Ethereum Smashes Against Key Resistance – Will the Dam Break?

ETH bulls charge again as price tests a critical resistance level—the same one that’s crushed rallies three times since March. On-chain data shows whales accumulating, but derivatives traders remain skeptical (probably too busy levering up on meme coins).

Technical outlook: A daily close above $3,800 could trigger algorithmic buying frenzy. Failure? Hello, $3,200 support—and another round of ’institutional adoption’ press releases from desperate VC bagholders.

Technical Analysis

By ShayanMarkets

The Daily Chart

The price created a clear bullish reversal pattern at the $1.5K support level and quickly rallied toward the order block located at the $1.8K mark. Meanwhile, if the market experiences a rejection from the order block, the bullish fair value gap located below the price can provide support and push the asset back higher.

With the 100-day MA taking a nosedive around the $2.2K level, this area is a probable bullish target for ETH on the daily timeframe.

The 4-Hour Chart

On the 4-hour timeframe, ETH created a clear bullish market structure shift, with the descending channel broken to the upside. An impulsive rally has taken the price from around the $1.5K area to the $1.8K level in only a few days.

The $1.8K resistance zone is a critical one, as it has previously provided support for the market several times over the last few months. Therefore, a bullish breakout above this area could be the beginning of a further bullish continuation.

Onchain Analysis

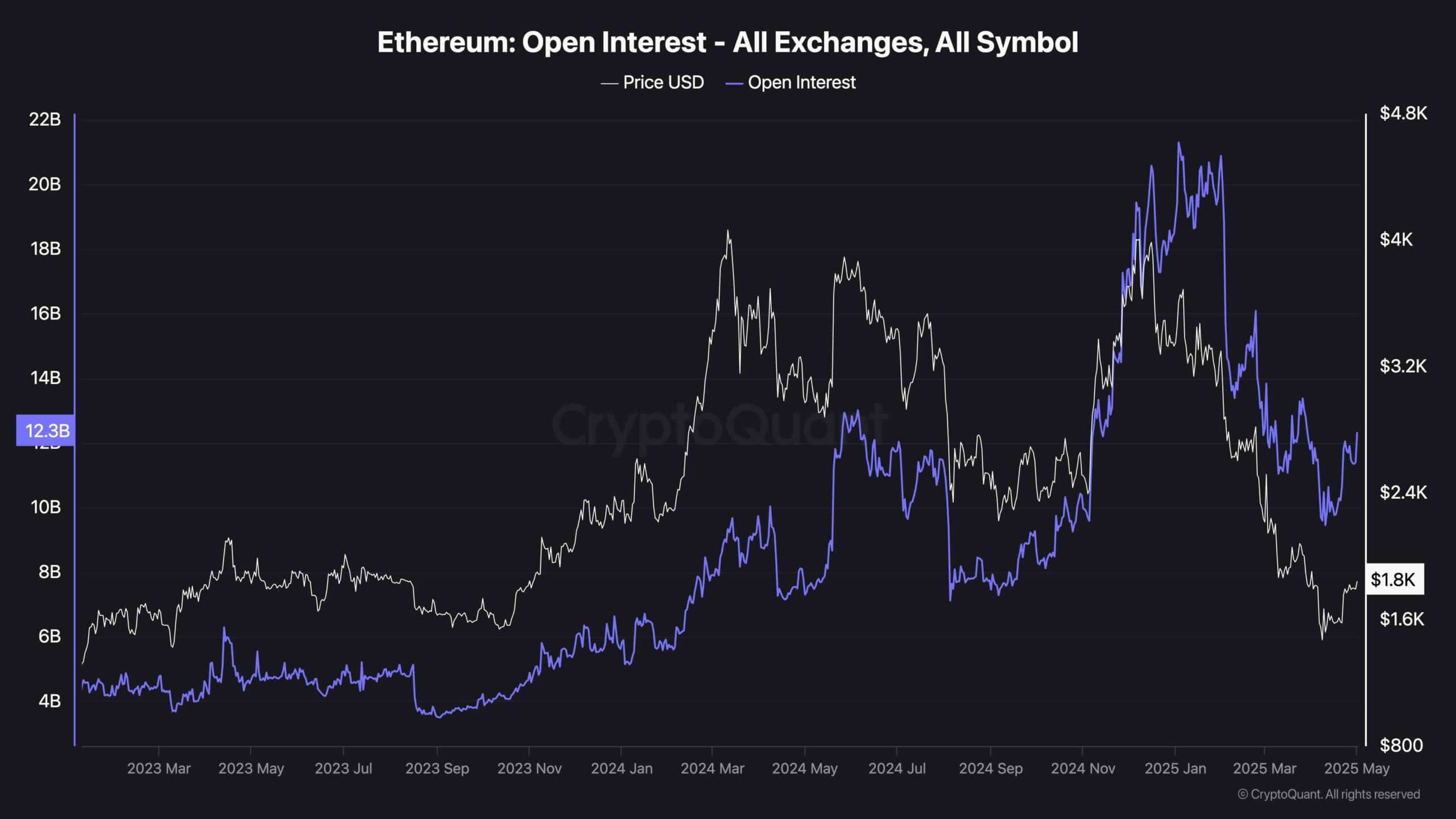

The Ethereum Open Interest chart from CryptoQuant offers valuable insight into the current derivatives market sentiment surrounding ETH.

During the last couple of cycles, Ethereum’s open interest has shown a strong correlation with price trends, rising steadily during bullish phases and dropping sharply during corrections.

In recent weeks, a slight recovery is visible. The asset has rebounded to $1.8K, and open interest is climbing again toward the $12B level. This rising open interest during a price recovery signals renewed speculative positioning, possibly anticipating a breakout or continued relief bounce.

However, considering past patterns, this also raises the risk of a volatile flush if the price stalls or reverses sharply again. Therefore, risk management will still be crucial in the coming weeks.