Bitcoin’s Wild Ride Obliterates 130K Traders—Who’s Left Holding the Bag?

Bitcoin just gave the crypto market a masterclass in volatility—and 130,000 traders paid the tuition.

Price swings sharper than a Wall Street banker’s suit left leveraged positions in tatters. Liquidation cascades hit like clockwork, proving once again that crypto doesn’t care about your stop-loss orders.

Meanwhile, institutional investors are probably sipping champagne—their OTC desks bypassed the bloodbath entirely. Retail traders? Not so lucky. The lesson? In crypto, the house always wins… until the blockchain flips the table.

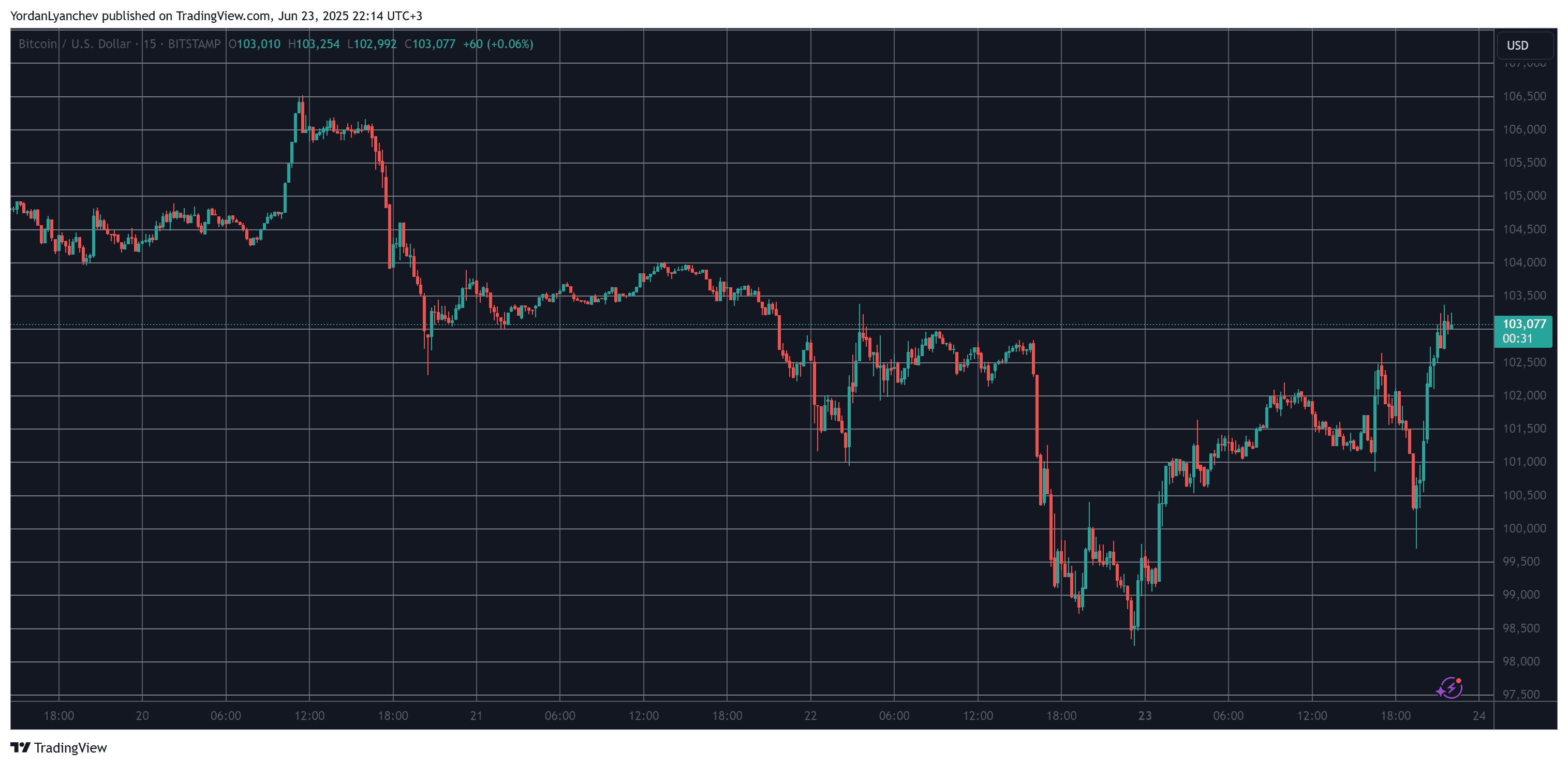

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

On the surface, today’s developments couldn’t predict the latest BTC price pump. As the chart above demonstrates, BTC slumped hard yesterday, and even though it recovered some ground earlier today, it dumped below $100,000 once again following Iran’s attacks against a couple of US military bases in the Middle East.

