Bitcoin Holds Firm at $100K While Altcoins Steal the Spotlight: Weekly Crypto Pulse

Bitcoin’s throne remains unchallenged as it clings to the $100K mark—proving once again that even digital gold can play the long game. Meanwhile, altcoins are throwing a rager, with Ethereum, Solana, and a parade of smaller tokens posting double-digit gains. Wall Street analysts are already scrambling to explain why they ’always believed in DeFi’—just ignore their 2023 memos.

Market sentiment? Greedy with a side of FOMO. Trading volumes hit ATHs as retail and institutional players alike pile into altcoin bets. BNB leads the charge among exchange tokens, while NFT platforms quietly bleed out—turns out JPEGs aren’t recession-proof after all.

Closing thought: The crypto pendulum swings fast. Today’s moonshot is tomorrow’s ’rug pull’ headline. Trade accordingly—and maybe keep some dry powder for when the suits start crying ’bubble’ again.

Market Data

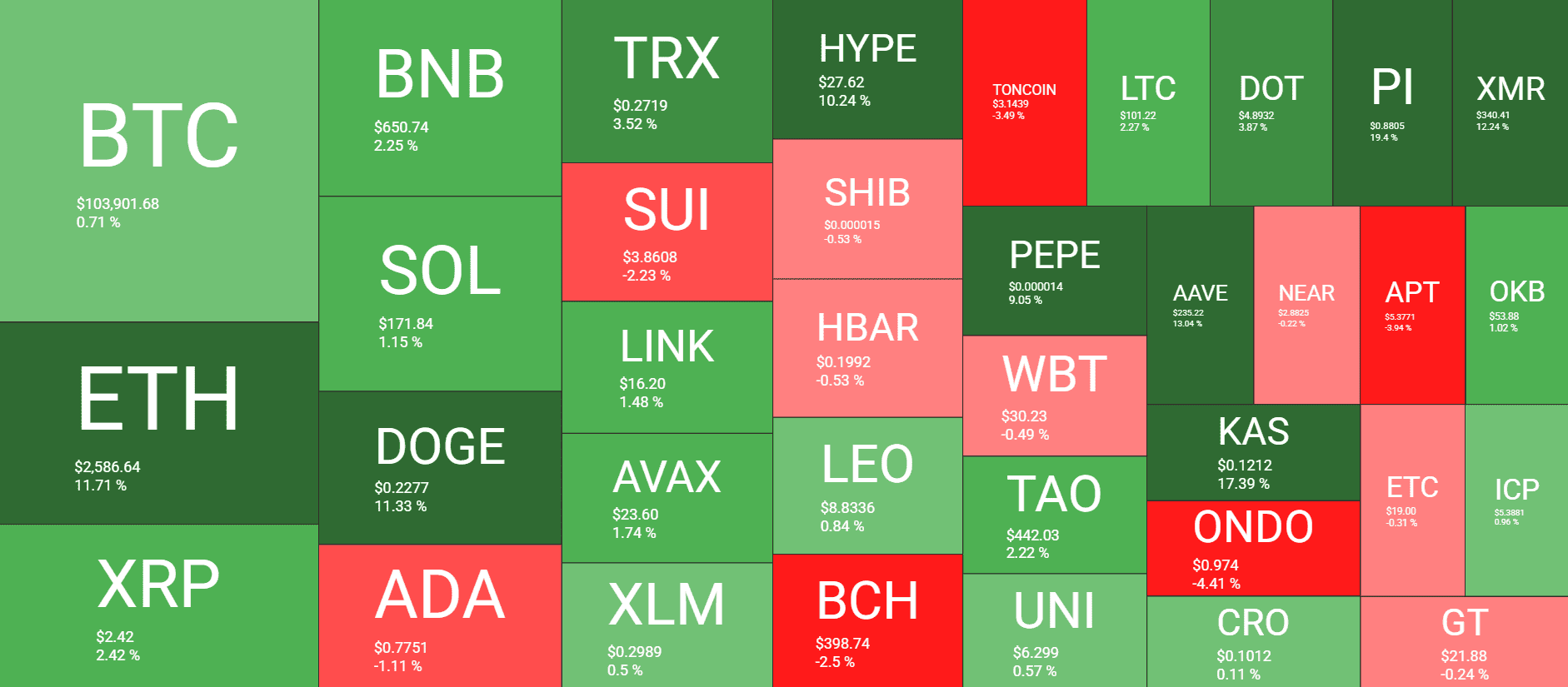

Market Cap: $3.447T | 24H Vol: $120B | BTC Dominance: 59.9%

BTC: $103,900 (+0.7%) | ETH: $2,586 (+11.7%) | XRP: $2.42 (+2.4%)

This Week’s Crypto Headlines You Can’t Miss

As the title of this Market Update suggests, there has been an ongoing narrative in the cryptocurrency community that an altseason has finally started. This article lists five major indicators suggesting that this relatively short period in the market has begun.

. The former BitMEX CEO remains confident that BTC will eventually surge to $1 million. In his latest iteration of this prediction, he reasoned that such a spectacular 10x surge from the current levels WOULD become possible due to the looming capital controls in the United States.

. Although many believe an altseason is upon us, there are some metrics suggesting that BTC should not be counted out yet. Vital signs, such as the growing realized capitalization as well as renewed capital inflows, hint that bitcoin’s run has just started and the asset is still very much in a bull cycle.

. ethereum has turned the whole narrative around it upside down in the past few weeks, and investors have started to pull out massive quantities of ETH from exchanges instead of the recent sell-offs. Its price touched a multi-month peak this week even though it was stopped above $2,700, at least for now.

Although BTC’s price rallied hard in the months after the US elections, there was no actual retail hype, unlike previous cycles. Now, though, on-chain information claims that such smaller market participants have finally reemerged, which could mean more gains in the NEAR future but also the nearing of the cycle’s top.

The past few weeks have seen a substantial divergence in the overall behavior between whales and smaller investors. The former cohort has continued to accumulate, while the latter has sold off some of their holdings, perhaps to realize profits during BTC’s climb above $100,000.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Hype, and solana – click here for the complete price analysis.