XRP Primed for Explosive Move: This Ripple Pattern Signals Major Breakout

XRP traders brace for volatility as technical patterns suggest an imminent price surge. The digital asset shows textbook breakout formation after weeks of consolidation.

Chart Analysis Reveals Setup

Ripple's native token displays symmetrical triangle formation with tightening volume—classic precursor to significant momentum moves. Historical data shows similar patterns preceding 50%+ price swings.

Market Mechanics at Play

Reduced exchange reserves coincide with increasing institutional interest. Payment corridor developments create fundamental tailwinds while technicals align for potential upward acceleration.

Regulatory clarity continues serving as catalyst, with banking integration progress outpacing traditional finance's glacial adoption timeline. Because nothing says innovation like waiting three business days for settlements.

All signs point toward decisive price action within current trading ranges. Whether bulls capitalize depends on volume confirmation at key resistance levels.

XRP Forms Final Leg of Technical Correction

XRP is completing a multi-month triangle pattern that has followed the ABCDE structure often seen in corrective phases. The current move places price action NEAR point (E), suggesting that the correction is almost complete. The range between $2.65 and $2.70 is acting as support.

This area also lines up with a prior wave (2) in a broader bullish setup. The pattern has remained intact so far, with no breakdown below the key support zone. The technical outlook points to a possible breakout if price holds and begins to MOVE higher from this base.

A push above $3.3 is being watched as the breakout trigger. This level sits just above the triangle’s upper resistance. A clean move above it could mark the end of the current range and the start of a new trend.

Key resistance levels are marked at $2.85, $3, and $3.10, based on Fibonacci retracements. A close above $3.3 WOULD place price back above all these points. The RSI is also beginning to rise after holding a base, which can signal momentum building. According to DefendDark:

Hi all!#XRP is nearing completion of the corrective action: ABCDE and preparing for Lift-off!

We are nearing the end of the consolidation.

After this consolidation, and reclaiming $3.333

nothing will be able to stop what’s coming.

Road to Double Digits #XRPArmy

Ohhh One… pic.twitter.com/u4LDOxf9Mx

— Dark Defender (@DefendDark) September 24, 2025

Short-Term Holders Show Signs of Capitulation

XRP’s Net Unrealized Profit/Loss (NUPL) for short-term holders has dropped below zero. This indicates that many traders who bought recently are now holding losses. The chart from Glassnode shows that previous dips into this range, such as in late 2024 and again in April 2025, were followed by recoveries.

Steph Is crypto commented:

BREAKING:#XRP IS CLOSE TO CAPITULATION FOR SHORT-TERM HOLDERS, WHERE PAST RECOVERIES BEGAN. pic.twitter.com/UV7Ascj9H7

— STEPH IS CRYPTO (@Steph_iscrypto) September 24, 2025

While this does not confirm a bottom, the setup is similar to past low points. Selling pressure may ease if holders are no longer exiting in high volume.

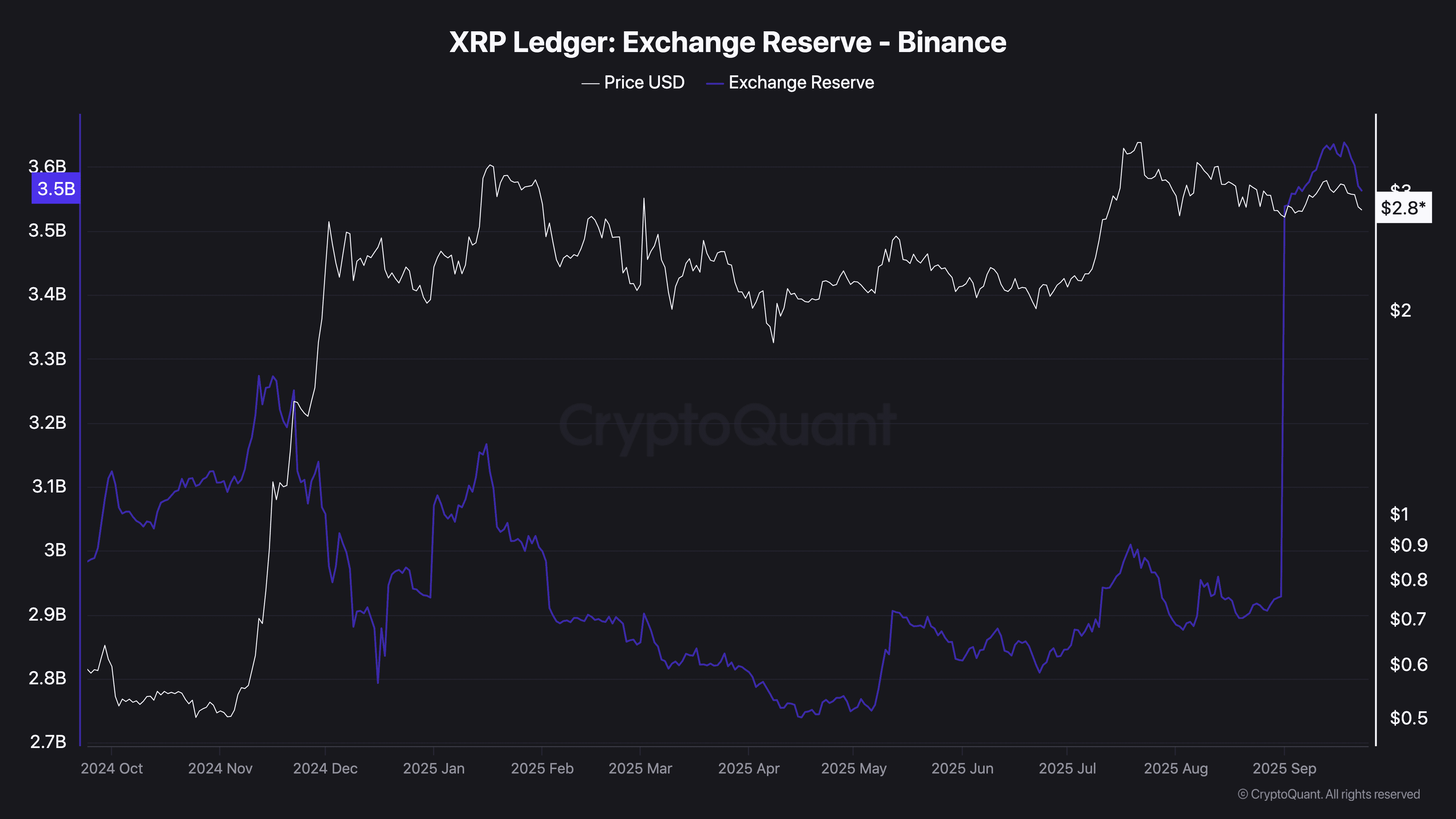

Binance Sees Spike in XRP Exchange Reserves

Above all, in September, there was a sharp increase of net inflows in Binance to an end of about 3 billion to one exceeding 3.5 billion: the highest level. Inflows may be due to user deposits, activity of trading desks, or simply mass preparations.

Price kept being in the region of $2.80 despite going reserves up. Buyers and sellers will likely be watching this closely to see if supplies will come on the market or just lie dormant.