Ripple’s Bull Run Over? AI Predictions That Will Shock the XRP Army

Artificial intelligence drops truth bombs on XRP's trajectory—and the results defy conventional wisdom.

The Algorithmic Takeover

Machine learning models crunch terabytes of market data while traditional analysts still debate chart patterns. These systems analyze everything from regulatory filings to social sentiment spikes—processing variables human traders can't possibly track in real-time.

Regulatory Roulette

SEC rulings create whiplash volatility that algorithms digest faster than CNBC anchors can report it. The machines see legal battles as quantifiable risk parameters rather than existential threats—calculating probabilistic outcomes while retail investors panic-sell.

Institutional Adoption Patterns

AI detects subtle institutional accumulation patterns invisible to the naked eye. The smart money moves before the headlines hit—leaving retail traders chasing shadows as liquidity shifts between dark pools and public exchanges.

Technical indicators scream one thing while fund flows whisper another. The machines process both languages fluently—and their translation suggests the XRP narrative contains chapters yet unwritten. Because nothing says 'sound investment' like algorithms outperforming fund managers charging 2-and-20.

That’s All She Wrote?

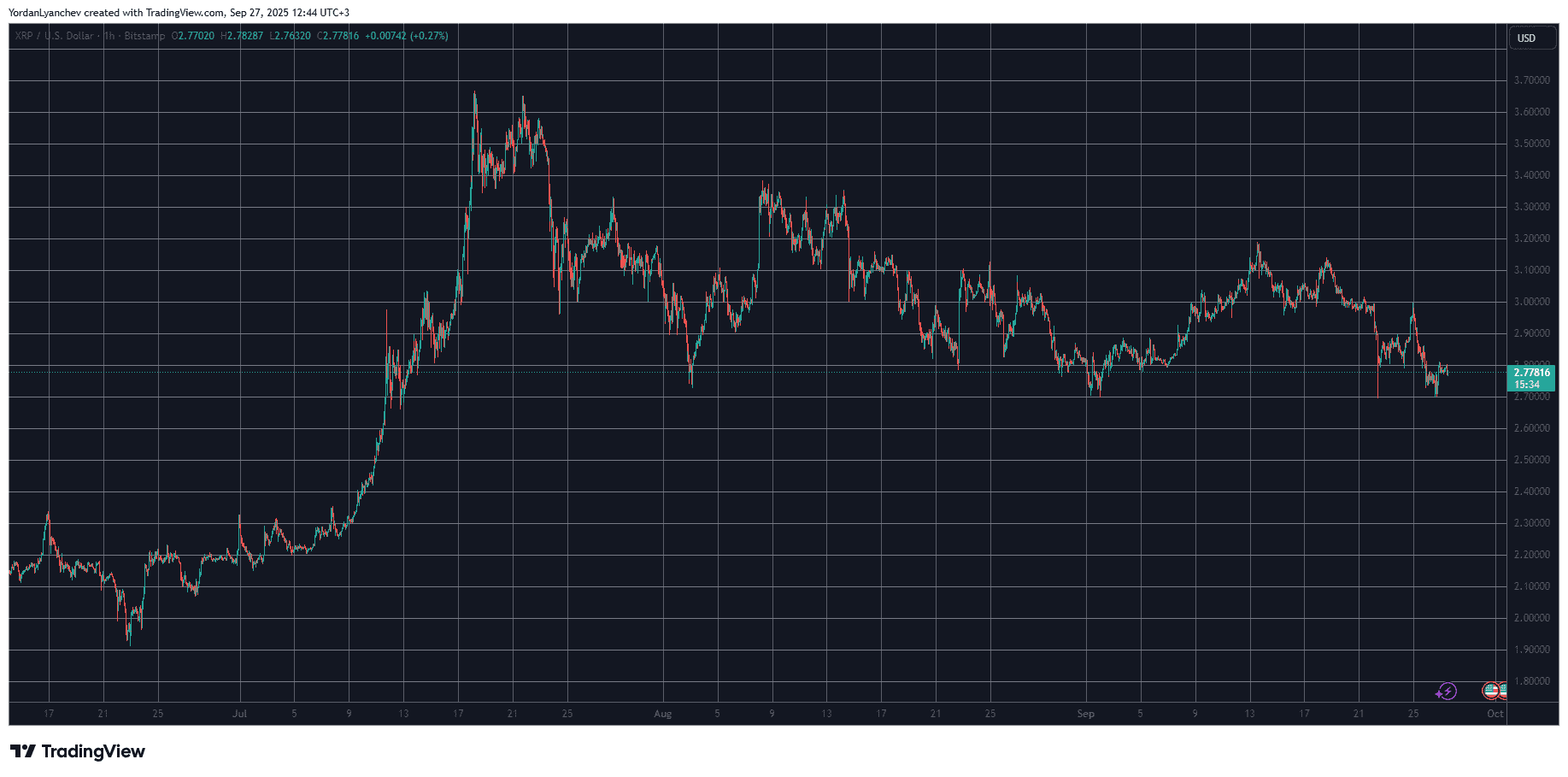

Before we dive into the AI’s detailed answer on this, let’s briefly recall XRP’s run that started last year after the US elections. At the time, it traded around $0.60 before it exploded beyond $1, $2, and eventually $3 in January. Speculations began about breaking its 2018 all-time high of $3.4, but XRP only managed to match it.

What followed was a months-long correction that drove it south to under $2 at one point. However, it managed to reclaim that level and remained at around $2.2-$2.3 by the start of the summer. Then came what many anticipated to happen earlier this year, and a spectacular run in July drove XRP beyond its 2018 ATH to a new one of $3.65.

After such a massive rally, the asset corrected and slipped below $3 on several occasions in the next couple of months. In fact, it has tested the $2.70 support four times since then, but that level has remained intact.

Being 25% away from its peak marked in July means that this is a pivotal point as analysts debate whether it’s a regular correction or the start of a full-on bear market.

ChatGPT admitted that such retracements are “common even during strong bull markets.” It reminded that XRP, alongside most other larger-cap alts and BTC, has experienced similar or even worse pullbacks in previous cycles before “setting fresh highs.”

As such, it determined that the bull run is “not necessarily over,” since one painful correction “doesn’t kill a cycle.” However, it warned that there are certain factors that need to improve for XRP to resume its rally.

The Factors

From a technical standpoint, the AI chatbot noted that the XRP Army shouldn’t be too concerned as long as the asset remains above the crucial $2.70 support. Nevertheless, a “decisive break below that level might signal a deeper cooling phase.”

Additionally, it argued that on-chain activity should at least remain at the current level. It also mentioned some macro factors, such as the Federal Reserve’s policy, which could impact XRP and other riskier assets. Jerome Powell’s warning about inflation in the US over the past week is considered arguably the biggest reason behind the crypto market’s pullback.

Lastly, ChatGPT indicated that if the US SEC finally greenlights all spot XRP ETF applications, which are more than a dozen, it could impact the underlying asset’s price positively, especially if the inflows are significant.