Cardano’s Latest Moves and Ethereum’s Price Drama: Crypto Pulse Check May 30

Cardano (ADA) flexes its upgrade muscle again—just another day in the land of ’Ethereum killers.’ Meanwhile, ETH price predictions swing between moon-shot optimism and ’wait for ETF approval’ hedging. Traders cling to hopium while institutions play the waiting game.

Elsewhere in crypto-land: BNB chain burns another pile of tokens (because nothing says ’deflationary’ like setting money on fire), and Bitcoin maximalists still won’t shut up about the halving. Stay tuned—the only certainty here is volatility.

Closing thought: If traditional finance is a tortoise, crypto’s the caffeinated hare—just don’t ask who’s winning the race.

Latest ADA Updates

Earlier this week, some members of the Cardano community noted that the US Securities and Exchange Commission (SEC) has May 29 as an initial deadline to approve or reject Grayscale’s application to launch the first spot ADA ETF in the United States.

The agency, however, opted to delay its decision until July 15. It has a maximum of 240 days to review the product, with a final deadline of October 22.

The price of ADA is down 7% on a daily scale, as its downtrend could be attributed to the SEC’s actions and the overall decline of the cryptocurrency market during that time frame.

Meanwhile, several key factors suggest that Cardano’s native token may soon regain its upward momentum. As CryptoPotato reported, whales purchased over 180 million ADA last week, which suggests strong confidence in the asset.

Another bullish element is the development of Cardano. Just a few days ago, Input Output revealed that Bitcoin Ordinals can now be wrapped and bridged to the Cardano blockchain through Fairgate’s BitVMX framework.

“This breakthrough marks a significant advancement in decentralized finance (DeFi), enabling seamless interaction between two of the most prominent blockchain ecosystems,” the team stated.

Where’s ETH Headed?

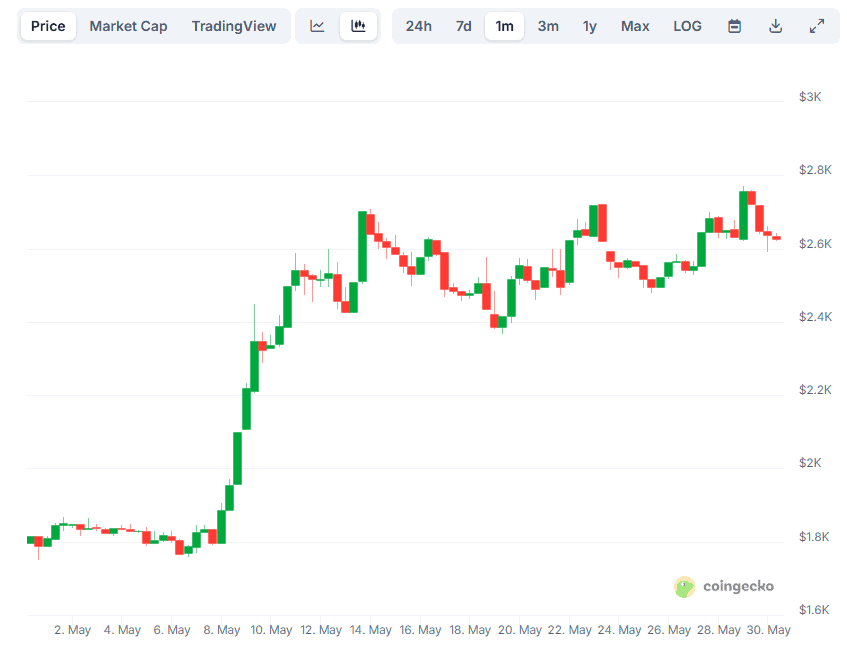

Despite the pullback over the past 24 hours, ethereum (ETH) is up 45% on a monthly basis, currently trading at just north of $2,600 (according to CoinGecko’s data).

Popular industry participants like the X users Daan Trades and Michael van de Poppe expect the asset to pump in the NEAR future under certain conditions.

The former saw a “big resistance” at $2,800, which will be “a tough level to break through quickly.” For his part, Michael van de Poppe touched upon the matter when the price was above $2,700, saying:

“Ethereum above $2,700 is a great sign. I think we’ll see $3,000+ in June.”

Those willing to explore other, even more bullish price predictions involving the second-largest cryptocurrency can take a look at our detailed article here.

What About XRP?

Ripple’s cross-border token has been on a downward trend lately, but it has seen an impressive 322% increase in the last year. As of this writing, it trades at around $2.20, having declined by 10% over the past week.

According to Santiment, the total supply in profit (at least on paper) had surged past 98% earlier this week when the asset traded at $2.3.

Thus, XRP outshined ADA (71%), ETH (71.5%), Doge (77.9%), and LINK (80.5%). While the data might sound optimistic and encouraging, Santiment issued a major warning, stating:

“When large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise.”

This takes us to Warren Buffett’s famous advice, who years ago advised investors to be greedy when others are fearful and vice versa.