Bitcoin’s Bullish Signal: Has BTC Finally Turned the Corner?

Bitcoin flashes its most convincing bullish signal since the last crash. The crypto giant shows technical strength that's making traditional finance players nervous.

Technical Breakout Confirmed

BTC's price action defies bearish predictions with multiple indicators aligning for the first time in months. The moving average convergence divergence histogram prints its highest reading since the 2024 rally began.

Market Sentiment Shifts

Traders who've been sitting on the sidelines suddenly face FOMO as institutional money quietly accumulates positions. The fear and greed index swings from extreme fear to neutral territory in just seven days.

Liquidity Flows Back

Exchange reserves hit 18-month lows while derivatives open interest spikes—classic accumulation patterns that preceded previous bull runs. Short positions get liquidated at a rate not seen since the last cycle's local bottom.

Wall Street's Reluctant Admission

Even traditional analysts can't ignore the technical setup, though they'll probably credit 'improved macro conditions' rather than admit crypto markets have their own logic. The same firms that called Bitcoin worthless at $20,000 suddenly discover its 'store of value properties' at $60,000—typical finance sector timing.

This isn't just a dead cat bounce. The market structure suggests sustained upward momentum could push BTC toward previous resistance levels faster than skeptics anticipate.

Bullish Divergence on the Chart

Bitcoin is showing early signs of a possible reversal after its latest decline. The price has fallen from above $114,000 to around $111,500, making lower lows. At the same time, the Relative Strength Index (RSI) has moved higher, forming a bullish divergence on the 2-hour chart.

Analyst Merlijn The Trader commented:

$BTC JUST FLASHED A BULLISH DIVERGENCE.

Price made lower lows. RSI made higher lows.

After the dump… momentum is shifting.

This is where reversals are born. pic.twitter.com/kP6RGwZ4PQ

— Merlijn The Trader (@MerlijnTrader) September 23, 2025

Higher closes following the drop suggest momentum is starting to MOVE away from sellers.

At the moment, Bitcoin is trading near $112,700 with a daily volume close to $49 billion. It has slipped slightly in the last 24 hours and is down 4% over the past week. The immediate support range sits between $111,500 and $113,000.

Merlijn pointed to two potential outcomes.

“AFTER THE DUMP COMES OPPORTUNITY. $BTC just gave us the setup legends wait for,” he said.

In one scenario, bitcoin holds above support and rebounds toward $124,000. In the other, the level breaks, sending price lower into the $102,000–$104,000 range before staging a recovery toward $120,000.

Short-Term Holders Selling at a Loss

On-chain flows show heavy selling pressure from short-term holders. Analyst Ted noted:

$3,390,000,000 $BTC is moved to exchanges.

Greed![]() → fear

→ fear![]() → selloff → accumulation → rally. https://t.co/jgwtRaEVFt pic.twitter.com/dqgzkU9O6C

→ selloff → accumulation → rally. https://t.co/jgwtRaEVFt pic.twitter.com/dqgzkU9O6C

— Ted (@TedPillows) September 23, 2025

Data indicates about 30.9K BTC was moved to exchanges within 24 hours at a realized loss of roughly $3.39 billion.

This activity reflects capitulation from recent buyers. In past cycles, similar loss-taking events at key levels have aligned with local bottoms, as long-term holders absorb supply from weaker hands.

