Crypto Whales Gobble 20,000 BTC in 48 Hours—Price Tsunami Incoming?

Bitcoin’s big players just made a jaw-dropping move—snapping up 20,000 BTC faster than a hedge fund manager orders avocado toast. Here’s what it means for the market.

The whale feeding frenzy

When crypto’s 1% drop nine figures on BTC in two days, you pay attention. This isn’t ’diamond hands’ retail FOMO—this is institutional capital moving with purpose. The last time we saw accumulation at this scale, Bitcoin ripped 40% in three weeks.

Liquidity vacuum ahead?

Exchanges are already feeling the squeeze. With 20,000 coins suddenly off-market—roughly a day’s global mining supply—the stage is set for a violent liquidity crunch. Cue the usual suspects: leveraged longs piling in, shorts getting wrecked, and your cousin ’Degen Dave’ YOLOing his rent money.

The cynical take

Of course, Wall Street will claim they ’saw the fundamentals’—right after they finish front-running the rally. Meanwhile, the SEC will probably sue the whales for ’market manipulation’... just as their banking buddies start quietly accumulating.

One thing’s certain: when whales move, retail gets the wake-up call. Buckle up.

Whales Filled Their Bags

The renowned analyst Ali Martinez unveiled on X that large investors scooped up more than 20,000 BTC in the past two days alone.

Whales have bought over 20,000 #Bitcoin $BTC in the last 48 hours! pic.twitter.com/cCmQOpUV8X

— Ali (@ali_charts) May 29, 2025

According to Martinez’s chart, the collective Bitcoin holdings of this investor cohort are just north of 4.7 million assets, which represents around 23.7% of the circulating supply.

Accumulation from whales is generally viewed as a bullish factor that may be a precursor of a price rally. It shows that such investors have increased their confidence in the asset, which could encourage smaller players to join the bandwagon as well.

Numerous X users reacted to the post, with some assuming that Michael Saylor could be among the individuals contributing to the buying spree. The company he co-founded has become the world’s largest corporate holder of bitcoin, while he personally owns over 17,000 BTC, as he confirmed last year.

Additional Bullish Elements

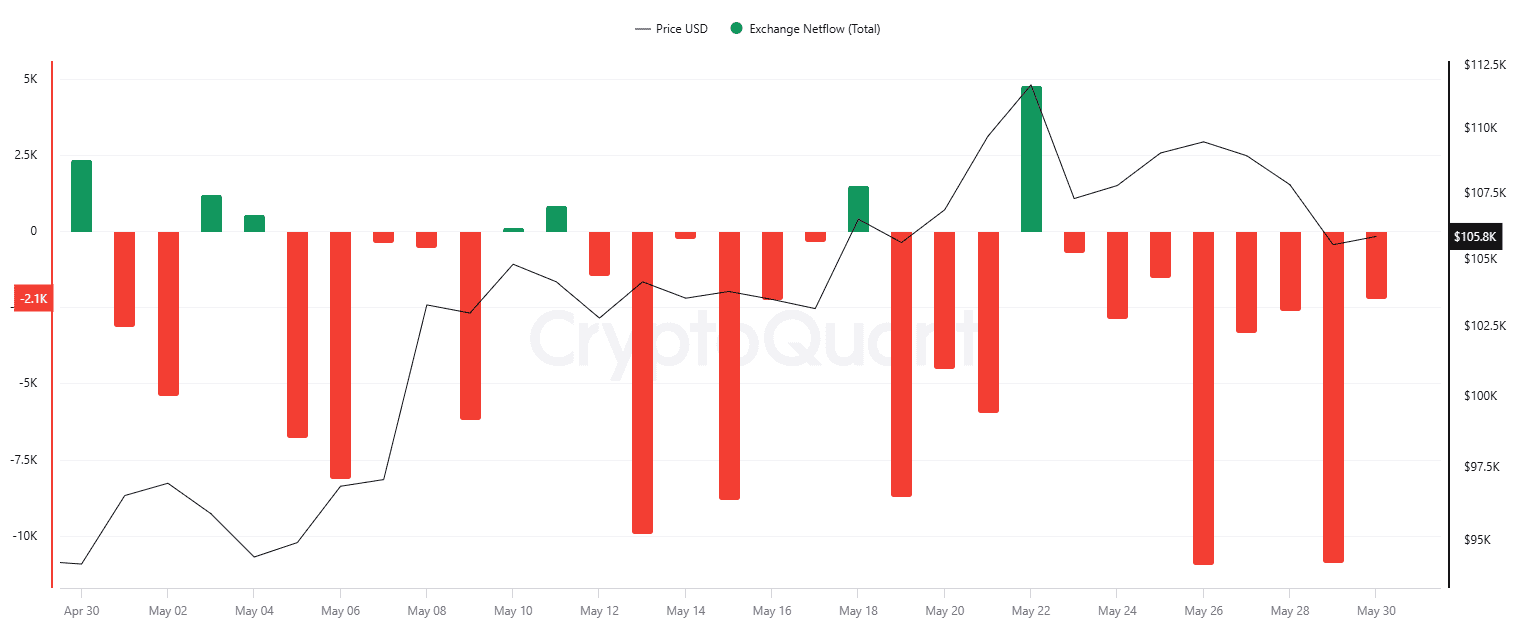

The aforementioned actions of the whales are not the only factor suggesting that the price of BTC could be on the verge of a rally. Over the past month, the supply of the asset on exchanges has dried up. Ali Martinez revealed that 30,000 BTC had been moved off centralized platforms within the timeframe, while the chart below shows that the exchange netflows were positive in only seven out of the last 30 days.

This suggests a shift from these entities toward self-custody solutions, which reduces the immediate selling pressure.

Bitcoin’s Relative Strength Index (RSI) should also be taken into account. The momentum oscillator measures the speed and magnitude of recent price changes and varies from 0 to 100.

When the ratio drops below 30, it typically indicates that the asset may be oversold and could be poised for a resurgence. Conversely, anything above 70 is interpreted as a bearish element. Over the past several hours, the RSI has been on a downward trend, currently standing just north of the lower mark.

Those willing to observe additional factors that may trigger enhanced volatility in BTC’s price in the short term can refer to our dedicated article here.