However, certain theories circulate online that Iran’s precise actions symbolized the beginning of peace talks, as the country’s leaders reportedly warned the US and the targeted military establishments about the missile strikes.

As such, the authorities could maintain a strong presence in front of their people but engage in de-escalating talks with the US and Israel at the same time.

Iran’s attack on US bases today was actually DE-ESCALATORY, and here’s why:

First, details have emerged that both President TRUMP and Qatari officials were notified “in advance” of this attack, per NYT and Axios.

Iranian officials say this was to “minimize casualties.”

On… https://t.co/UPOA0aEKDs

— The Kobeissi Letter (@KobeissiLetter) June 23, 2025

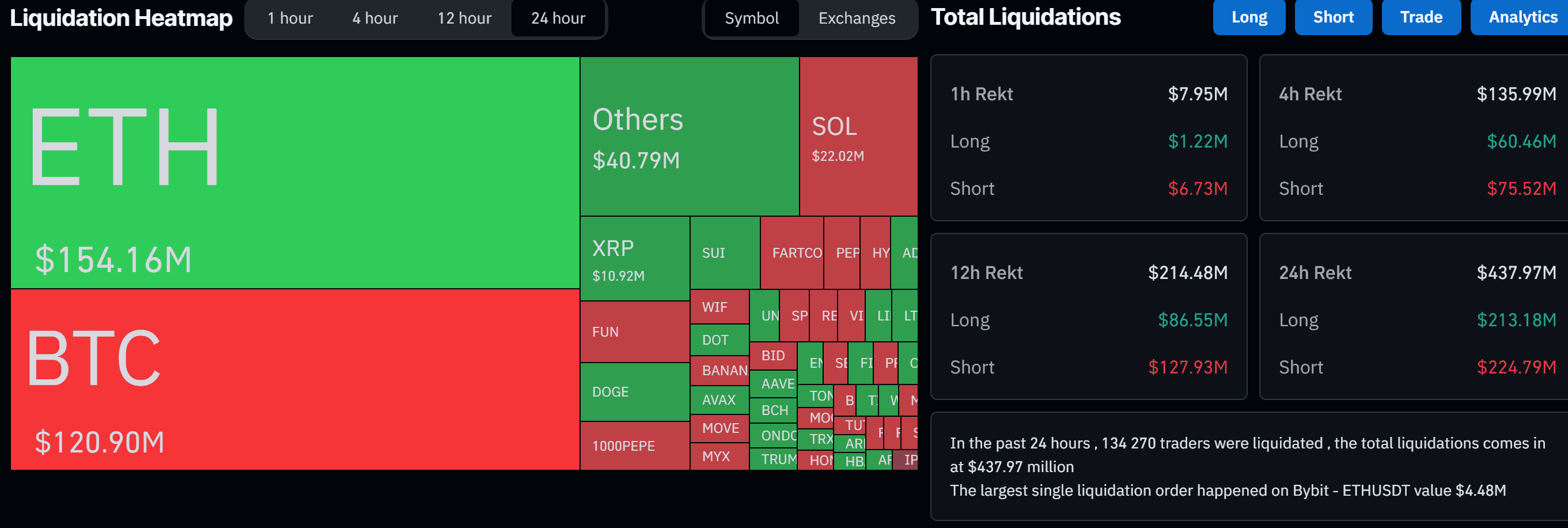

Whether this will unfold as predicted is yet to be seen, but the volatility is a fact as BTC posted several big moves in either direction in the past few days. When we focus on the events in the last 24 hours, it’s evident that these fluctuations have harmed over-leveraged traders, as more than 134,000 have been wrecked within this timeframe.

The total value of liquidated positions is close to $440 million, and ethereum has taken the main stage, outplacing BTC. This is mostly because ETH went from over $2,400 to under $2,200 and back to $2,300 within hours.