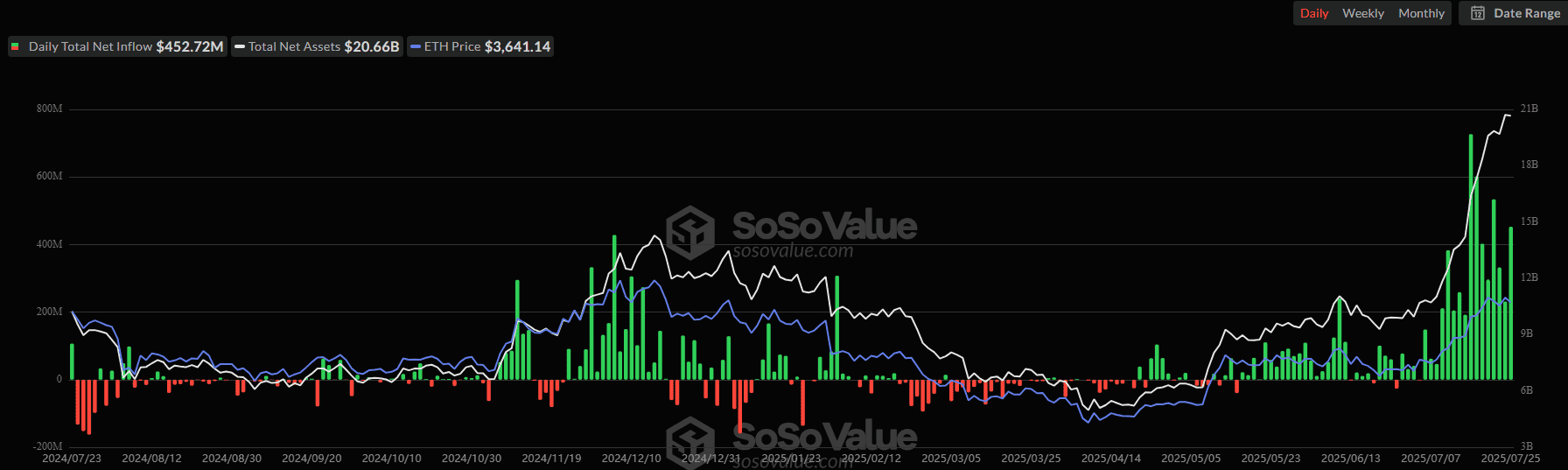

The massive capital flowing into spot ETH ETFs also supports the price momentum. Data compiled by SoSoValue shows that the daily netflows have been positive over the last several weeks, signaling solid interest from investors.

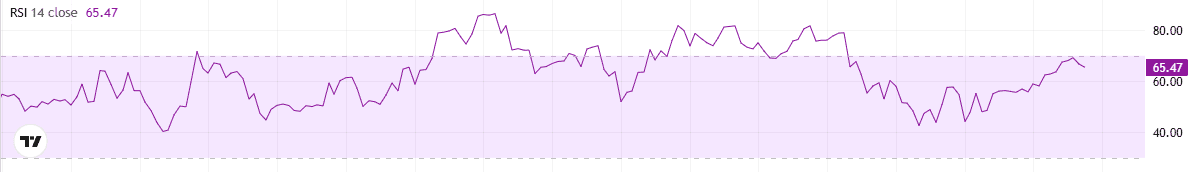

However, some indicators should serve as warnings to investors. Ethereum’s Relative Strength Index (RSI), for instance, has neared 70, meaning the valuation has pumped too quickly in a short period of time. Readings above that level suggest the price might be headed for a short-term correction, while anything below 30 is viewed as a buying opportunity.

The Next Potential Targets

Numerous members of the crypto community believe ETH is ready to chart new peaks. The X user cyclop claimed the asset “just doesn’t give a chance to buy lower,” describing this as “the strongest sign of strength you can get.” That said, they envisioned a parabolic MOVE to as high as $4,800.

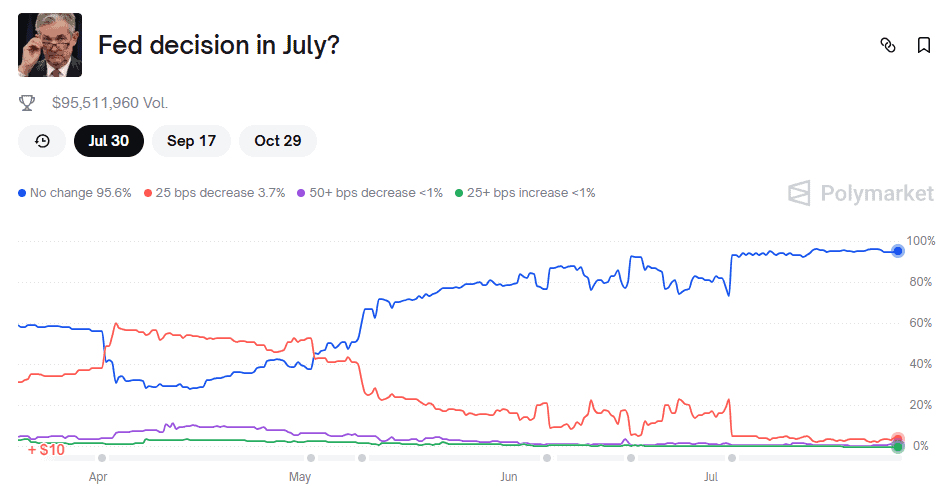

For his part, Crypto Rover reminded that ETH’s price pumped substantially following the previous two FOMC meetings. The next gathering of the Federal Reserve is scheduled for July 29 – July 30, after which the central bank will announce its interest rate decision.

According to Polymarket, there is a 95.5% probability that the benchmark will remain unchanged at 4.25%-4.50%, and we have yet to see whether this will have an impact on ETH and the broader crypto market.