Trump’s Bold 30% Tariffs on EU & Mexico: Is Bitcoin the Next Safe Haven?

Trade wars are back—and crypto markets are watching. President Trump just slapped a 30% tariff hammer on EU and Mexican imports, sending traditional markets into a tailspin. Could Bitcoin become the ultimate tariff-proof asset?

The geopolitical gambit

When protectionism rears its head, capital finds escape routes. Gold's glittering—but decentralized assets offer something physical commodities can't: instant borderless transfer. Bitcoin's 24/7 markets don't care about customs forms.

Wall Street's tariff headache

Traders are scrambling to hedge exposure as supply chains shudder. Meanwhile, crypto whales are stacking SATs—because nothing says 'screw your trade barriers' like a self-custodied Bitcoin wallet. (Take notes, traditional finance.)

The cynical take

Of course Goldman's already spinning this as 'portfolio diversification' while quietly shorting agricultural ETFs. Some things never change—except Bitcoin's resistance to political theater.

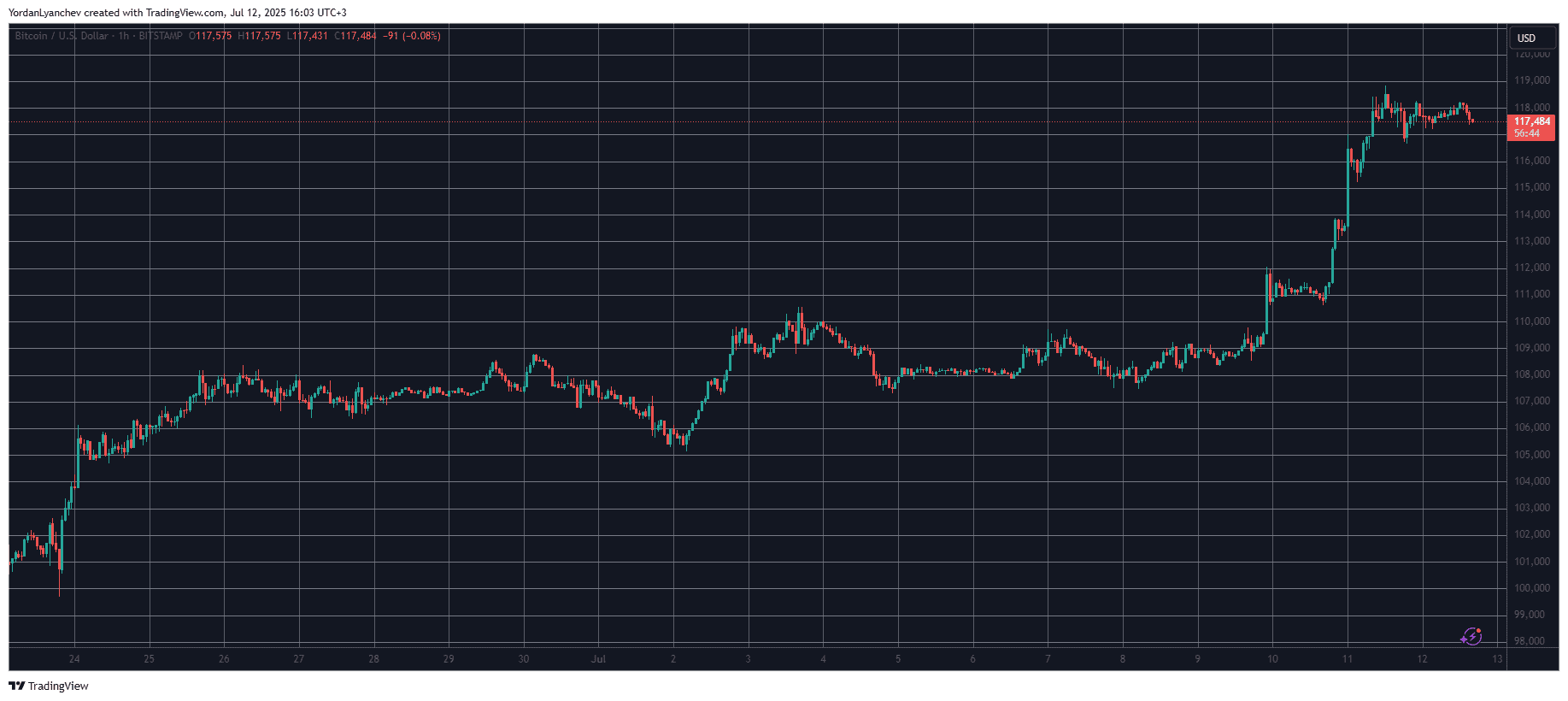

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView