Ethereum Eyes $3K Breakout—Here’s the Fuel It Needs

ETH bulls are circling as key technical and on-chain signals hint at a potential surge past the psychological $3K barrier. Liquidity pools show whales accumulating, while staking yields tighten supply—classic setup for a volatility spike.

Watch these triggers:

- Spot ETF whispers: BlackRock’s recent Ethereum Trust filing lit a slow burn under prices. Approval could send institutional FOMO into overdrive.

- Layer 2 explosion: Arbitrum and Optimism now process 4x Ethereum’s base layer transactions. Scaling narrative = bullish fundamentals.

- Shanghai upgrade aftermath: Unlocked staked ETH isn’t flooding markets as feared. Turns out crypto hodlers prefer...hodling.

Of course, Wall Street’s algo-trading desks will claim they saw it coming—right after they finish front-running retail traders again.

Technical Analysis

The Daily Chart

ETH has pushed through multiple resistance zones and is now testing the $2.6K—$2.7K region. It aligns with the 200-day moving average and the lower boundary of the long-term channel, which was broken to the downside weeks ago.

The RSI is also now in overbought territory, printing above 75, hinting at potential exhaustion. A daily close above $2.7K WOULD confirm a bullish breakout and open the door to $3K+, while rejection from this level could pull ETH back toward the $2.2K support level.

The 4-Hour Chart

The 4-hour chart shows a textbook breakout from a descending channel followed by strong bullish follow-through. The asset is consolidating just above the $2.6K zone after a vertical leg higher.

There’s still room to stretch toward the $2.8K area, but the current sideways price action combined with a declining RSI suggests cooling momentum. A break below $2.6K could trigger a short-term correction toward $2.1K before the next leg.

Sentiment Analysis

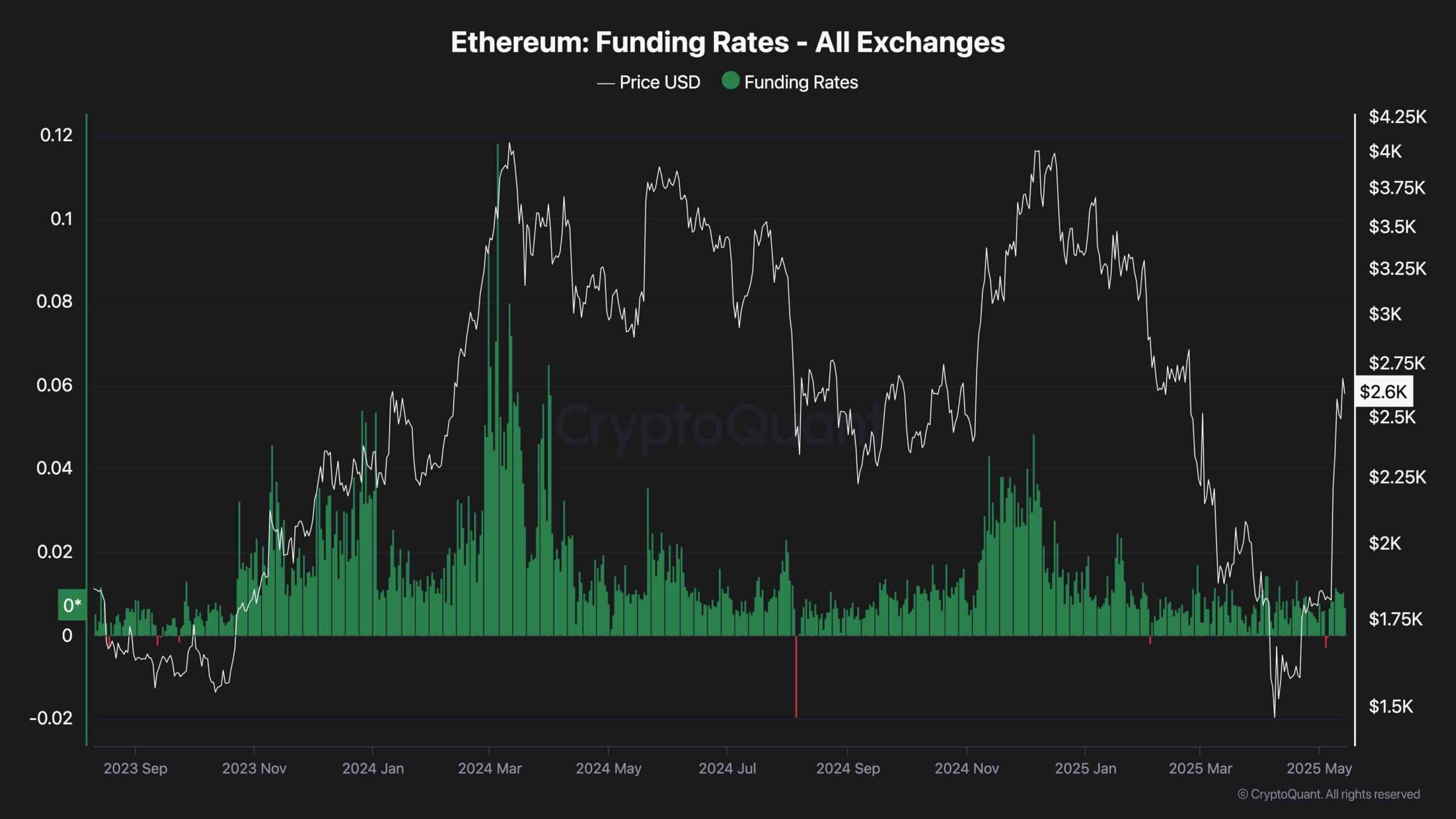

Funding rates across all major exchanges remain slightly positive, reflecting bullish market sentiment. However, they are not yet at extreme levels, indicating the rally may still have fuel left. Ethereum’s open interest has also climbed significantly alongside the price, suggesting new positions are entering the market rather than closing out shorts, typically a sign of genuine momentum.

That said, traders should remain cautious. The elevated RSI on the daily chart and crowded positioning shown by the rise in funding rates could set the stage for a short-term flush if ETH gets rejected at key resistance. Historically, such sentiment surges have been followed by local tops or consolidation phases.

Monitoring funding spikes and open interest behavior over the next 24–48 hours will be critical to gauge whether this rally can extend further or if a pullback is on the horizon.