Bitcoin’s On-Chain Metrics Scream ’Buckle Up’—This Rally Has Legs

Forget the skeptics—blockchain data suggests Bitcoin’s bull run is barely out of first gear. Network activity, whale accumulation, and miner behavior all point to one thing: this party’s just getting started.

The whale watch: Big-money players are gobbling up BTC faster than a Wall Streeter orders artisanal avocado toast. On-chain footprints show sustained accumulation at levels that historically precede major price surges.

Miners aren’t selling: The smart money—those actually running the network—are hodling tight. When these guys hold through price spikes instead of dumping, you pay attention.

Retail’s still sidelined: The real FOMO hasn’t even hit yet. Mainstream investors remain cautiously watching from the sidelines, which means rocket fuel remains in the tank.

So while traditional finance pundits clutch their pearls over volatility, the blockchain doesn’t lie. This market’s got room to run—whether the suits are ready or not.

Bitcoin Enters “Unprecedented” Bull Phase

According to Santiment’s latest tweet, an important on-chain signal supporting this bullish momentum is the declining Mean Dollar Age of Bitcoin holdings, which reflects a younger average age of coins in circulation. This trend has historically aligned with major bull cycles.

Over the past five years, there have been three major bull runs, and Santiment found that each has been accompanied by a noticeable drop in the average age of held BTC. Since April 16th, this metric has declined from 441 days to 429 days, which indicates that long-dormant whales are beginning to MOVE their holdings.

As these older coins re-enter active circulation, it strengthens the narrative that the market is in an “unprecedented” bull phase. In fact, this phase could possibly be one of the most significant in Bitcoin’s history.

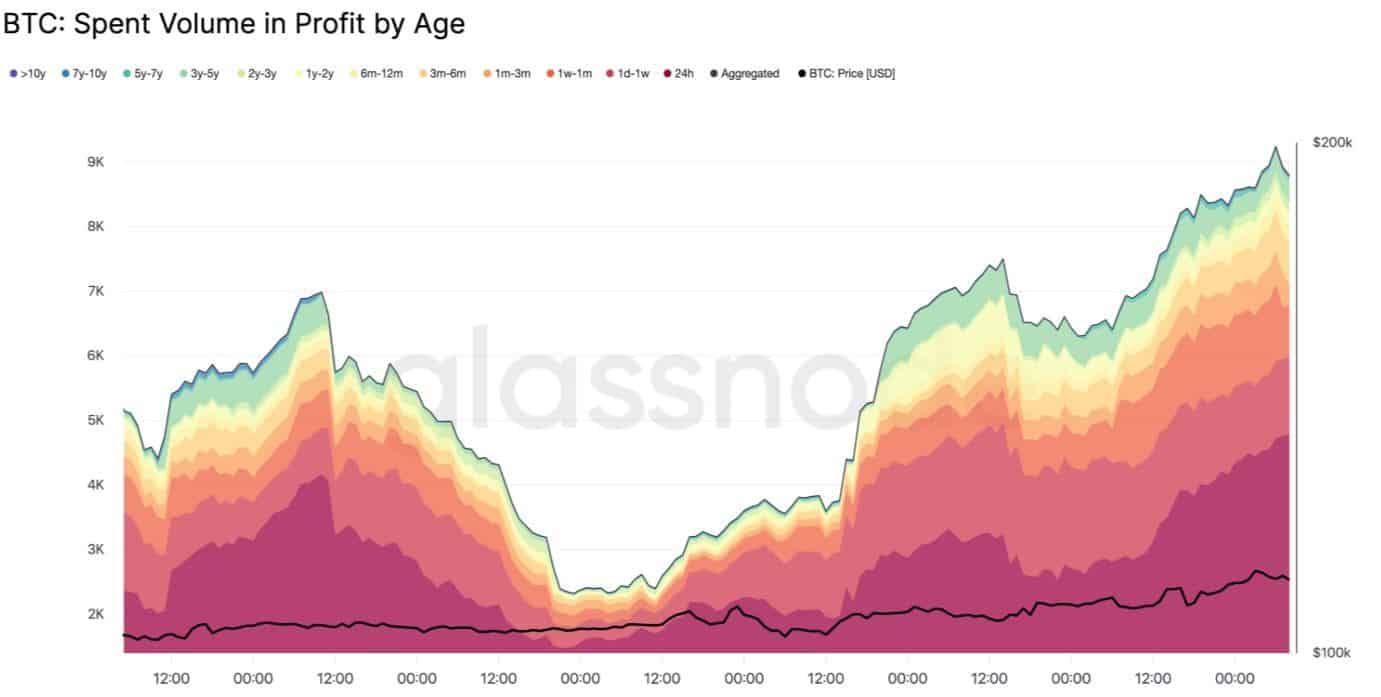

Further supporting this, Glassnode’s analysis revealed that despite Bitcoin’s ATH, realized profit-taking volume was just $1 billion, less than half the $2.10 billion seen when bitcoin first crossed $100K in December 2024.

Bitcoin Climbs Global Asset Ranks

Coin age distribution shows short-term traders dominating activity, with 6-month-old assets dropped to 13.4% from 24.7%. This indicates that long-term holders are broadly refraining from distributing coins at current levels, which is indicative of a stronger conviction and reduced speculative behavior.

CryptoRank’s latest data highlighted a growing macro correlation. Bitcoin’s price movements increasingly mirror trends in the global M2 money supply. Now the fifth-largest asset by market capitalization, Bitcoin appears to be following broader liquidity patterns more closely.

The chart includes a 10-week forward projection of M2, historically a leading indicator for the cryptocurrency. This suggests that changes in global liquidity precede shifts in Bitcoin’s price. With the current M2 forecast pointing to continued growth, the data signals potential sustained upside for the cryptocurrency in the NEAR term.