Bitcoin to $1M? Adam Back’s Bull Case for the Ultimate Moon Shot

Forget "to the moon"—Blockstream CEO Adam Back sees Bitcoin punching through seven figures. Here’s the brutal math behind the audacious target.

The Scarcity Playbook

With fixed supply and institutional FOMO, Back argues Bitcoin’s 21 million cap turns it into "digital gold on steroids." Hedge funds stacking sats? Just the opening act.

Halving Hysteria Meets Hyperbitcoinization

Each four-year supply cut tightens the noose. By 2028, miners’ daily drip drops to 3.125 BTC—enough to make even Wall Street’s algo-traders sweat bid wars.

The Kickstarter: Global Liquidity Tsunami

Central banks printing fiat like confetti? Back’s thesis leans hard on currency debasement. "When Brazil’s coffee farmers demand BTC, you’ll know we’re halfway there," he quips—between sips of irony-laced bourbon.

The Cynic’s Corner

Sure, and my yacht’s parked next to Satoshi’s. But for once, the crypto crowd might be underhyping things—BlackRock’s ETF was just the appetizer.

Wall Street is the Game-Changer

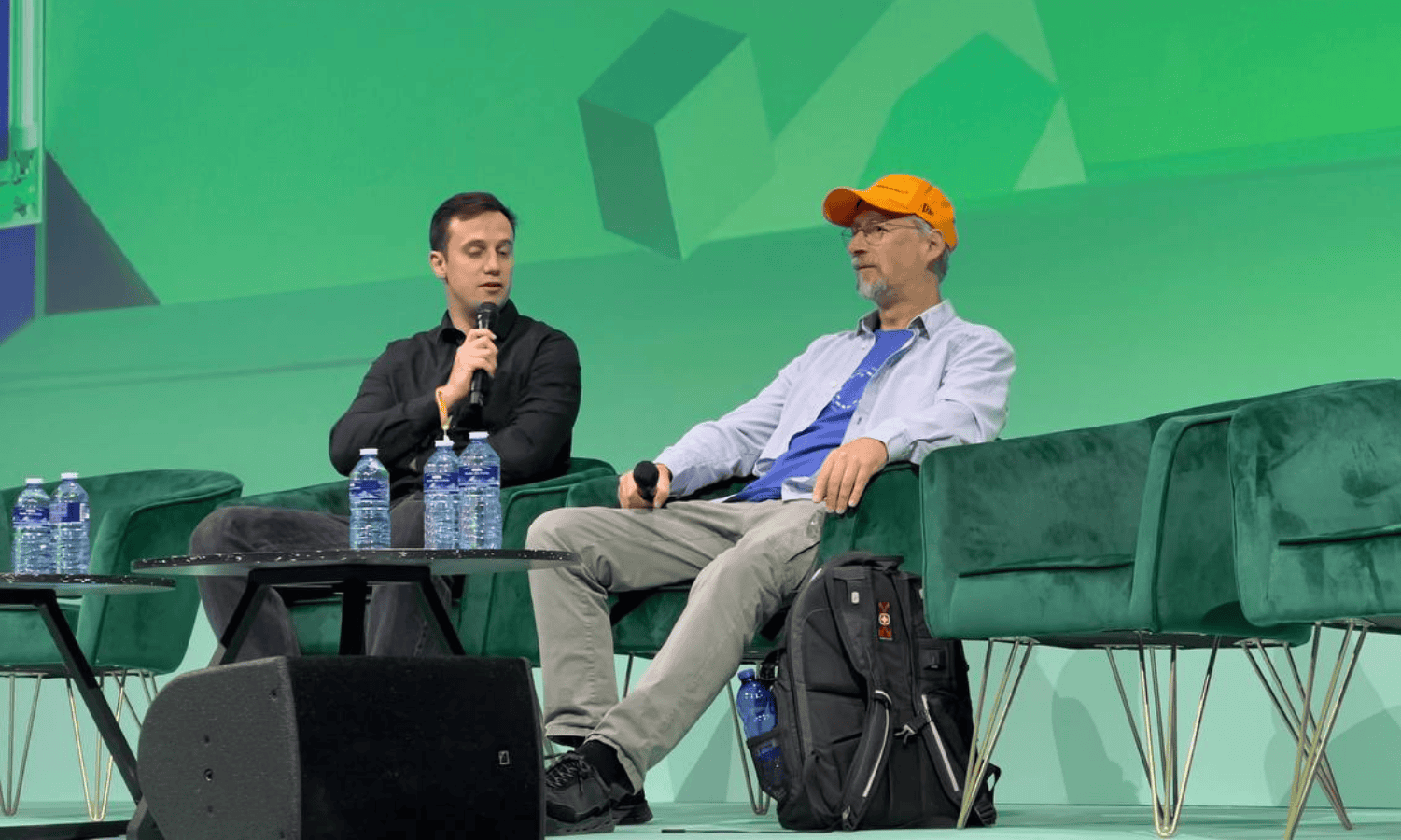

At the recent bitcoin 2025 event, Strategy Executive Chairman Michael Saylor emphatically stated:

“When Wall Street is 10% Bitcoin, Bitcoin will be $1,000,000 a coin.”

According to him, this level of allocation WOULD equate to as much as $20 trillion flowing into BTC markets, making a hostile takeover economically impossible as aggressive buying would only empower existing holders.

The Bitcoin maxi isn’t alone in his mega-bullish outlook. Blockstream CEO Adam Back believes BTC could achieve the $1 million target way before Wall Street accumulates 10% of the cryptocurrency. He suggested that even a widespread 2% allocation across major asset managers like BlackRock would be enough to push Bitcoin’s price to that level.

It is not the first time Saylor has predicted BTC’s price hitting seven figures. In a September 2024 interview with CNBC, he forecasted a long-term price for the king cryptocurrency of $13 million, calling it “perfect money” in contrast to fiat currencies, which he labeled “pseudoscience.”

Other prominent voices such as former Binance chief Changpeng Zhao, popularly known as CZ, have echoed similar sentiment. The crypto entrepreneur previously projected BTC could end up anywhere between $500,000 and $2 million in this cycle.

Cathie Wood’s ARK Invest is another entity sharing the optimism. In April, the firm revised its base case target for BTC to $1.2 million by 2030, with a bullish estimate of $2.4 million. ARK attributed the potential surge to institutional adoption, especially via spot exchange-traded funds (ETFs), as well as Bitcoin’s growing role as a decentralized, programmable store of value.

In the company’s estimation, all bets would be off if BTC manages to capture at least 6.5% of the projected $200 trillion global investable assets market. This would dwarf gold’s current share at roughly 3.6%, a comparison backed by data that Bitcoin enthusiast and early stage angel investor Fred Krueger recently shared, showing that more Americans now own Bitcoin (49.6 million) than Gold (36.7 million), with significantly higher average holdings.

Price Performance

Meanwhile, BTC’s price action reflects a market digesting its recent surge to a new all-time high of $111,814. At the time of this writing, the asset was trading at $105,466, after oscillating between $105,112 and $106,365 in the last 24 hours.

On the weekly timeframe, it gained a modest 0.6% to outperform the broader crypto market, which dipped 0.8% in that period. Zooming out some more, BTC’s current price is a 2.1% improvement over the last month, while on a yearly basis, it has soared 52.2%, highlighting a long-term uptrend with brief pullbacks.