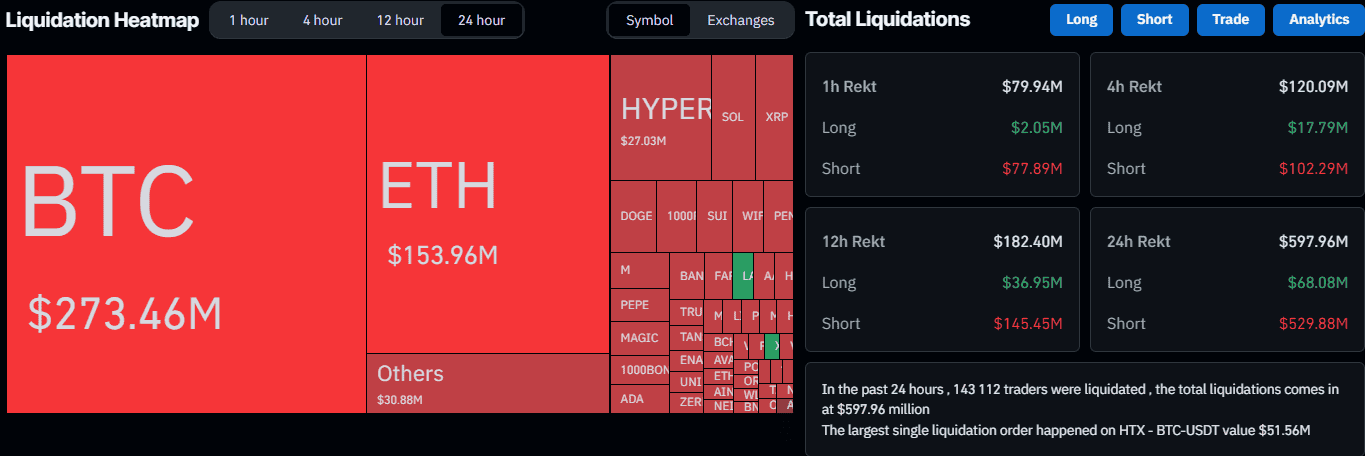

🚀 Bitcoin Rockets Past $112.8K ATH, Wiping Out $600M in Liquidations

Bitcoin just rewrote the rulebook—again. The OG crypto smashed through its all-time high like a bull in a china shop, hitting $112.8K and leaving a trail of $600M in liquidated shorts. Traders who bet against digital gold got steamrolled faster than a DeFi rug pull.

Liquidation carnage: The rally turned leveraged positions into kindling—proof that the market eats overconfident bears for breakfast. Meanwhile, Wall Street analysts still can't decide if BTC is 'digital gold' or a 'speculative bubble.' (Spoiler: it's both.)

What's next? With institutions FOMO-ing in and retail traders meme-ing their way to the moon, this party's just getting started. Just remember: in crypto, ATHs are like Icarus' wings—they either melt or turn into rocket fuel.

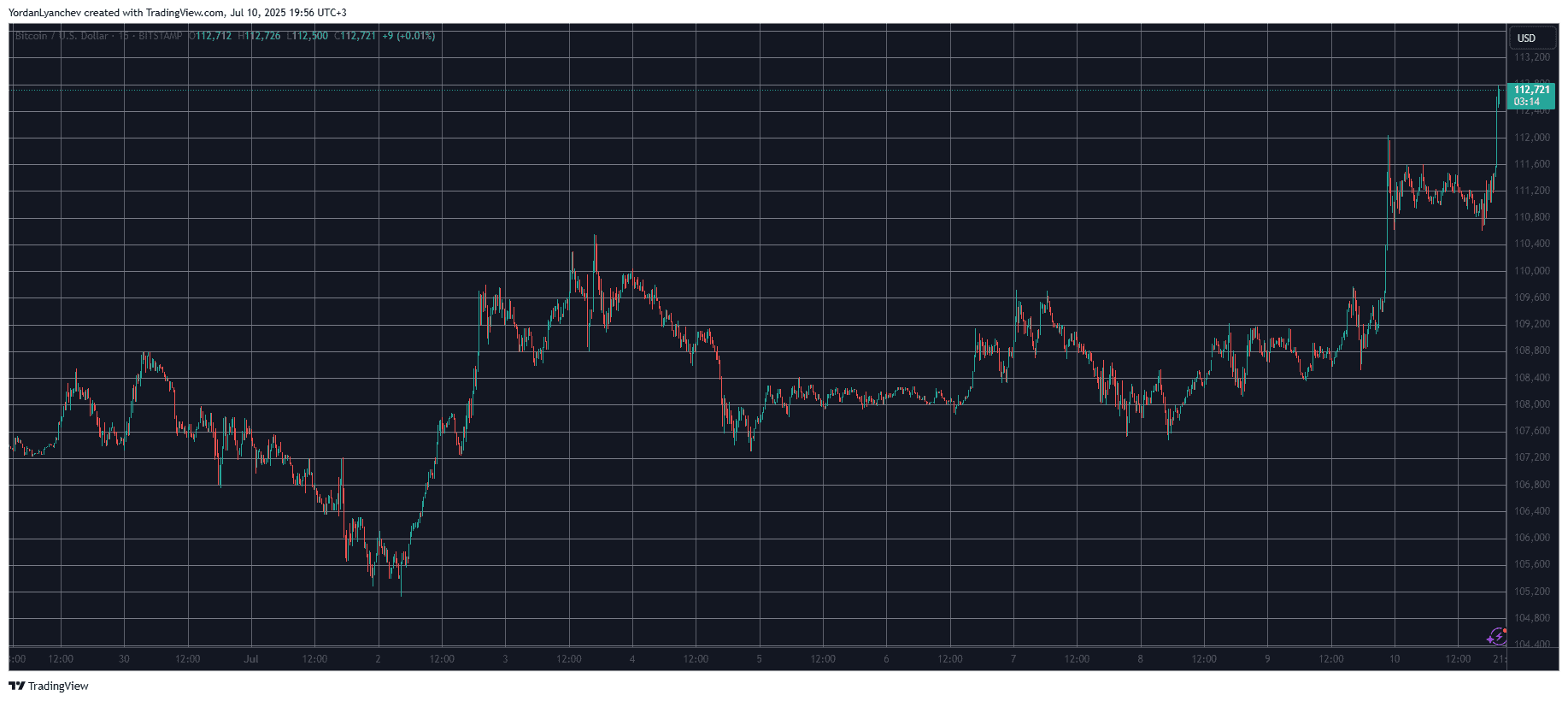

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

BTC was stuck in a consolidation phase for weeks, with a lower boundary at $105,000 and an upper one at $110,000. However, the asset finally showed early signs of a potential breakthrough yesterday following Trump’s call for the Fed to reduce the interest rate by a historic percentage.

This time, the $110,000 barrier couldn’t contain bitcoin, and the asset blasted through it with ease yesterday, popping up to a new all-time high at $112,000 amid growing demand from US investors.

It retraced slightly today, but the bulls went back on the offensive hours ago, pushing the cryptocurrency to a new peak of $112,800.

With many altcoins posting impressive price increases over the past 24 hours, it’s no wonder that the overall liquidations within that timeframe have marked a multi-week high of $600 million.

Naturally, shorts are responsible for the lion’s share, including this single position where a mysterious whale was wrecked for over $51 million.

In the past hour alone, the liquidations have topped $80 million as BTC and most alts started to regain traction.