Bitcoin Smashes $100K Barrier—Are We Headed for a New All-Time High?

Bitcoin just bulldozed past the $100,000 psychological barrier, leaving traders scrambling and skeptics muttering about ’irrational exuberance.’ The question now: is this the launchpad for another historic rally?

The Technical Setup: BTC’s weekly chart shows a textbook breakout after months of consolidation. Volume spikes suggest institutional players are piling in—or maybe just hedge funds chasing performance before quarterly reports.

Market Sentiment: Fear & Greed Index hits ’Extreme Greed’ territory (again). Retail FOMO is building, but derivatives data shows surprisingly restrained leverage—for now.

The Cynic’s Corner: Wall Street analysts who called Bitcoin ’worthless’ at $30K are now publishing $150K price targets. How convenient.

One thing’s certain: with volatility this high, buckle up. The crypto rollercoaster just left the station.

Technical Analysis

The Daily Chart

On the daily timeframe, BTC has pushed through the $100K resistance level and is now hovering around the $103K mark. This breakout came after a clean reclaim of both the 100-day and 200-day moving averages and a retest of the ascending trendline that’s been respected over the last months.

Moreover, the RSI is firmly in overbought territory, currently above 75, indicating strong bullish momentum, although it also warns of a possible short-term cooldown. If the breakout is sustained, the next visible resistance level will be around $108K, while the $99K zone will now act as a new key support.

The 4-Hour Chart

Investigating the 4H-chart, we can see the breakout from a rising wedge that had been forming for over a week. Price first broke above the $97K–$98K range, and exploded toward the $103K area.

Momentum indicators like RSI confirm strength, although we now see early signs of short-term exhaustion. This suggests a possible retest of the breakout zone around $100K or even $98K before continuation. Yet, as of now, the overall structure favors further upside unless the $96K–$97K zone fails to hold.

Onchain Analysis

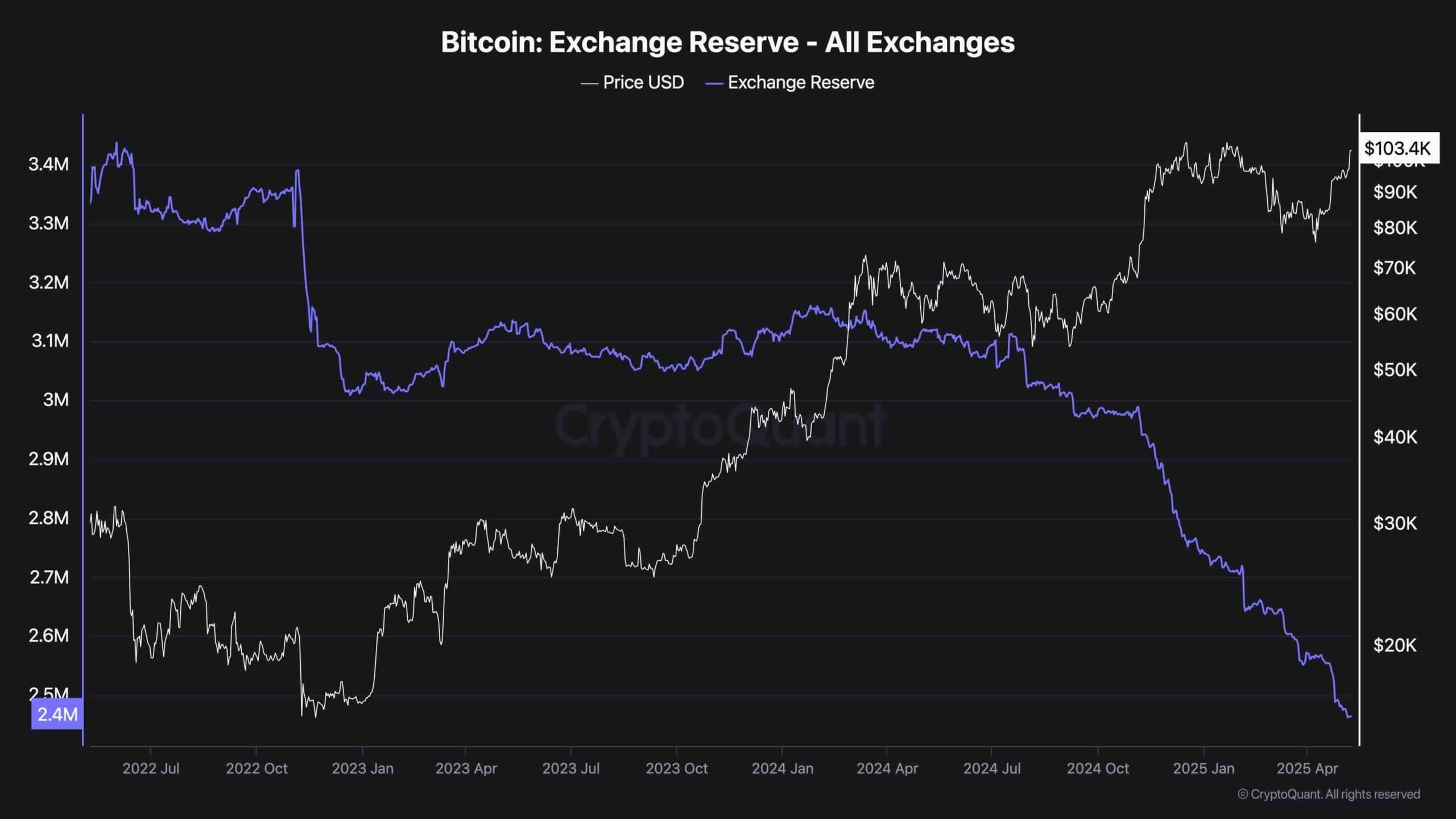

Exchange Reserve

From an on-chain perspective, exchange reserves continue to plunge, making a new multi-year low. This ongoing decline reinforces the long-term bullish thesis: less BTC available on exchanges typically reflects accumulation behavior and reduced selling pressure.

It also suggests that long-term holders are not eager to offload their coins even at these high levels. The macro trend of shrinking exchange balances supports the current breakout and adds confidence to the sustainability of the rally, even if we get short-term pullbacks.