Ethereum at a Crossroads: Is a $2.8K Dip the Springboard to ETH’s Next Rally?

Ethereum bulls hold their breath as ETH flirts with a critical support level. Will the smart contract giant stage a tactical retreat before its next surge?

The $2.8K question. Market watchers eye this psychological threshold like traders watching a tightrope walker—equal parts anticipation and dread. Recent price action suggests Ethereum might need one last shakeout before continuing its upward trajectory.

Technical tightrope. The charts show ETH dancing between bullish momentum and overdue correction. While fundamentals remain strong (DeFi TVL up 42% quarter-over-quarter, L2 adoption hitting new highs), even the mightiest crypto assets need to catch their breath.

Wall Street's watching—with their usual mix of FOMO and skepticism. Traditional finance analysts suddenly care about gas fees again (how quaint) as institutional ETH products see record inflows. Meanwhile, crypto natives keep building through the noise.

Final thought: Whether ETH takes the scenic route through $2.8K or rockets straight past it, one thing's certain—the smart money's betting this isn't Ethereum's final act. Just don't tell the 'efficient markets' theorists.

Technical Analysis

By ShayanMarkets

The Daily Chart

ETH has recently seen a notable influx of buying pressure, breaking above the key $2.8K resistance, which had acted as a persistent barrier in recent months. This breakout has led to the formation of a higher high, signaling a shift toward a bullish market structure on the daily timeframe.

However, Ethereum now finds itself trading within a critical range between $2.8K and $3.3K, where a short-term consolidation phase is likely. The upper boundary of this range also aligns with a bearish order block, suggesting potential supply and selling pressure at this level.

If Ethereum manages to break above the $3.3K resistance, the next bullish target WOULD likely be the $4K psychological threshold, a major technical and psychological level.

The 4-Hour Chart

On the lower timeframe, ETH’s impulsive rally has been halted NEAR the $3K level, as momentum cools. The $2.8K zone, previously strong resistance, is now being retested as support. A proper pullback to this region would serve to validate the breakout and establish a stronger base for the next leg up.

The 0.5-0.618 Fibonacci retracement levels also serve as potential targets for this ongoing correction, providing confluence with short-term demand zones.

In the coming days, Ethereum is expected to consolidate and correct, potentially setting the stage for another bullish rally toward the $3.3K resistance.

Sentiment Analysis

By ShayanMarkets

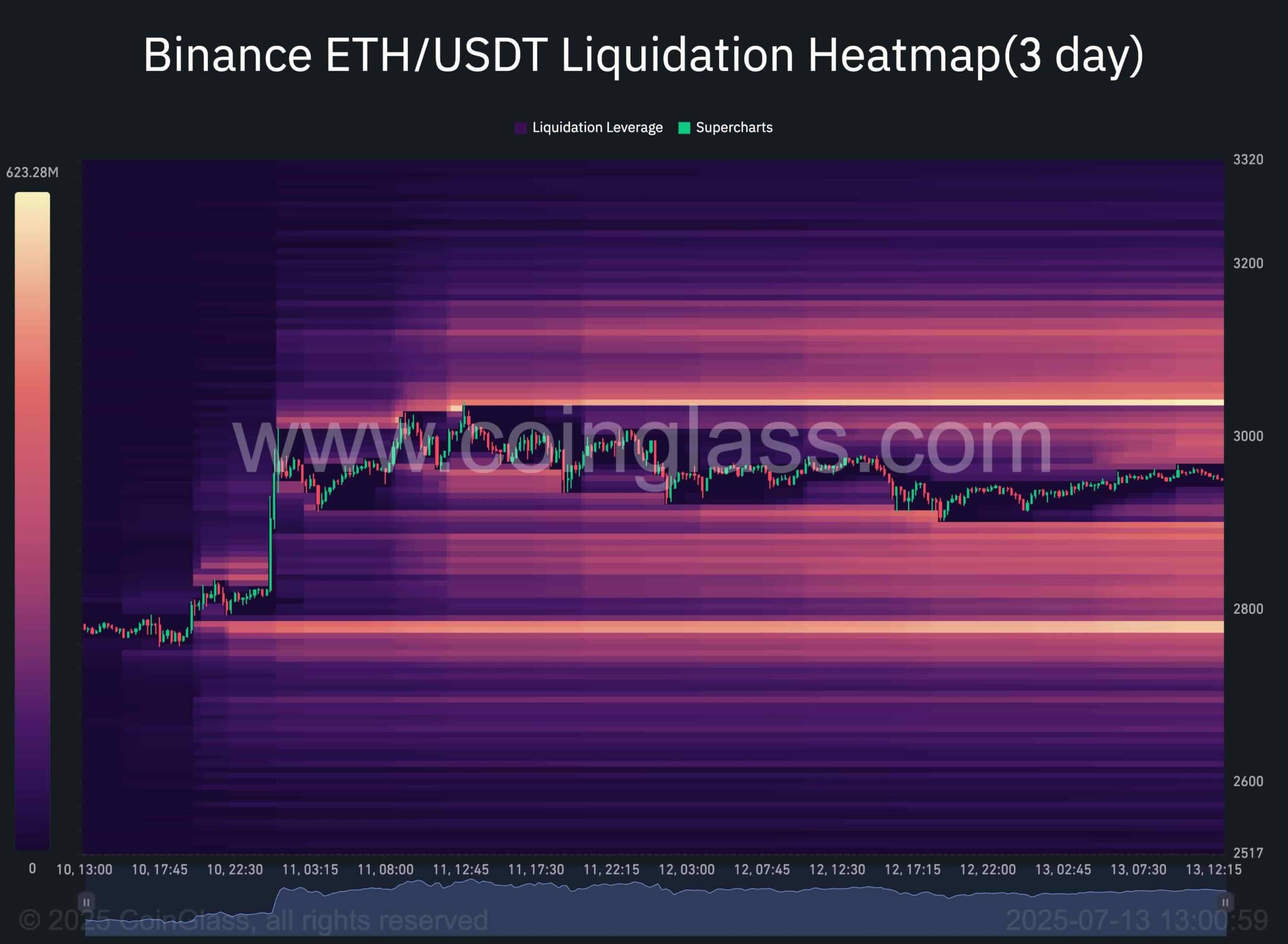

This chart visualizes the Binance Liquidation Heatmap, which pinpoints zones where significant liquidation events are likely to unfold. These areas often act as liquidity magnets, attracting price action due to the high concentration of Leveraged positions. In such scenarios, large players or “whales” tend to capitalize on these zones to enter or exit trades efficiently.

At present, a prominent liquidation cluster is located just below the $2.8K mark, implying a high probability that Ethereum’s price may gravitate toward this level. Should this scenario play out, ETH would complete its pullback to this key support, potentially reigniting bullish momentum and setting the stage for a rally toward the $3.3K resistance.

On the flip side, another sizeable liquidity pool sits above the $3K level, indicating that following the pullback, Ethereum could also MOVE higher in the short term to tap this zone, potentially triggering a short-squeeze and fueling further upside.