Bitcoin Smashes Resistance—$100K Target Now in Play After Bullish Breakout

Crypto’s flagship asset just punched through a critical resistance level—and traders are betting the rally has legs. Here’s why $100K looks increasingly plausible.

The technical setup: Bitcoin’s weekly close above $72k confirms the breakout, with on-chain data showing minimal sell pressure from long-term holders. Derivatives markets are flashing green too—open interest is rising without excessive leverage (for now).

Macro tailwinds: The Fed’s dovish pivot meets Bitcoin’s halving supply shock. Wall Street’s ETF flows hit $12B this month alone—institutional FOMO is real, even if the suits still don’t get the tech.

The cynical take: Of course Goldman Sachs will launch a ’digital asset advisory group’ now that fees are up for grabs. Where were these bankers at $3K?

Bottom line: This market rewards the brave and punishes the late. $100K isn’t guaranteed—but the path just got clearer.

Technical Analysis

By Edris Derakhshi

The Daily Chart

BTC has broken above the $92,000 level after consolidating for most of April. This breakout comes after a successful reclaim of the 200-day moving average, located around the $89,000 mark, which now acts as strong support around $88,000.

The next major resistance lies at $100,000, while support is now locked in at the $92,000 breakout zone. Judging by the bullish momentum, however, a continuation toward the $100,000 level is more probable in the coming weeks.

The 4-Hour Chart

On the 4-hour chart, price surged through the $92,000 resistance with high volume and has started forming a tight consolidation just above it, signaling a healthy continuation pattern.

The RSI also briefly spiked above 70 and is now stabilizing around the 60–65 range, leaving room for further upside without being overextended. Any retest of the $92,000 zone that holds would reinforce this level as a new base before continuation higher.

On-Chain Analysis

By Edris Derakhshi

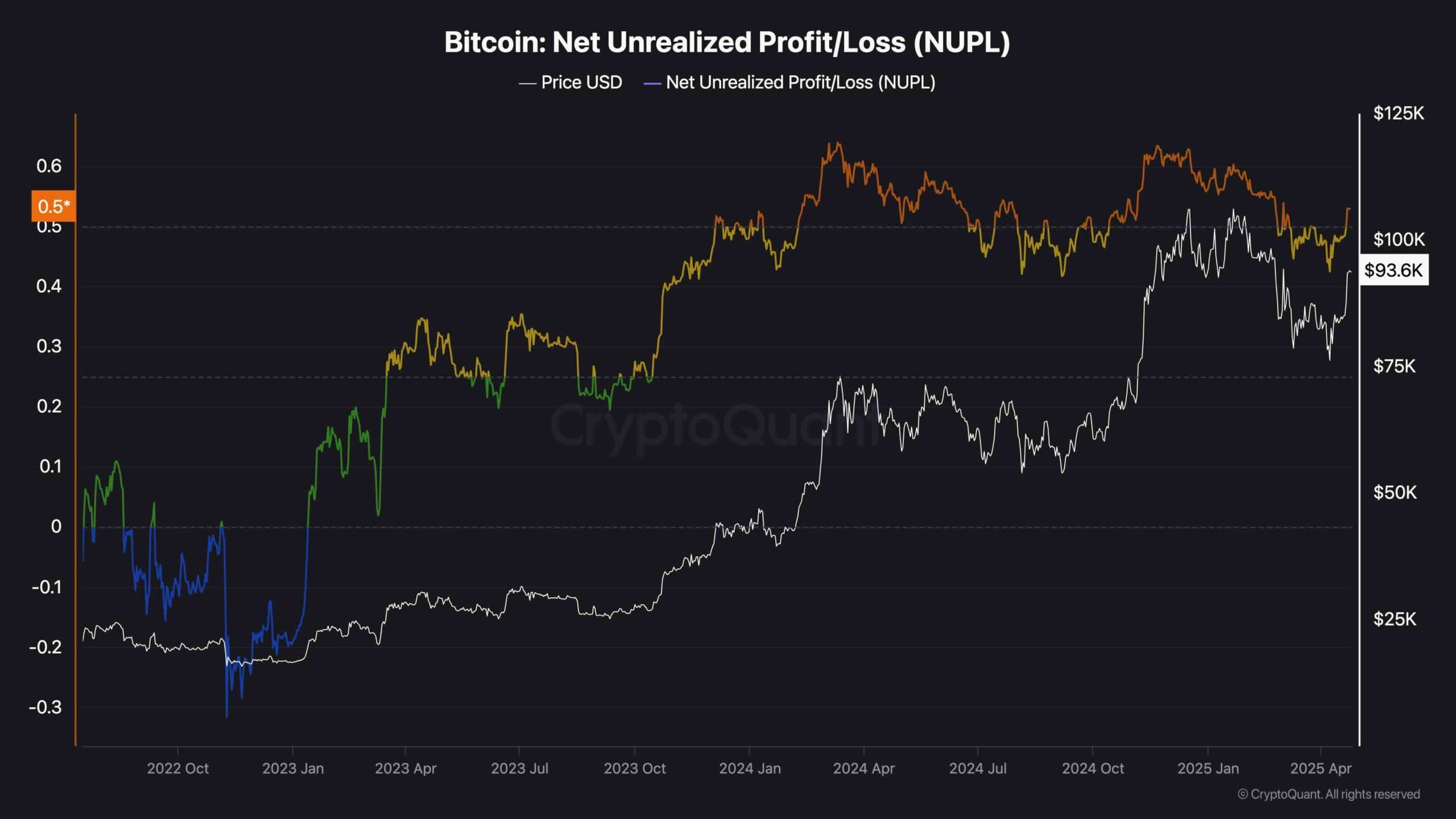

Net Unrealized Profit Loss (NUPL)

Net Unrealized Profit/Loss (NUPL) has bounced sharply, moving back into the belief/optimism zone. This indicates that holders are once again sitting on significant unrealized profits, but sentiment hasn’t yet flipped to euphoria.

This phase historically supports price continuation as holders remain confident and are less likely to sell aggressively. With NUPL well below its extreme peak levels, there’s still runway for further upside before greed tops out.