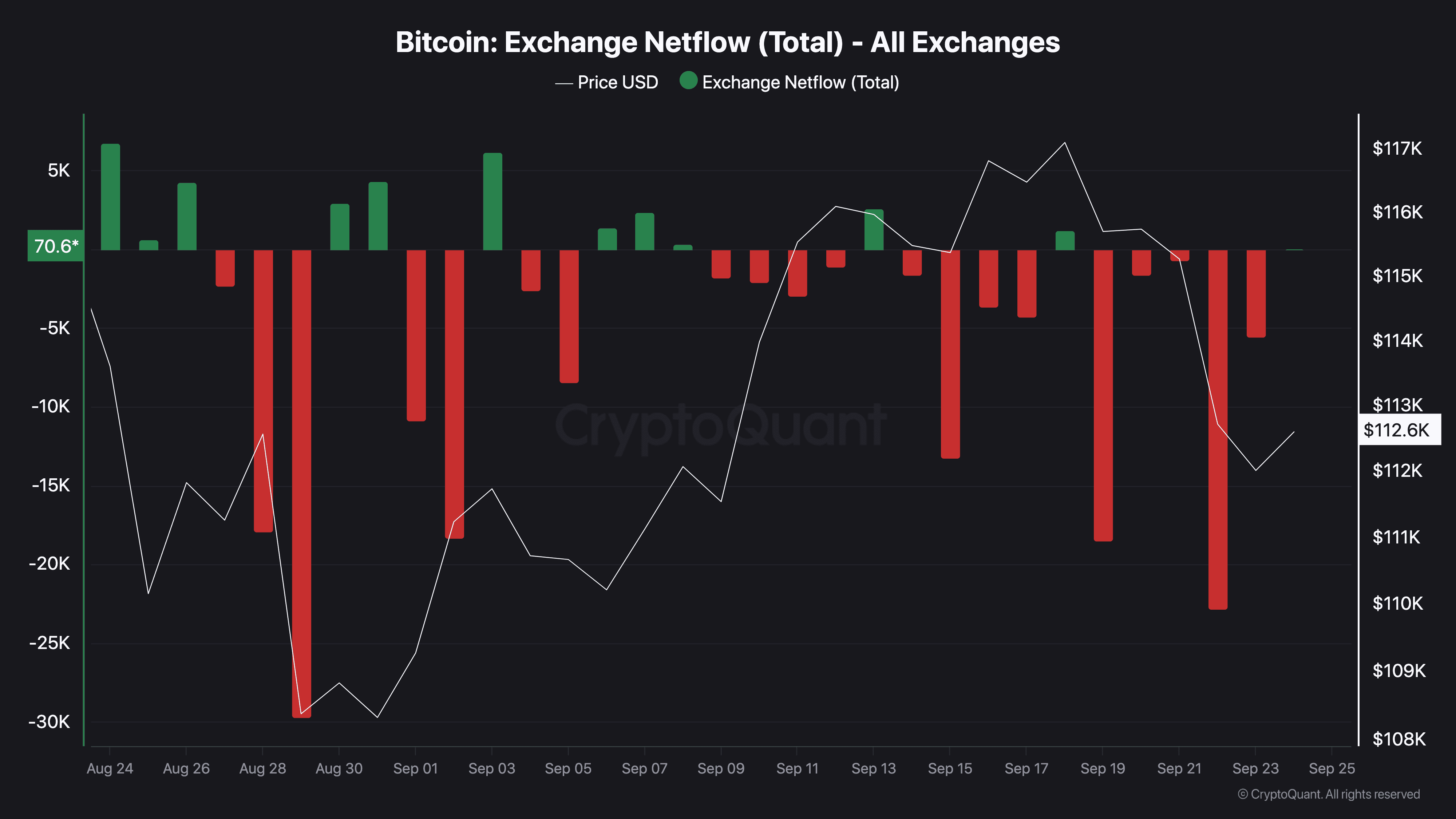

Exchange Netflows Show Outflows

Exchange netflow data adds further context. Over recent weeks, large outflows have dominated, with several days exceeding 20,000 BTC leaving exchanges. During the latest decline to $112,000, outflows spiked close to 30,000 BTC.

Sustained withdrawals mean that investors are putting coins into storage instead of preparing to sell. Historically, persistent outflows amid price weakness have been key marks of accumulation phases, decreasing supply on exchanges and setting up recovery conditions.

Bitcoin remains under pressure through this phase with potential evidence of change. Bullish divergence, short-term capitulation, and consistent outflows from exchanges may foster conditions where the price can bounce back, provided support holds.