🚀 Bitcoin Smashes ATH Record as Altcoins Go Parabolic – Trump’s Tariffs Shake Markets | Weekly Crypto Rundown

Bitcoin just rewrote the record books—again. The OG crypto punched through its all-time high with the force of a institutional FOMO tsunami, while altcoins staged a gravity-defying rally that left even seasoned traders blinking at their screens.

Meanwhile, former President Trump lobbed another trade war grenade—because nothing says 'market stability' like abrupt 30% tariffs on overseas crypto miners. (Wall Street analysts promptly downgraded their 'uncertainty' forecasts from 'high' to 'ludicrous.')

Altseason goes thermonuclear

Ethereum isn’t just keeping pace—it’s dragging the entire smart contract ecosystem into the green. SOL, ADA, and even meme coins are posting double-digit surges as retail piles into 'the next Bitcoin.' Spoiler: 99% won’t be.

Regulatory shrapnel

Trump’s latest broadside against Chinese mining operations sent hash rates wobbling—but Bitcoin’s resilience had miners shrugging and rerouting rigs within hours. Take that, protectionism.

The week’s lesson? Crypto markets eat geopolitical drama for breakfast. Just don’t look at your portfolio before coffee.

Market Data

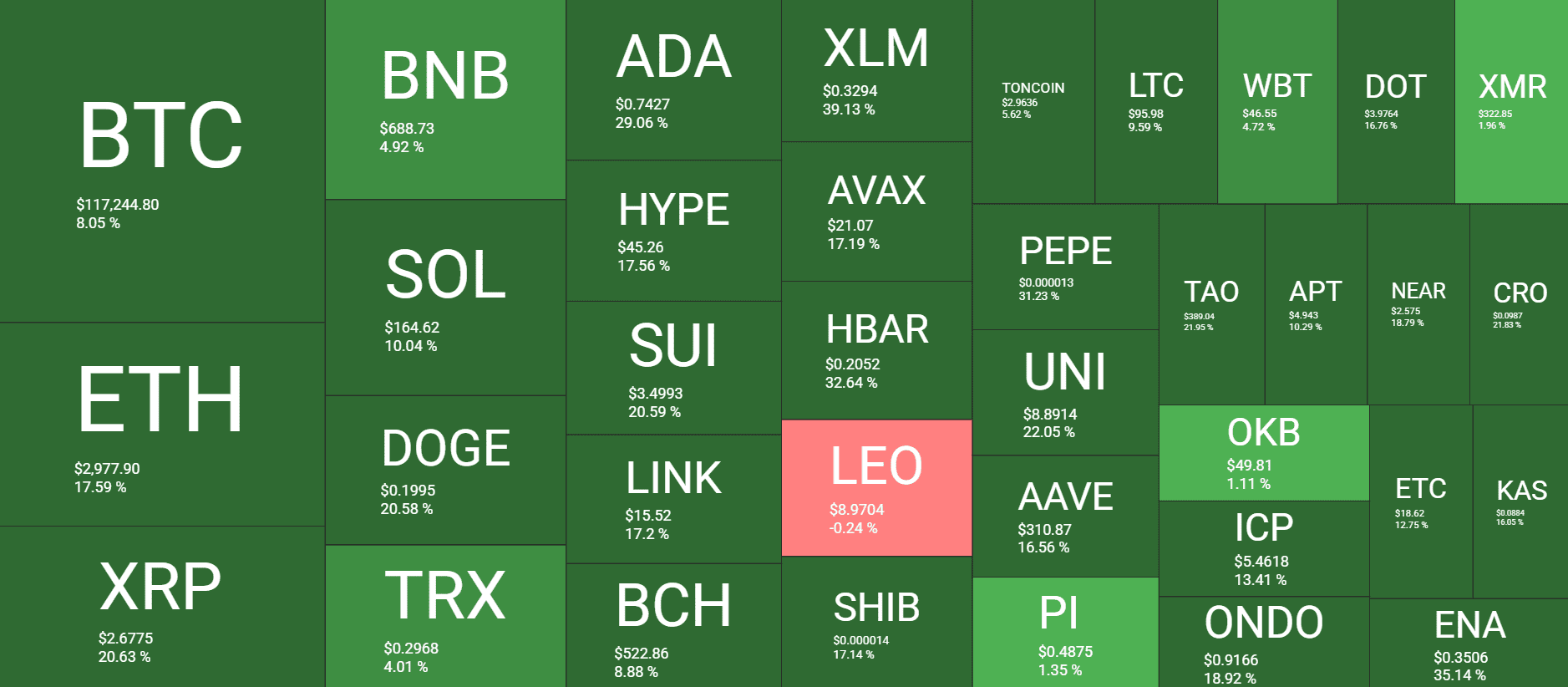

Market Cap: $3.75T | 24H Vol: $262B | BTC Dominance: 62.4%

BTC: $117,550 (+8.2%) | ETH: $2,990 (+17.7%) | XRP: $2.73 (+22.4%)

This Week’s Crypto Headlines You Can’t Miss

. Following this historic run and new all-time high, analysts, commentators, and everyone in between rushed to offer their opinion on what drove the asset and how high it can go. According to CryptoQuant, this rally is different due to several factors you can check here.

. Before today’s peak, which marked the first one for the month at $112,000, reports emerged that retail investors were still nowhere to be found. Instead, the majority of the gains were attributed to larger and institutional investors.

. BNY Mellon, the oldest US bank and one of the most consistently bullish on the cryptocurrency industry, will serve as the custodian for Ripple’s stablecoin, RLUSD. The asset reached a substantial milestone this week, hitting $500 million in market cap.

BNB’s burning program continues to operate as expected. The latest token burn, completed earlier this week, saw over $1 billion worth of BNB being sent to null addresses.

. Despite the positive market moves and new peaks, one crypto company faced an exploit, in which the attacker siphoned roughly $42 million worth of digital assets. Nevertheless, the perpetrator agreed to a bounty proposition and returned most of the funds.

. ETH’s price jump to a new multi-week high of over $3,000 came in the aftermath of a record-setting inflow day into the spot ethereum ETFs. Naturally, BlackRock’s product led the pack, with $300 million in net inflows.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and HYPE – click here for the complete price analysis.