Ethereum Primed for May Surge? Analysts Drop Bombshell Price Targets

Ethereum bulls are licking their chops as May kicks off—technical setups and on-chain data suggest ETH could be gearing up for a monster rally.

Here’s what the charts are screaming:

- Whale accumulation spikes to 3-month highs (because nothing says ’trust’ like billionaires quietly hoarding assets)

- Key resistance at $3,800 looks ready to crumble after 4 rejection attempts

- Staking yields outpacing Treasury bonds—take that, traditional finance

Top predictions from traders who actually survived the last cycle:

1. $4,200 by mid-May (basic Fibonacci extension play)

2. $5,000+ if ETF whispers gain volume (we’ve seen this movie before with Bitcoin)

3. Worst-case hold at $3,400 (because even crypto needs safety nets)

Will this finally be Ethereum’s month to flip the script—or just another ’buy the rumor’ trap? The blockchain doesn’t lie... but your trading history might.

Where Next for ETH?

The second-largest cryptocurrency in terms of market cap experienced a substantial pump on a 14-day scale, rising by 16% and currently trading at over $1,800. Despite the resurgence, its overall performance in the last several months remains unsatisfactory.

The popular X user Carl Moon revealed to his 1.5 million followers on X that Ethereum (ETH) has been falling for five months in a row. In February, for instance, the price collapsed by nearly 32%.

Carl Moon, however, pointed out that May has historically been one of the most positive periods for the asset. ETH has posted losses in only three out of ten Mays throughout its history. The ongoing month has also delivered the highest average gains over the years – around 27.31%.

X user SHERIFF shared a similar thesis. They outlined that ETH bled out in seven out of the last eight months. The negative performance was also combined with low sentiment and “dead” volatility. On the other hand, these are the times when “the next big move brews,” the analyst claimed.

For his part, Merlijn The Trader made an interesting comparison between Bitcoin’s performance in 2020-2021 and Ethereum’s recent structure. He predicted a potential price explosion if “history is on our side,” adding that he’s “loading ETH.”

In 2020, Bitcoin consolidated at $8K…

Most ignored it. Then it hit $64K.

Today, Ethereum is showing the exact same structure.

Accumulation. Compression. Explosion loading.

I’m loading $ETH. History is on our side. pic.twitter.com/0PEtoWGNze

— Merlijn The Trader (@MerlijnTrader) May 1, 2025

CRYPTOWZRD chipped in, too, projecting a potential short-term scenario. The analyst set $2,120 as the next key resistance target, envisioning “a quick move” toward $2,800 if the asset breaks through.

Abandoning Exchanges

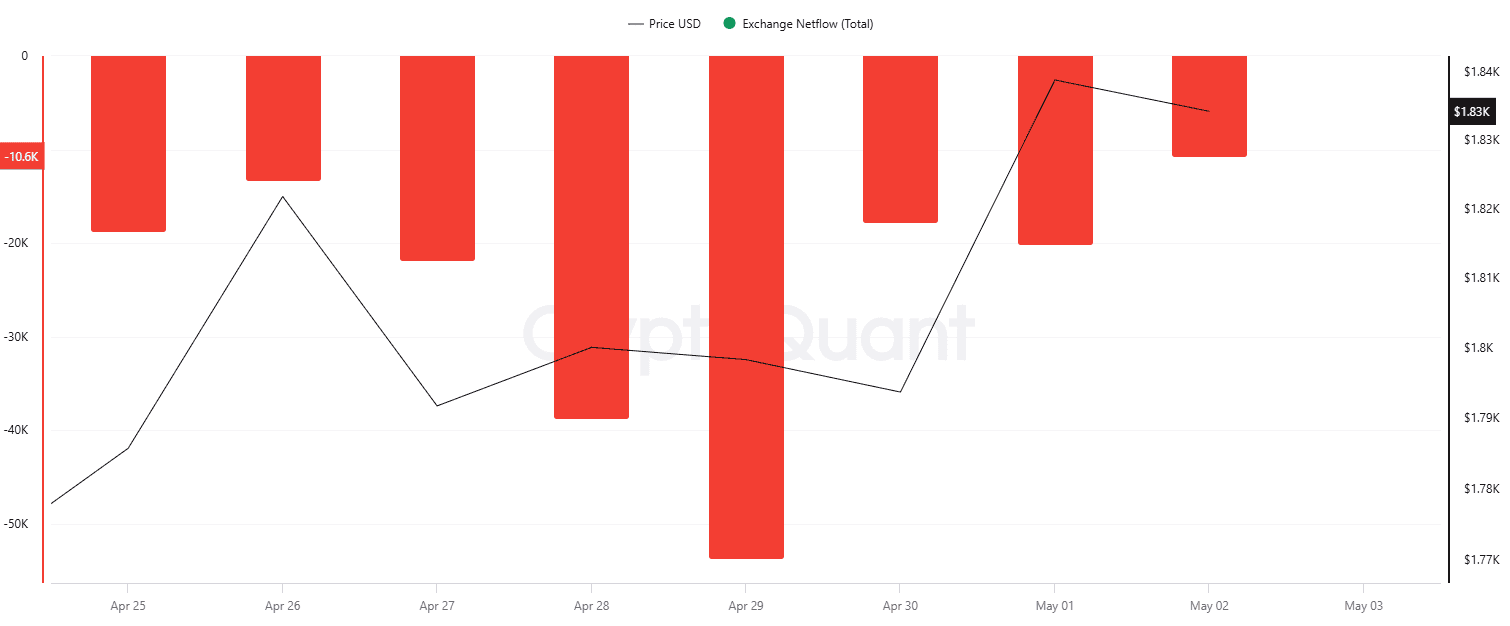

One factor that supports the optimistic predictions outlined above is ETH’s exchange netflow.

Outflows have dominated over inflows in the past week, signaling that investors have shifted from centralized platforms toward self-custody methods. This development is generally bullish for the price since it reduces the immediate selling pressure.