Why Pi Network (PI) Isn’t Mooning: Analyst Exposes the Hidden Roadblocks

Pi Network's stagnant price action has traders scratching their heads—while the rest of crypto surges ahead. Here's why the 'mobile mining' darling keeps underperforming.

The hype-to-reality gap

PI's lack of major exchange listings and slow mainnet rollout leaves it stranded in speculative purgatory. No trading volume, no liquidity—just a graveyard of hopium-fueled Twitter threads.

Adoption vs. speculation

While the team brags about 35 million 'engaged users,' actual wallet activity tells a different story. Most holders treat PI like lottery tickets—hoarding, not transacting.

The VC-shaped hole

Unlike SOL or AVAX, PI never courted institutional money. That means no market makers, no OTC desks, and definitely no overpaid analysts shilling it on CNBC.

Wake-up call: In crypto, even shitcoins pump with the right backers. PI's grassroots approach might be noble—but nobility doesn't pay the gas fees.

PI Lags Behind

The entire cryptocurrency market has been on fire over the past few days, with Bitcoin (BTC) tapping a new all-time high price of over $118,000. The altcoins performed quite well, too: Ethereum (ETH) spiked by 8% daily to surpass $3,000, Ripple (XRP) jumped by 9%, and Cardano (ADA) headed north by 16%.

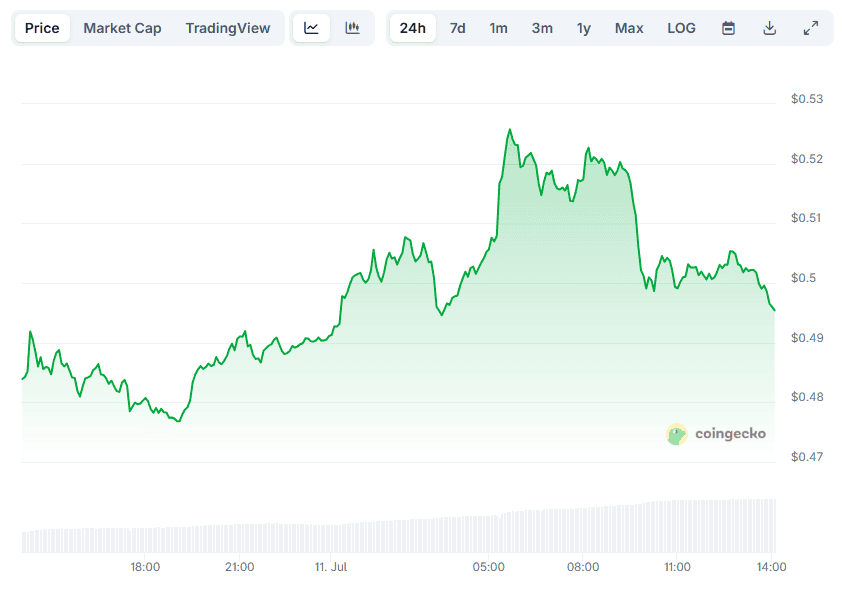

Pi Network (PI) has also posted some gains, albeit far insignificant compared to the majority of cryptocurrencies. Its valuation increased by 2.2% over the last 24 hours, and it currently trades at just below $0.50. Its market cap briefly exceeded $4 billion before retracing to the current $3.8 billion, making Pi the 38th-largest digital asset.

According to one popular X user, the native token of the controversial crypto project could follow BTC’s bullish momentum. However, they suggested that PI’s “missing decentralization, communication from the CT, and liquidity” would hamper the prospects of serious gains.

“It won’t rise any significantly as it does not have enough liquidity and no decentralization. No one wants to put capital into an ecosystem where 1 couple controls everything,” the X user claimed.

Despite a slight price uptick over the last 24 hours, PI is down 70% on a two-month scale. X user Zoe recently argued that the asset’s “main problem” lies in its massive supply and the constant release of new tokens.

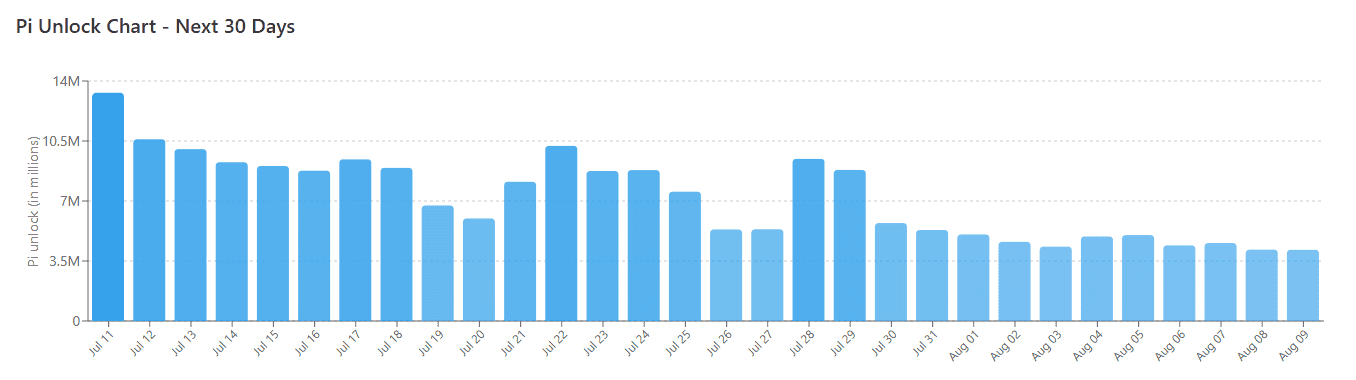

More than 215 million coins are set to unlock in the next month, with approximately 13.3 million PI scheduled on July 11 alone. This development allows investors to sell their holdings, potentially pushing the valuation even lower.

Zoe thinks PI’s price may continue to “bleed slowly” as long as the team behind the project does not introduce a burning mechanism.

Another Bearish Factor

The rising number of PI coins stored on centralized crypto exchanges indicates a rising selling pressure and could contribute to a renewed downturn in the asset’s price.

The total amount of coins on such platforms stood at 376 million as of July 10, but over the past 24 hours, there was an increase of approximately four million, bringing the figure to 381.4 million.

Gate.io leads with 178.5 million in their depositing wallet, whereas Bitget comes in second with 133.7 million.