Ethereum Price Prediction: Can ETH Smash $6,000 By 2025? Latest Polymarket Odds Revealed

Ethereum's $6,000 target sparks heated debate as traders weigh technical patterns against market sentiment.

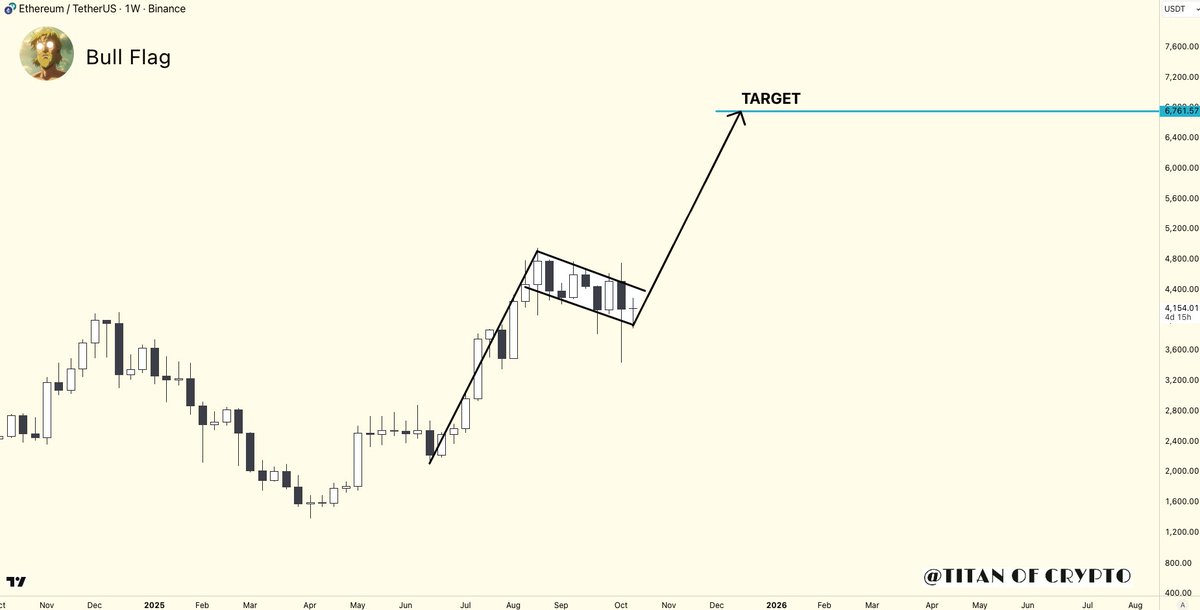

Bull Flag Formation Intact

Despite recent volatility, ETH maintains its bullish structure—trading volume suggests institutional accumulation continues behind the scenes. The $6,000 projection represents a 150% surge from current levels, matching 2021's parabolic momentum.

Polymarket Odds Shift

Prediction markets show 42% probability of ETH hitting $6,000 before 2026, though liquidity remains thin—typical for crypto derivatives where everyone's an expert until the margin call hits.

Technical Crossroads

MACD divergence warns of short-term pressure, but Ethereum's fundamental upgrades override chart noise. The Merge's efficiency gains and growing Layer-2 ecosystem create structural tailwinds traditional finance still struggles to price.

Whether ETH reaches escape velocity depends more on macroeconomic tides than technical patterns—because in crypto, even the 'smart money' sometimes forgets gravity exists.

Bearish Momentum Builds on Weekly MACD

Ali Martinez noted that ethereum is close to a bearish MACD crossover on the weekly timeframe, a pattern that has led to steep price drops in past cycles. The last two times this signal appeared, ETH fell by 43% and 61%. The MACD histogram is also turning lower, pointing to fading momentum.

Ethereum $ETH is on the verge of a bearish MACD crossover on the weekly chart. The last two times it happened, the price dropped 43% and 61%. pic.twitter.com/RRIjFeR63k

— Ali (@ali_charts) October 16, 2025

Ethereum is trading near $4,000 at press time, down 4% over the past day and 10% on the week. The crossover has not yet been confirmed. If the signal completes, some expect a stronger correction to follow.

RSI Oversold and Flag Pattern Still Active

Tom Tucker noted Ethereum’s RSI is sitting at around 16, a level considered deeply oversold. He said, “RSI at 16.25 = heavily oversold territory,” adding that rebounds often follow similar readings. Tucker also noted that bearish signals might be drawing in sellers too early.

Titan of crypto shared a chart showing a bull flag pattern on Ethereum’s weekly chart. The flag follows a sharp rally and is still intact. If the breakout occurs, the pattern points to a move toward $6,700. This is based on the height of the flagpole added to the breakout point.

Moreover, Martinez also highlighted MVRV Pricing Bands, which track historical deviation from Ethereum’s realized price. ETH is holding above the mean band at $3,900, marking it as a support area.

$3,900 is a major support zone for Ethereum $ETH. If it holds, the Pricing Bands point to a move toward $5,000 or even $6,000. pic.twitter.com/GV6OFQqO3T

— Ali (@ali_charts) October 15, 2025

If this area holds, the upper pricing bands suggest upside toward $5,000 and $6,000. If it fails, traders may look toward lower zones near $2,800.

Institutional Demand and Blockchain Use Expanding

Bitwise reported that 95% of ETH held by public companies was bought in the last quarter. A total of 4.4 million ETH was added, a 1,937% rise compared to the previous quarter. Combined holdings by public firms and ETFs now stand at 12.50 million ETH, or 10.31% of the total supply.

Cipher X said Ethereum is becoming the settlement LAYER of the digital economy. USDC supply is nearing $45 billion, while BlackRock’s BUIDL fund now holds over $2 billion in tokenized US Treasuries. Cipher said both are “growing side by side” without coordination, powered by market use of Ethereum’s infrastructure.