Ethereum Price Alert: ETH Primed for a Breakout to $4,000 in 2025?

Ethereum isn't just knocking on $4K's door—it's picking the lock. After months of consolidation, ETH's technicals scream bullish. Here's why traders are loading up.

Key Levels to Watch

The $3,800 resistance just became ETH's chew toy. A clean break here could trigger algorithmic buying frenzies—just in time for Q3's institutional inflows.

Market Sentiment Shift

Fear? Gone. Greed? Pumping. Retail FOMO meets hedge fund 'strategic positioning' (translation: they missed the bottom). Even Bitcoin maximalists are sneaking ETH into their bags.

Macro Tailwinds

With the SEC's ETF foot-dragging becoming a Wall Street meme, smart money's bypassing regulators entirely—building exposure through offshore derivatives. Classic finance, always finding the loophole.

Bottom Line: This isn't 2021's hype cycle. Ethereum's fundamentals finally justify the price tag. Will $4K hold? Ask the leverage traders getting liquidated on both sides.

Technical Analysis

By ShayanMarkets

The Daily Chart

On the daily chart, ethereum is respecting its bullish structure, having flipped the $3,300 zone from resistance into support. The 100-day and 200-day have also created a bullish crossover, providing additional confirmation of the trend.

Moreover, the RSI, which recently entered overbought territory, has slightly cooled down but remains elevated, suggesting that momentum might be overheated. Yet, the clean sweep and reclaim of prior highs around $3,300 reflect strength and commitment from buyers, and as long as this level holds, the bulls are in control.

This structure is a classic sign of trend continuation, especially when supported by strong volume and momentum indicators. If the price begins to expand again from this consolidation range, the next upside target would likely be the $4,400 region, where Ethereum topped during previous cycles.

Conversely, a break below $3,300 WOULD raise concerns of a deeper retracement, but for now, that scenario seems less likely unless broader market weakness emerges.

The 4-Hour Chart

The 4H chart further supports the bullish case with a clearly defined ascending trendline holding the price. The asset continues to respect the trendline, and each dip has been met with strong buying interest, signaling that bulls are still active and defending the uptrend.

However, some caution is warranted in the short term, mainly due to the overbought conditions on the daily chart. If ETH fails to hold above the $3,700 zone or loses the ascending trendline, a short-term correction toward $3,500 would be a healthy reset. This level also aligns with the daily support block, making it a logical area for buyers to step in again if tested.

On-Chain Analysis

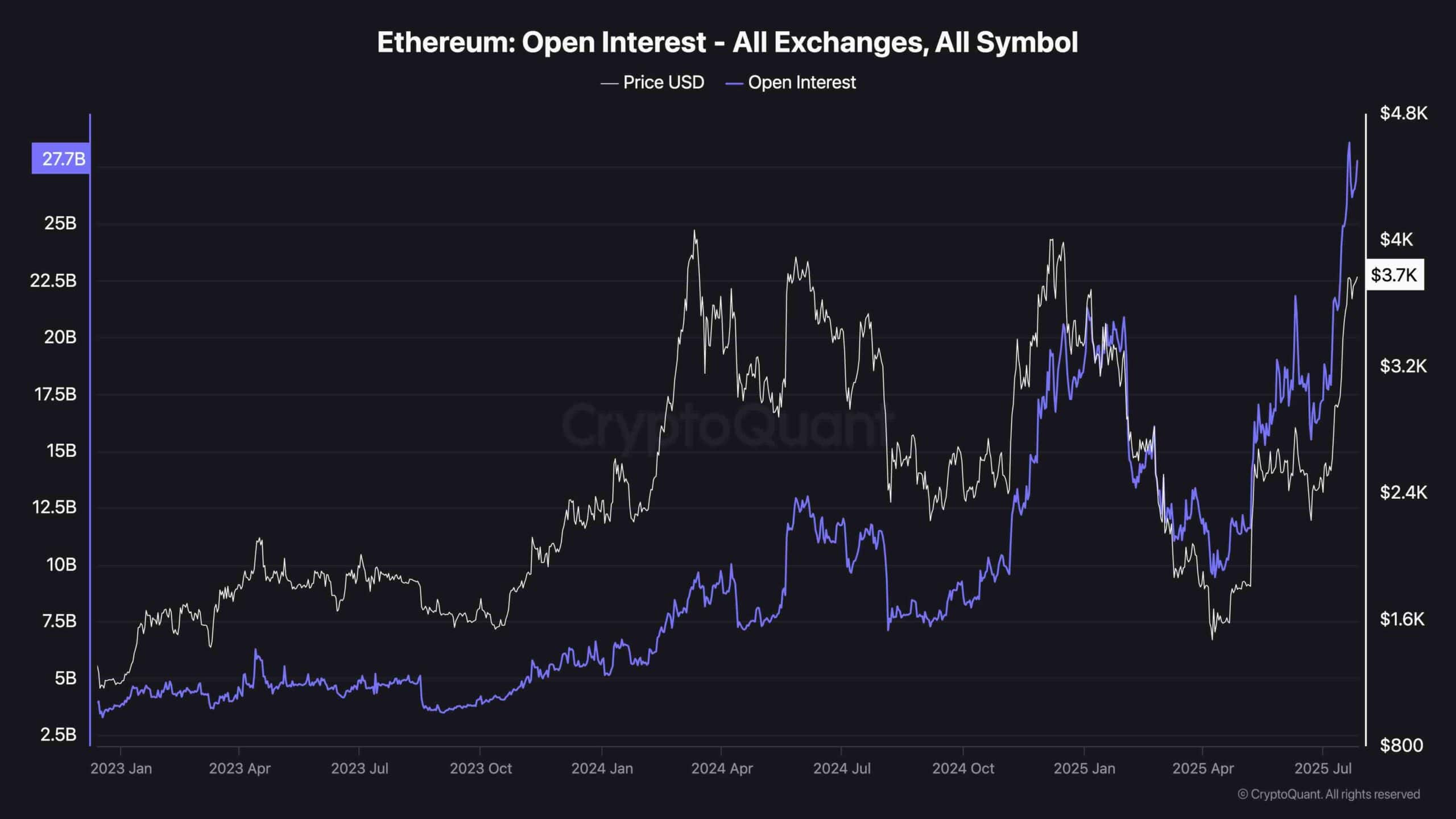

Ethereum Open Interest

On the sentiment side, Ethereum’s open interest across all exchanges has surged to over $27 billion, marking its highest point in years. This indicates a massive influx of Leveraged positions and reflects growing speculative appetite in the market. Historically, rising open interest in tandem with rising price signals confidence and trend strength, but it also increases the risk of a long squeeze if the market turns.

What’s notable, however, is that despite the elevated OI, funding rates remain at relatively moderate levels. This suggests that the majority of traders are not excessively over-leveraged, and we are not yet seeing the kind of euphoria typically associated with major tops.

It gives Ethereum more room to push higher without the immediate threat of a sharp deleveraging event. For now, positioning remains optimistic but not overheated, keeping the path open for a potential breakout above $4,100.